"Hawkish" Cut Means Pound Sterling Will Refind Winning Ways Against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Images

The British Pound might stay under pressure in the near term, but a "hawkish" cut from the Bank of England could help it reclaim its status as an outperformer.

The Pound to Euro exchange rate fell below 1.18 and is on course to erase all its July gains after the Bank cut interest rates by 25 basis points. The Pound to Dollar exchange rate meanwhile fell a full per cent to 1.2712.

The weakness shows that the market did not fully expect a cut, while the Pound entered the August 01 decision with a major overhang of extended 'long' positioning, leaving it exposed to a big pullback.

However, Governor Andrew Bailey said the MPC will be "careful not to cut interest rates too quickly or too much." This will limit the downside in UK rate expectations and underpin the Pound once the position clear-out has happened.

"In our view the BoE delivered a hawkish cut. The decision was characterised as a "slight reduction" in the degree of policy restrictiveness. The BoE gave no clear guidance on future rate path and emphasised a meeting-by-meeting approach," says Sonali Punhani, UK Economist at Bank of America.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The Bank of England has executed this hawkish cut very well. While the anticipated reduction in rates was delivered, market pricing for future cuts has remained largely unchanged," says Stefan Koopman, Senior Macro Strategist at Rabobank.

Analysts at Barclays said the Pound would fall as part of an initial reaction to the decision but that a "hawkish cut" would ultimately see it "benefit".

This suggests a profile of near-term GBP weakness and a reboot of outperformance down the line.

"We stay constructive," says Kamal Sharma, FX strategist at Bank of America. "Hawkish cut has no GBP impact. We remain constructive on better fundamentals."

Even if the Bank of England cuts again in 2024, the UK will continue commanding an elevated interest rate relative to most G10 economies, boosting the appeal of Sterling-denominated assets and Sterling itself.

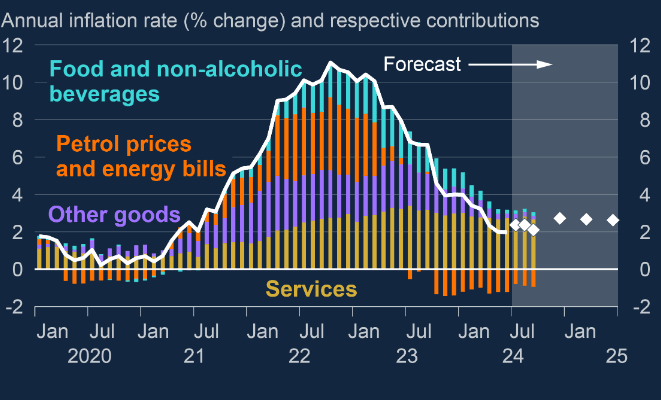

Above: The Bank's forecasts show inflation will rise again, limiting the need for a deep path of rate cuts.

Economists we follow are gravitating to the view that the Bank will likely pursue a cut once every quarter going forward, implying a relatively steady and predictable path for financial markets to adjust to.

"The accompanying guidance and forecasts suggest it will proceed cautiously. Accordingly, we suspect the Bank will keep rates on hold in September before proceeding with the next 25 basis point cut in November. And the risks to our forecast are tilted towards cuts being a bit slower and smaller than we currently expect," says Ruth Gregory, Deputy Chief UK Economist at Capital Economics.

Short-term Headwinds to Persist

The Pound entered Thursday's decision restrained by a record 'long' position, which meant a significant portion of the active market was already holding contracts that would deliver a return in the event of the Pound rising.

Such crowding can create headwinds as it becomes increasingly difficult to find new entrants into the trade. It also means that any setbacks in the newsflow or data can create a bonfire of these positions as investors exit trades by selling the Pound.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Bank thinks it can cut interest rates further without stoking inflation, but it warns it sees an upside skew to its forecasts and that pressure here was largely domestic in nature.

The Bank said it was appropriate to keep monetary settings "restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term had dissipated further."

Bailey, Breeden, and Lombardelli joined Ramsden and Dhingra in voting for a cut, but Pill, Greene, Haskel, and Mann continued to support a hold at 5.25%.

"We continue to expect the MPC to cut Bank Rate again in November. We then expect the Committee to reduce the policy rate at a quarterly pace thereafter until Bank Rate hits 3% in 2026-Q3," says James Moberly, an economist at Goldman Sachs.