Pound Surprisingly Rebounds After GDP Miss - What’s Happening?

The pound strengthened after the release of lower-than-expected GDP data on Wednesday - a puzzling reaction to negative news. What lay in the report that so emboldened traders - or is it all in the charts?

Data released from the Office of National Statistics (ONS) on Wednesday showed that the economy grew by 0.4% from Q2 to Q3 of 2015 – a lower result than the previous 0.5% estimate made in November.

Second quarter growth was revised down from 0.7% to 0.5%.

A year-on-year comparison showed a 2.1% rise in Q3 – down two basis points from the previous 2.3% estimate.

Positives in amongst the data included the following, and may have been a factor in sterling's mysterious strength:

Labour Productivity reached an all-time high, and given this is a metric which has been of concern to the BOE and therfore could impact interest rate expectations, it may have offset the overall negative tone of the headline figures:

“UK Labour Productivity as measured by output per hour grew by 0.5% from the second to the third calendar quarter of 2015 to the highest level ever recorded for this series.”

Productivity data was delivered with a proviso, however, that the trajectory had declined, as productivity was still, “some 13% below an extrapolation based on its pre-downturn trend.”

Household Spending also reached an all-time-high, and was 3.0% higher in Q3 2015 compared to Q3 2014. :

“Following falls in 2010 and 2011, it has now increased to £278.2 billion, the highest volume spending since the start of the series. In each quarter since Quarter 2 (Apr to June) 2014, volume spending has exceeded the previous high in Quarter 4 (Oct to Dec) 2007.”

Business Investment showed strong gains in Q3, rising by 5.8% compared to a year ago and by 1.0bn pounds – or 2.2% from Q2.

The Q3 Current Account came out lower at -17.5bn, from -21.5bn expected, which would normally be considered positive.

However the Trade Deficit component increased to 8.7bn in Q3 from 4.7bn in Q2, and it was only because of a rise in the Trade in Services Surplus to 1.4bn and a narrowing in the deficit in Investment Trade, that the total current account deficit fell.

Technical Charts showing GBP on major support in many pairs

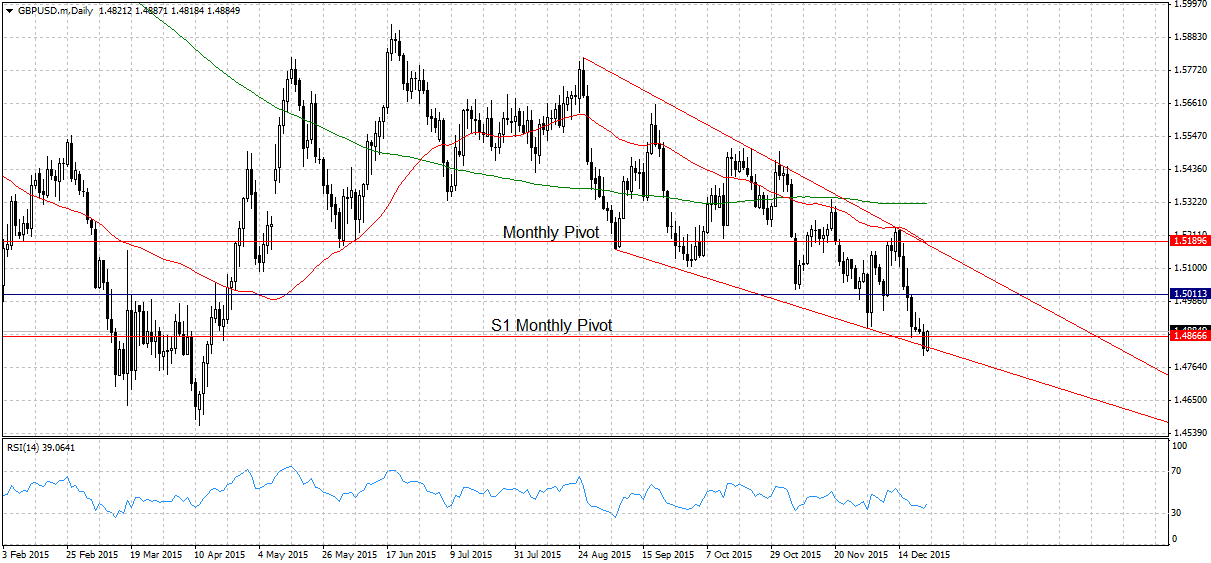

One explanation for the inexplicable bounce in sterling is that it is a technical bounce off a major support level.

On a daily chart of GBP/USD the pair has bounced off support from the S1 Monthly Pivot and the lower border line of a wedge formation; Tuesday’s price bar touched both these powerful support levels on Tuesday at 1.4865 and 1.4840, respectively.

For technical traders the cluster would have presented an opportunity to buy – not sell the pound.

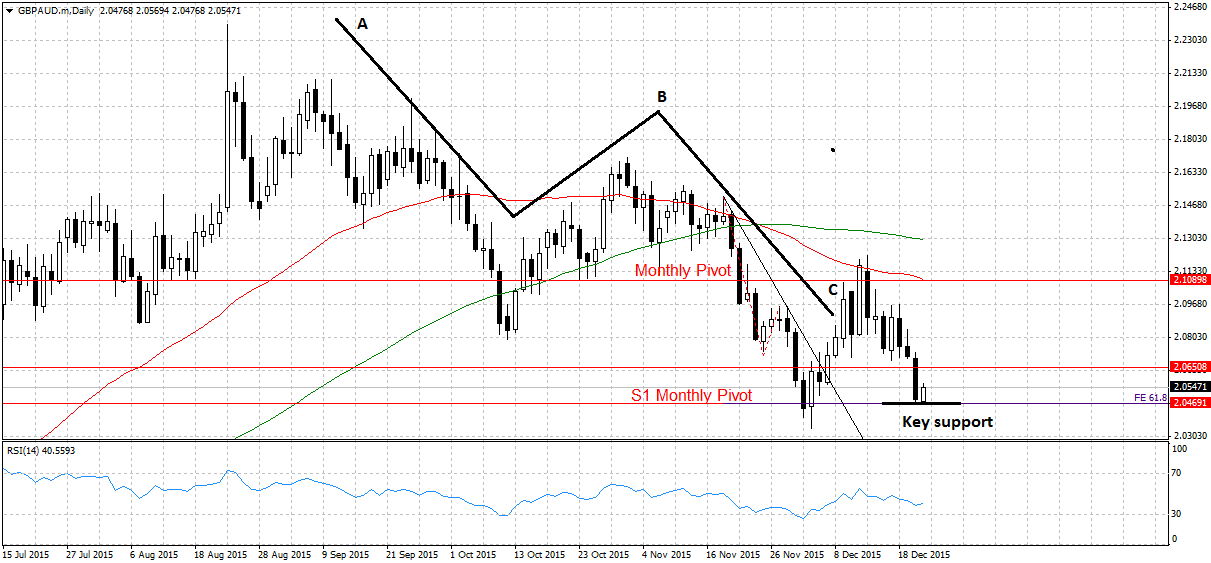

On GBP/AUD there is also a formidable support matrix at yesterday’s lows, which may explain the inexplicable rebound today.