Pound Sterling "At Risk of Summer Correction" against Euro and Dollar

- Written by: Gary Howes

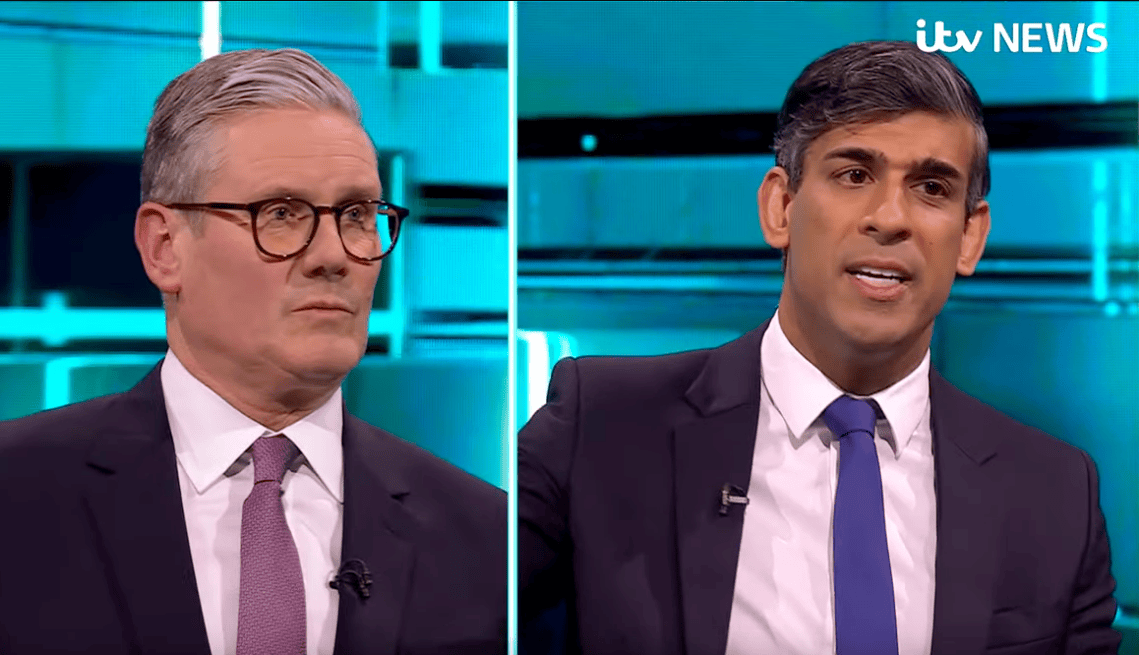

Above: ITV hosted the first leadership debate, which viewers judged was won by Prime Minister Sunak.

The British Pound remains one of 2024's best-performing currencies, but analysts say the market is mispricing Bank of England rate cuts and a close election result, which could make for a soggy summer.

Overnight, Prime Minister Rish Sunak reminded the nation that he is still in the race, beating his rival Keir Starmer in the first of two leader election debates.

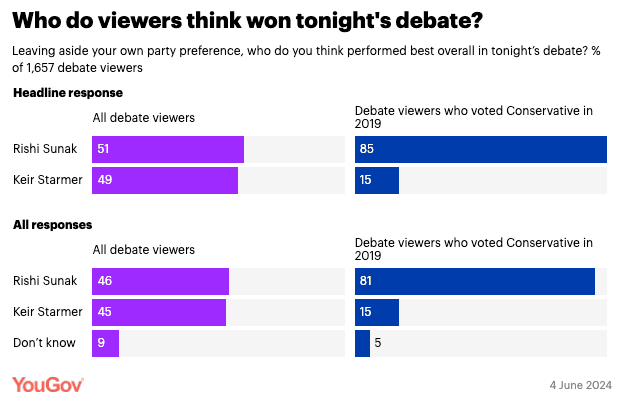

A snap YouGov poll that followed the debate showed Sunak was deemed the better performer by 51-49% as he went on the offensive and solidified the Conservatives' 'we have a plan' pitch to the electorate. Starmer didn't seem to enjoy the format and was, at times, flustered by Sunak's strategy of pressing for the details of Labour's solutions to the numerous challenges facing the country.

The election has not bothered the Pound owing to Labour's near-unassailable lead and expectations for policy continuity under the next government, given the similar economic policies adopted by both parties.

But, should the result become more uncertain, volatility could rise, say analysts.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Should the polls tighten as the electoral campaign proceeds (we expect a narrower Labour majority than implied by the polls), we can expect an uptick in Sterling volatility allied to a moderation in Sterling valuations," says Jeremy Stretch, an analyst at CIBC Capital Markets.

"The election news hasn't had a negative impact on sterling so far, but noise could pick up if polls show the incumbent Conservatives narrowing the gap, thus increasing uncertainty," says George Vessey, Lead FX Strategist at Convera.

As we move through the midweek trading session, the Pound to Euro exchange rate continues to ease back from its 21-month highs and could be set for a fifth consecutive daily decline. The Pound to Dollar exchange rate is also paring recent advances at 1.2767.

In the short-term, the European Central Bank on Thursday and Friday's U.S. job report are the highlights for these Sterling pairs, but we will continue to watch polls and any flicker of volatility if they tighten.

"The Conservatives may be able to boost their support by winning over the unusually high proportion of their previous voters who don’t yet know how they will vote," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Bank of England Threatens a Soggy Summer for GBP

In recent years, politics has been a driving force for the Pound, owing to far-left Labour leaders and the thorny issue of Brexit. But now, the Bank of England is the main driver.

The Pound was helped to fresh multi-week highs against both the Euro and Dollar as The pre-election purdah placed on civil servants means Bank of England employees cannot discuss interest rates outside of official policy meeting dates, lowering volatility in the Pound.

But the calm will be tested by next week's wage data and the inflation report in the following week. Both will inform the tone of the June 20 interest rate decision at the Bank of England.

Last week's strong inflation print means a June cut is out of the question, and markets see slightly less than a 50% chance of an August cut, which some analysts say is too low.

They see a risk that the Bank could use the June 20 decision to signal that it is nearly ready to cut, which would weigh on UK bond yields and the Pound.

"A slowing economy allied to the risk of a graduated increase in political risk favours real money GBP longs being at risk of a summer correction, sending Sterling lower," says CIBC's Stretch.

CIBC's economists say a recent uptick in UK GDP does not mean the economy is in the clear, warning that downward revisions to March retail sales risk a downgrade to provisional GDP.

"We anticipate activity levels moderating towards trend levels (~0.3% qoq) through the rest of 2024. Key to the prospective deceleration is a moderation in discretionary spending. Such a correction will prove a function of increasing precautionary saving as consumers remain mindful of both an easing labour market and costly mortgage resets," says Stretch.

The prospect of an August rate hike will, however, ultimately rest on where inflation goes. If the June 19 print exceeds expectations again, we would anticipate the Bank will have limited opportunity to signal it is time to cut interest rates.

This could keep the odds of an August rate cut at bay, allowing further GBP outperformance.