The Pound Showing Potential For a Rebound If Labour Data Points to Rising Wages

- Key labour market data scheduled for release on Tuesday, May 14

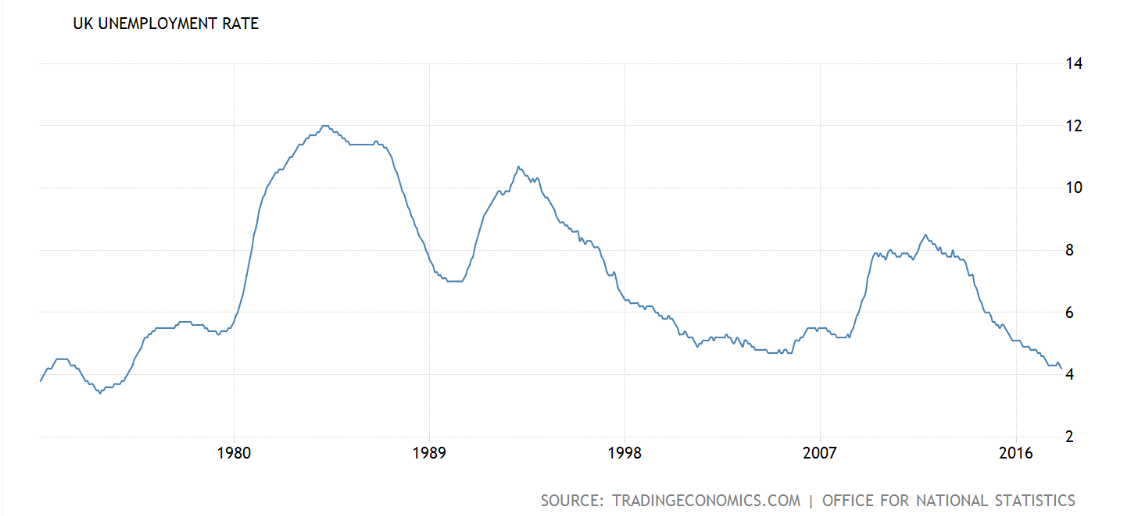

- Unemployment rate in UK now below level at which it will start to have increasing impact on wage inflation

- Higher wages could improve sentiment on Pound Sterling

© DragonImages, Adobe Stock

The British Pound could find support from wage and employment data on Tuesday, May 15 should numbers confirm a long-term trend of improvement.

The rate of unemployment, which has been trending lower for some time, has now reached its lowest level for over 40 years, and the resulting 'tightness' in the UK labour market should theoretically impact on wages, pushing them up as a scarcity of skilled workers results in a higher premium being put on their services.

The Pound could gain an important boost from the effect, says Andreas Steno Larsen, a strategist at Nordea Bank, who offers some much-needed cheer-leading for the under-fire Pound in a recent note.

Sterling took such a drubbing last week after the Bank Of England disappointed markets at their meeting.

But Larsen points out that the unemployment rate in the UK is actually now below a key level known as NAIRU by economists, which is short for the Non-Accelerating Inflation Rate of Unemployment, and this could be flashing positive green lights for Sterling bulls.

The theory behind NAIRU is that if unemployment falls below a certain level it pushes up wages as per our explanation above re scarcity of skills, and this pushes up inflation.

Higher inflation leads to the central bank having to put up interest rates, and higher interest rates appreciate the local currency by attracting greater inflows of foreign capital, which are drawn by the promise of higher returns.

There is now an increasing probability that the record low unemployment rate in the UK will force up wages and this, in turn, will propel the Pound higher.

"This week’s labour market report is another chance for the Sterling to get some much-needed underpinning. The unemployment rate might drop further below the most recent NAIRU-estimate by Bank of England – something that is needed for the market to trust the long-term +2% inflation forecast from Bank of England," says Larsen.

At the time of writing the GBP-to-EUR exchange rate is seen trading at 1.1357, having been as low as 1.1317 in the previous week, the GBP-to-USD exchange rate is seen trading at 1.3596, having been as low as 1.3460.

Current expectations are for average earnings excluding bonuses in March to rise by 2.9% and average earnings including bonuses by 2.6%. This is from a rate of 2.8% for both in February.

The unemployment rate is expected to remain at 4.2% and employment change to come out at 130k, when the data is released by the Office of National Statistics (ONS) at 9.30 GMT tomorrow morning.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.