Indian Rupee Tipped to Experience Further Losses Against Sterling

Image © Adobe Stock

- GBP/INR hits a ceiling, but can go higher

- India faces risks including weak Rupee, rising oil prices and credit crunch

- RBI policy meeting is key event for INR

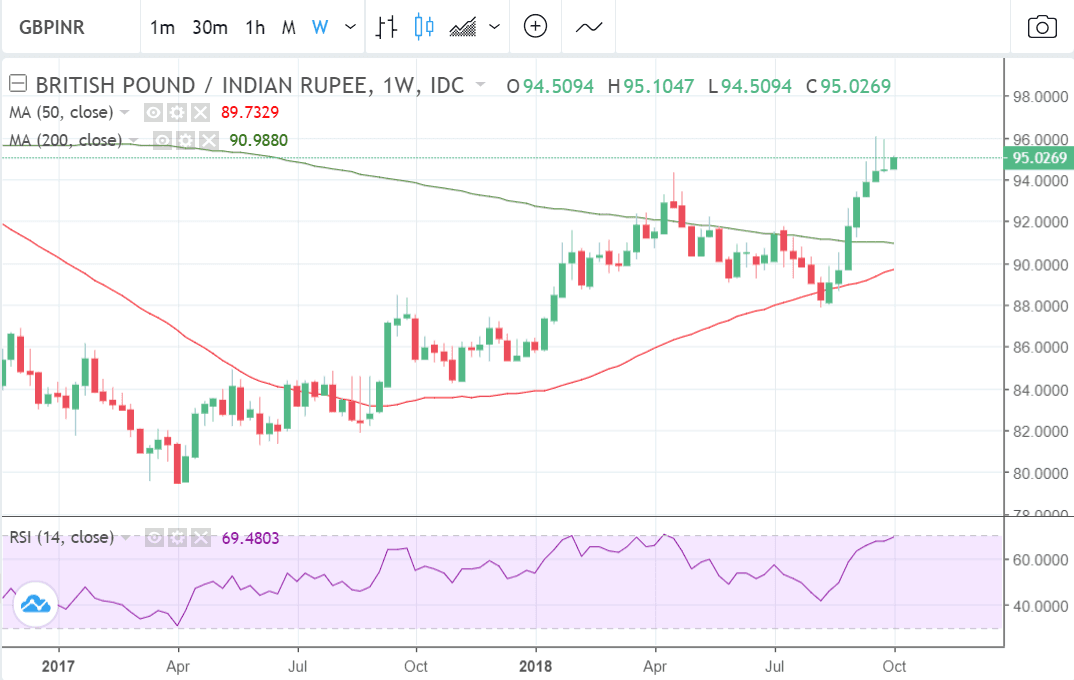

At the time of writing the Pound-Rupee exchange rate is quoted at 95.34, having been as low as 88 in August. The Rupee has lost over 9.0% of its value and it has done so against the Pound in less than nine weeks; and we see little to suggest now is the time to fight the trend.

However, from a technical perspective, the GBP/INR rally has stalled after posting its September highs on the 19th but this represents a plateauing more than a reversal - at least as things currently stand.

The advantage is always with the established trend which is more likely to continue than end.

The temporary pause is a sign traders are probably 'taking profit' on their long trades before the market resumes going higher again. This is what we expect to happen with GBP/INR.

