Pound-to-Rupee's Downtrend Forecast to Extend To 50-day MA at 84.81

The Pound has bounced against the Rupee after establishing the October 6 lows but the short-term downtrend from the September highs remains intact and is probably likely to continue.

GBP/INR has been broadly going sideways after falling to 85.17, at the midpoint, or 50% Fibonacci retracement of the previous August-September rally.

The midpoint of price moves is a significant level where prices often encounter support or resistance and can stall or reverse the trend.

The short-term downtrend which began after the market rolled over on September 22, however, remains intact and we see a strong chance of a continuation lower eventually once the pair has ended its sideways consolidation.

Confirmation of a continuation lower would come from a break below the 85.19 low of October 6, which would be expected to lead to a continuation down to a target of 84.81 at the level of the 50-day moving average.

Moving averages are dynamic levels of support and resistance which can put a floor or ceiling on the market and prices often stall, consolidate or pull-back from them, which is why they make good targets.

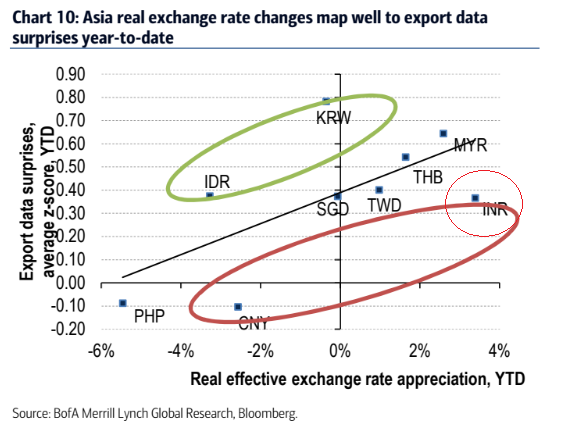

Further reinforcing our view that GBP/INR could extend lower is research from Bank of America Merril Lynch (BofA) who have found the Rupee is undervalued, by cross-referencing export data's surprise index with the Rupee's REER (Real Effective Exchange Rate) appreciation over the year-to-date.

The results below show that compared to most other Asian currencies INR is substantially below the line of 'best fit'.

BofA, however, partly put this down to the 'idiosyncratic' factor that the Bank of India (RBI) has higher than average reserves of Dollars, suggesting they have been intervening in the market and selling Rupees (in exchange for Dollars) to keep the value of the domestic currency artificially low - no doubt to boost export competitiveness.

Other macro-drivers may include the following:

The Indian government is drafting an ambitious plan to provide the poorest in Indian society with social security, involving an injection of 1.2 Lakh-Crore (trillion) of Rupees in a safety-net - from a currency perspective, this is likely to raise inflation expectations, interest rates, and therefore the value of the Rupee.

Another positive for the Rupee is the news that the Abu Dhabi sovereign wealth fund, the ADIF is pumping 1 billion Dollars into the Indian National Investment and Infrastructure Fund (NIIF).

The impact of exchanging $1bn on a liquid currency pair such as GBP/USD or EUR/USD is around a 100-200 point move during liquid hours or double during low liquidity hours, according to data from broker Oanda, as well as information from an article interviewing a bank foreign exchange trader with knowledge of how large orders impact on exchange rates.

This suggests the possibility of a large move up in the Rupee in the next few weeks, although the impact on the Pound rate will not be as extreme as versus the UAE Dirham, assuming the exchange is made using the local currency (which is itself pegged to the Dollar).