The Phantom Liquidity Behind the GBP Flash-Crash

Gaps in liquidity are likely to expose foreign exchange markets to more flash crashes similar to that experienced by Sterling in October argue Bank of America.

October 7th 2016 saw the Pound fall to extreme lows, with some platforms registering declines commensurable with the referendum sell-off.

The GBP/USD pair fell to lows of anything between 1.1830 and 1.1340 depending on the platform you were looking at.

A fall to 1.1340 from the previous day’s 1.2600 close is equal to a 10% drop in percentage terms and is the same as the fall registered after the referendum.

The UK government’s tough stance on Brexit provided the fundamental context for the falls, but only some kind of market failure would explain the shear depth of the fall.

We have already heard from those who say the market's move from inter-personal dealings to algorithmic dealing was the prime reason for the failure.

An algorithmic panic-attack is certainly the consensus explanation that has energed.

But the truth is a combination of issues are most likely behind the decline.

Bank of America Merril Lynch and Abn Amro are two banks suggesting the problem may have had more to do with the ‘illiquidity’ of sterling at the time the currency began falling.

The volumes of Pounds traded during the Asian session overnight are notoriously low, and it was in these illiquid market conditions that the pound began to make step declines lower.

The simple fact is that there were not enough buy orders near to the exchange rate to conclude a deal and so this led to prices probing ever lower to find another side to transact with.

In normal liquid market conditions there is always someone - a buyer or a seller – willing to take the other side of the deal at a price close to market, however, because the Asian session is so quiet this was not the case during the flash crash.

“Last week, Sterling experienced the second-largest daily decline ever, over the course of only a few minutes. While growing worry about a hard Brexit was the fundamental catalyst for the move, the speed and magnitude of the decline emphasizes the more furtive dangers of worsening liquidity,” say Bank of America.

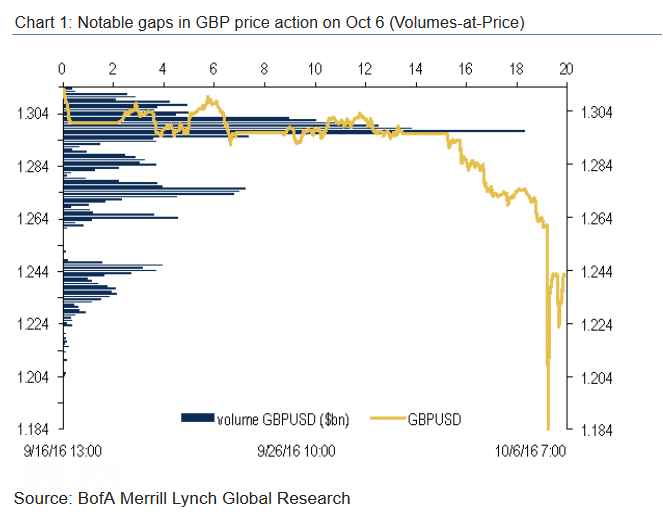

Bank of America suggest the lack of liquidity is a definite risk to the stability of the FX market, and highlights complete gaps in the market where there were no orders whatsoever.

Bank of America argue that the lack of liquidity, “in turn, results in greater risks of flash crashes, like the one we saw last week. Indeed, over the course of less than 10 minutes, the over 6% decline in GBPUSD coincided with less volume transacted than the total volume from 1.28 to 1.26.”

The move was also the single largest ever recorded measured by comparing real volatility to expected volatility based on volume.

Ex Interbank Trader Sean Lee of ForexTell has said the lack of volatility was as a result of a lack of interbank traders who previously had traded currencies 24/7 around the world providing constant liquidity to the market.

“Whether for regulatory, commercial or technical reasons, the very core of the FX market no longer exists; namely the hundreds of interbank traders who sat at their desks and provided pricing no matter what the conditions,” says Lee.

Lee says that instead of the hundreds of traders at their desks managing foreign exchange a handful of computers now sit where they used to.

The second reason for the crash was due to the programmes these computers use to manage FX flows, also known as algorithms.

An algorithm is a programme which instructs a computer to make trades at certain levels.

For example, if the market falls below a level such as 1.26 then the algorithm might instruct the computer to close all buy orders, as things are looking more bearish.

According to Lee, the various machines tend to share the same sorts of algorithms which probably led to them all suddenly selling sterling after a certain level had been breached, and this, in turn, speeded up the currency’s decline.

1.2600 is considered the most probable culprit as it was a major knockout option barrier, which is a level where many options, in this case, call options, which are a type of currency derivative that gain value when the exchange rate rises, were closed out en masse.

Algorithms are also responsible for another possible cause of the crash.

Hedge Funds and Asset Managers often use trading algorithms to automatically execute trades when markets start to move rapidly.

In simple terms, these programmes execute buy or sell orders when the market reaches a certain threshold of momentum.

In prolonged volatile conditions they can sometimes set off chain reactions which heighten momentum by increasing selling, which then feeds back even steeper momentum to the algorithm which can reload and relaunch further sell orders, in a nasty endless feedback loop which floods the market with sell orders.

This may further explain the sudden steep crash, particularly If it was coupled with a case of 'phantom liquidity'.