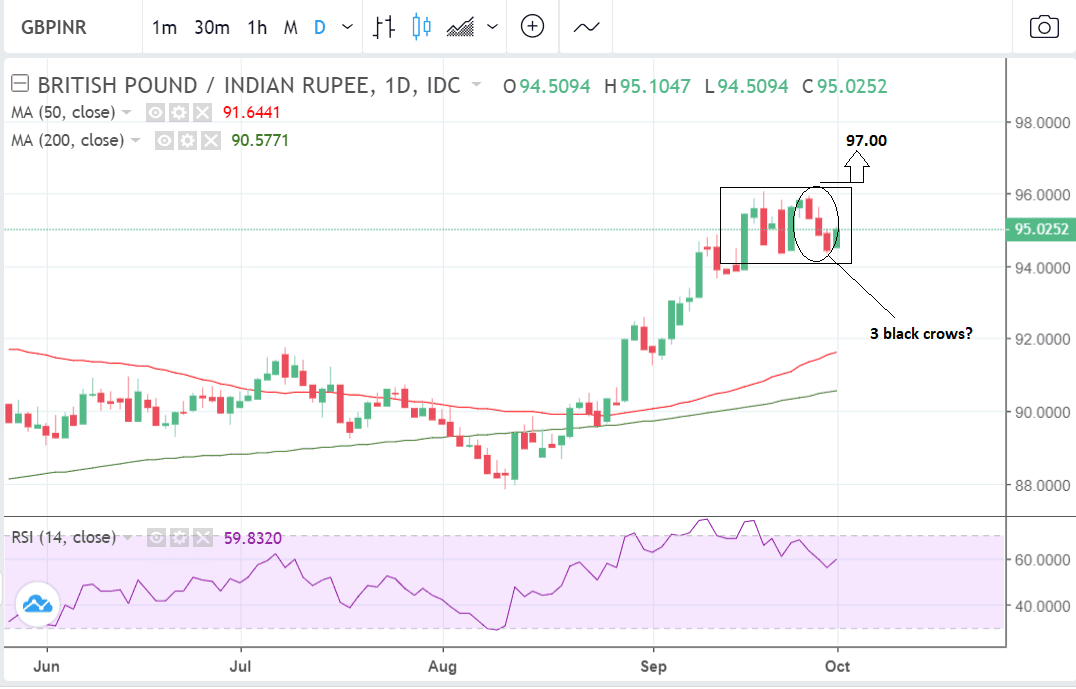

Even the negative 'three black crows' Japanese candlestick set-up, which formed at the end of last week, and is normally a negative reversal sign, is unlikely to indicate downside on this occasion.

These patterns are much more likely to work when they represent a steeper decline when compared to the rise in days which preceded them, which is not the case this time, as the days before they formed were strong bullish green up-days suggesting the uptrend was very much still alive.

If the market can break above the September 19 highs at 96.06 it is likely to extend higher and rise to the next target at 97.00.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Indian Rupee: What to Watch this Week

The main event for the Indian Rupee in the week ahead is the meeting of the Reserve Bank of India (RBI) on Friday at 10.00 B.S.T.

The general consensus amongst the analyst community is that the RBI will raise interest rates by 0.25% at the meeting in order to stem the devaluation of the currency.

Analysts at Morgan Stanley say they expect the RBI to hike the short-term rates at its October meeting and that it remains bearish on the Rupee despite the recent emerging market (EM) stabilisation as concerns about the recent default of a local financial institution, rising oil prices and a widening fiscal deficit persist.

"The default has led to a rise in corporate spreads and increases the refinancing pressure on domestic financial institutions at a time when our economist expects the RBI to hike at its October meeting," the Morgan Stanley report said.

Talk of India being caught in a credit crunch has heaped further woe on the Rupee, as it could effectively mean the economy comes under vice-like 'pincer-move' from both a weak currency and defaulting financial institutions, and the central bank will have a hard time battling on two fronts.

This morning it was announced that the RBI has taking measures to ease the credit crunch which is causing liquidity in the banking system to dry up as fear grips lenders.

The RBI conducted two open market operations (OMOs), a form of quantitative easing in which the central bank buys government bonds from struggling banks and FIs to provide them with liquidity. On Monday it announced a new OMO of Rs 36,000 crore.

"Based on an assessment of the durable liquidity needs going forward and the seasonal growth in currency in circulation observed in the build-up to the festive season, we have decided to conduct the purchase of government securities under OMOs worth Rs 36,000 crore in October 2018," the RBI said in a release Monday.

The Indian currency is likely to be highly sensitive to the news flow regarding the evolving crisis in its capital markets. The problem for the RBI is that the two menaces the economy is currently facing - the weak Rupee and credit crunch require mutually incompatible medicines.

The weak Rupee needs higher interest rates and less liquidity so that it strengthens; the credit crunch needs lower interest rates to encourage lending and greater liquidity. What is good for one is bad for the other and vice versa.

On the hard data front, Nikkei manufacturing and services PMI indices for September are due to be released or have already been released.

Manufacturing PMI showed a higher-than-previous result of 52.2 when it was released on Monday morning at 10.00 B.S.T, but nevertheless fell short of the 52.4 expected.

Services PMI is out at 6.00 on Thursday; in the previous month of August it showed a result of 51.5.

PMI's are survey-based gauges of activity within industry sectors. A result of over 50 is indicative of expansion and contraction if under 50.

India has to import all its fuel so the price of oil is another major driver of the value of the Rupee. Part of the recent sell-off has been due to higher oil prices which have tipped India into a trade deficit. If this trend in oil prices continues it bodes ill for the Rupee which is highly negatively correlated to the commodity.

Although the Indian economy is facing some major headwinds, it is also the fastest growing economy in the world and it has some very solid fundamentals, including a widely diversified and entrepreneurial economy, so structurally the country has some sound foundations.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here