The Pound-to-Indian Rupee: Tech Forecast, News, and Data For the Remainder of the Week

Brexit talks will continue to dominate Sterling's performance whilst the Rupee will take its cue from GDP data which will need to impress again to push the currency higher.

The Pound-to-Indian Rupee is rising in a short-term uptrend on the weekly chart, which began at the April 2017 lows and is expected to continue higher.

We see a probability of it reaching an end target at around 90.85 based on the possibility that it is forming an abcd pattern on the weekly chart.

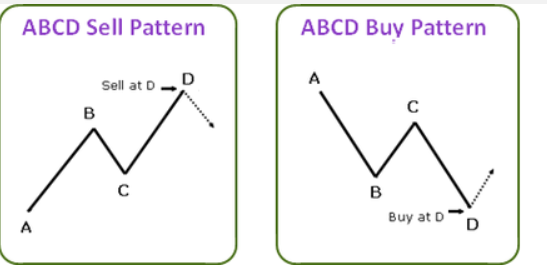

Abcd patterns look like zig-zags (see examples below) with wave a-b trending, b-c corrective and c-d in the direction of the trend again.

Image Courtesy of you-forex.com

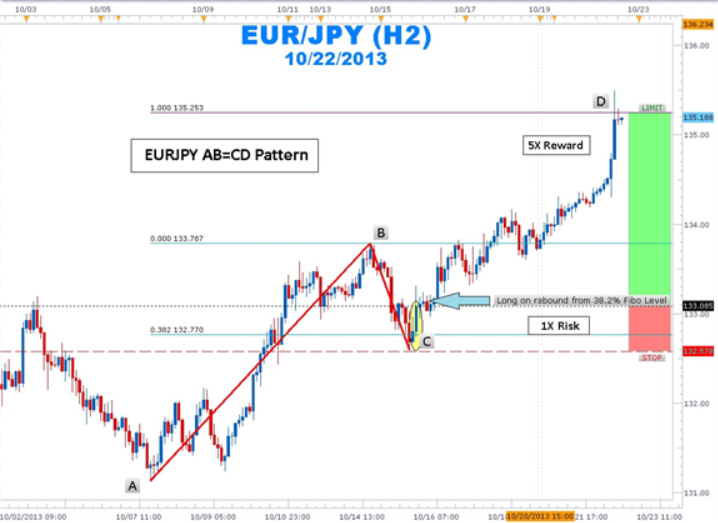

Image Courtesy of DailyFX

Waves a-b and c-d are usually the same lengths so it is possible to calculate the probable end of 'd'.

Applying that method to GBP-INR generates an end target at 90.85.

Intraday Chart

On the four hour chart, the Pound-to-Indian Rupee is going sideways in a consolidation range, which now looks quite extended, and we expect it to break out higher soon.

A move above the range highs at 86.50, confirmed by a move above 86.70, would signal a breakout and the start of a new bullish leg, towards a near-term target at 87.25, based on the height of the range extrapolated higher, which is the normal method for establishing targets from breakouts.

Data and Events for the Indian Rupee

The main data release for the Rupee in the coming week is GDP data for the third quarter out on Thursday, November 30 at 12.00 GMT.

GDP has been steadily declining over the last three quarters falling to only 5.7% in the most recent Q2 period.

Some put the slump down to the demonetization scheme which was meant to encourage the cash economy to use banking more and saw all high denomination bank notes taken out of circulation if not deposited in a bank account before a certain date.

This reduced the cash in circulation, impact on growth.

The majority of analysts see growth rebounding in Q3, however, and coming out at 6.4%.

Economic data release experts tradingeconomics.com expect it to come out at a slightly higher 6.5% even.

The Indian Rupee is quite sensitive to the price of oil as it has to import most of its energy.

The meeting of OPEC (Organisation of Petroleum Exporting Countries), therefore, this week could be quite significant.

OPEC can manipulate the price of oil by agreeing to restrict supply and they are widely expected to agree on voluntary supply cuts at their next meeting on Thursday, November 30.

If the price of oil rises the Rupee may weaken as it will have to sell more Rupees to buy the same quantity of oil as before.

Data and Events to Watch for the Pound in the Coming Week

Whether the Pound can ultimately break higher against the Euro will depend on progress over Brexit negotiations; it appears this issue will increasingly dominate sentiment on Sterling into year-end with a key EU summit on the matter in mid-December being a highlight.

It is at this summit that EU leaders will decide whether or not to greenlight or redlight the progression of negotiations onto the all-important issue of trade and the future relationship.

Businesses and Sterling will need this process to begin as soon as possible.

Much like the many-headed Hydra, a mythical creature that Hercules fought, which regrew two new heads for every one he cut off, so the Brexit negotiations keep growing new problems for Prime Minister Theresa May just as she has seemingly dealt with one.

Just after appearing to agree on a divorce bill that will help propel Brexit negotiations onto the issue of trade, a new problem has presented itself in the form of the border between Northern Ireland and the Republic of Ireland.

Irish Prime Minister Leo Varadka has threatened to veto any EU agreement to progress Brexit negotiations if he feels progress on the Irish border is inadequate; this is quite an interesting stance considering such a veto could push the EU and UK to a hard-

Brexit and no European country has more to lose on a hard-Brexit than Ireland considering the UK is easily their largest trading partner.

A senior Irish diplomat in the EU has said it would really be better all round if the UK remained in the trade and customs union - or at least the customs union as then there would be no border issue.

He warned the UK people not to put too much faith in future free trade agreements as even the best of these, would "fall far short of being in the single market."

One solution would be to essentially keep Northern Ireland in the EU (exempting it from Brexit) so that the border could be left open, however, this idea has been met with firm resistance from the DUP, Theresa May's partners in government, and her only key to a parliamentary majority.

With no clear solution, the Irish border issue is now likely to further delay the onset of the next stage of Brexit talks, and Theresa May has only got until December 4 to come up with a solution.

Clearly, how the Ireland issue evolves in the coming week, will probable be a factor impacting on Sterling with any substantial break-down suggesting the Brexit process will be slowed down.

"The bigger hurdle to clear in order to reach “sufficient progress” is agreement on the Irish Border. The Irish Government’s position is that an “electronic border” is not viable. As a result, it won’t settle for anything less than a UK commitment to regulatory equivalence between Northern Ireland and the Republic in line with EU standards," says Andrew Wishart, UK Economist with Capital Economics.

Wishart notes the UK’s current intention is to leave the Single Market and the Customs Union and regulatory equivalence across the Irish border would require a customs border between Northern Ireland and the rest of the UK, which David Davis has ruled out.

But Mr. Barnier pointed out in a speech on Monday that contrary to arguments this would come at the cost of the integrity of the UK single market, many rules in Northern Ireland already differ from that in the rest of the UK.

From a hard-data perspective, the main release in the coming week will be Manufacturing PMI on Friday, December 1, at 9.00 GMT, which is forecast to show an uptick to 56.5 from 56.3 previously.

Investment bank TD Securities expect the result to be even higher as Eurozone growth spills-over into the UK:

"While strength in its euro-area counterparts is being driven by broad-based growth there, spillovers to UK businesses should nevertheless give the measure a lift, and November's CBI indicators seem to suggest continued healthy growth by firms," they said in a week ahead round robin.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.