Pound Sterling vs. Euro and US Dollar Today: Business Confidence has a Story to Tell

- Lloyds' business confidence report is out

- Report shows high correlation with movements in the Pound

- Pound-to-Euro exchange rate today: 1 GBP = 1.1211 EUR

- Pound-to-Dollar exchange rate today: 1 GBP = 1.3143 USD

Look at the chart above. It tells us that the Lloyds Bank Business Confidence Barometer actually has a strong correlation with the performance of Sterling.

This is interesting in that the Lloyds Business Confidence Barometer is considered a second-, if not third-tier, release and therefore of little consequence to Sterling.

But thanks to researchers at Westpac, we know this release is actually of more consequence to Sterling valuations than many would imagine.

On Tuesday, July 31, the latest Lloyds Business Barometer reading is released.

The report says business trading prospects edged down 1pt to 34% in July, but were still up from this year’s low of 31% in April; it is signalling an underlying quarterly pace of economic growth of around 0.3%.

It's "not looking pretty for the Pound as consumer confidence remains weak," says Viraj Patel, foreign exchange strategist with ING Bank N.V.

Regarding optimism for the economy generally, the barometer edged slightly higher in July, but remained lower than the start of the year.

Yet, the details of the report suggest to us that its a case of 'more of the same' as opposed to any significant deterioration in sentiment being endured by British businesses. A net balance of 25% said that their optimism for the economy has improved, up 2 points on last month.

46% of firms (up 1pt) indicated greater optimism, while 21% (down 1pt) said their optimism had fallen. Taking into account both trading prospects and economic optimism, our measure of overall business confidence was unchanged at 29%.

We would expect the same 'more of the same' feelings to be reflected by Pound Sterling price action over coming days if the correlation between confidence and the Pound are maintained.

Our reading is that the latest report is suggestive of Sterling more or less treading water around current levels.

Concerning short-term moves, there can be no doubt that it is the Bank of England which will be in control.

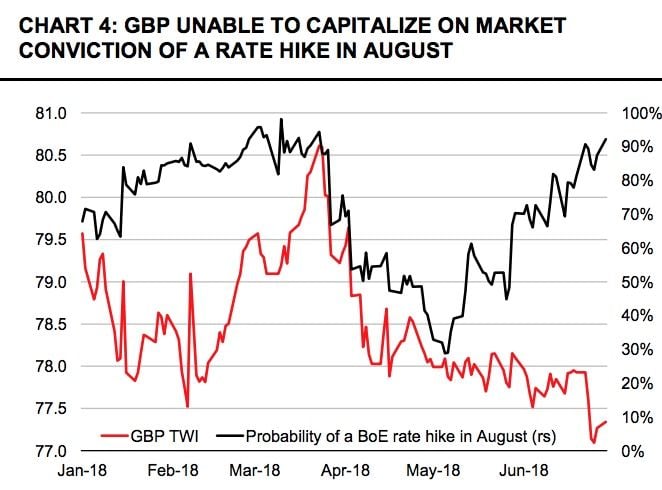

"GBP price action looks precarious going into Thursday’s Aug BoE meeting – with investors seemingly uninterested in a hawkish BoE hike," says ING's Patel. "This seems about right to us, with the balance of risks pointing to limited GBP upside from what is likely to be a dovish BoE hike (see our GBP & BoE scenario analysis)."

Analyst Roberto Mialich at UniCredit Bank fears Sterling, which has not benefited so far from prospects of tighter monetary policy at home (see above) may suffer both likely scenarios:

1) If the BoE hikes, as we also expect, we would see this as a policy mistake hurting the economy, and thus the currency, over the medium term.

2) If the bank leaves the rate unchanged, investors’ disappointment will likely lead to new GBP sales.

ING meanwhile we see two factors driving GBP in the short-term:

1) Bank of England policy and

2) 'No-deal Brexit' risks

"Gven that they are not mutually exclusive, and the extent to which the BoE can exert a credible hawkish stance depends on the Brexit political climate, we see the GBP outlook becoming increasingly binary," says Patel.

ING say we might see GBP/USD test 1.30 – and EUR/GBP breach 0.90 – in the coming months, but "it’s worth re-iterating that this short-term dip in GBP doesn’t mask the longer-term bullish potential."

EUR/GBP at 0.90 gives a GBP/EUR exchange rate at 1.11.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here