Pound Sterling Volatility to Rise On a Conservative Comeback, Say Analysts

- Written by: Gary Howes

Above: Amersham, Buckinghamshire. Prime Minister Rishi Sunak holds a rally with Gareth Williams at Amersham and Chiltern RFC. Picture by Edward Massey / CCHQ.

Pound Sterling has taken news of a July 04 General Election in its stride, hitting multi-week highs against the Euro, but some analysts say the currency could wobble if Labour's sizeable advantage in the polls declines.

Pound Sterling has taken news of a July 04 General Election in its stride, hitting multi-week highs against the Euro, but some analysts say the currency could wobble if Labour's sizeable advantage in the polls declines.

The thinking behind this is simple: the Pound likes certainty, and right now, the solid Labour majority indicated by the polls offers that certainty.

"A stable Labour majority could allow the pound to shed some of its risk premium," says Thomas Flury, Strategist, UBS Switzerland AG.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Should the Conservative Party manage to whittle down Labour's lead, the outcome of the election becomes more uncertain and money markets show investors are prepared for some volatility in the Pound around July 04.

"The election news hasn’t had a negative impact on sterling so far, but noise could pick up if polls show the incumbent Conservatives narrowing the gap, thus increasing uncertainty," says George Vessey, Lead FX Strategist at Convera.

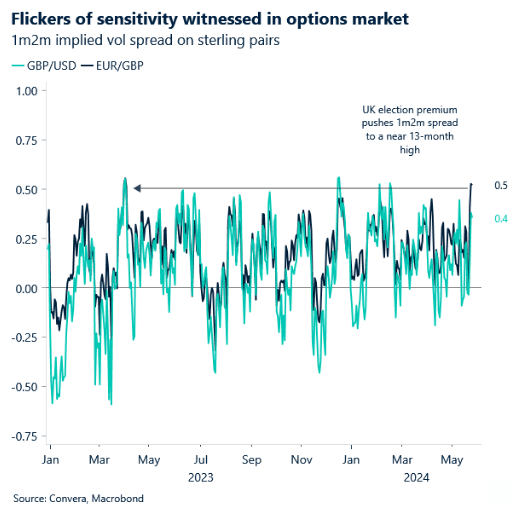

Options markets reflect the anticipation of volatility picking up, explains Vessey, with 2- and 3-month implied volatility, which captures the election date, spiking higher.

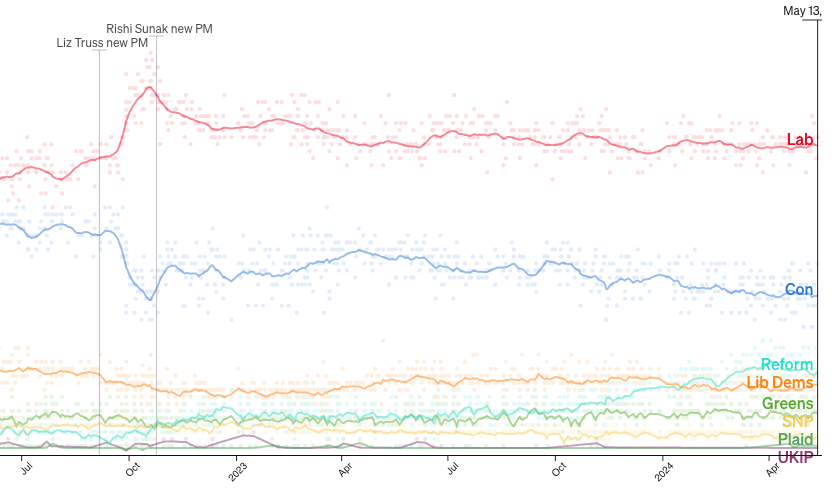

The Conservatives are some 20 points behind Labour in the polls but this gap could shrink in the coming weeks as the parties lay out their stalls. Former Prime Minister Theresa May's fortunes in 2017 serves as a reminder that a large poll lead can evaporate in the course of the campaign period.

"The Conservatives may be able to boost their support by winning over the unusually high proportion of their previous voters who don’t yet know how they will vote," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

The most volatile scenario for Pound exchange rates would involve no party scoring the majority required to govern on its own. A 'hung parliament' would mean a period of negotiations between the parties is required, which can lead to some uncertainty in the future economic policy.

"Sterling may be more volatile at times into July 4th than it has been recently as polling ebbs and flows. This would be particularly so if opinion polls were to narrow to be consistent with a hung parliament or small majority for either of the two main political parties," says Paul Robson, Head of G10 FX Strategy for EMEA at NatWest Markets.

"A smaller than anticipated majority for Labour is a downside risk," says Kenneth Broux, a strategist with Société Générale.

But analysts are nevertheless in agreement that any jitters will likely be shortlived given how similar the leading parties are in their economic and fiscal outlooks.

"Ultimately though, neither party is promising radical fiscal policy shifts, and neither party is going to want to spook financial markets like former PM Truss did back in October 2022. Therefore, it’s possible that this election campaign will be much less volatile and the direction of UK assets, like the pound," says Vessey.

Above: Poll of polls by Politico show a stable and substantial Labour lead.

Goldman Sachs says in a weekly currency note that it does not expect the UK general election to have a major influence on Sterling in the short term.

It notes Labour leads in the polling averages by about 20ppts, and fiscal space will be relatively limited in the next Autumn Statement, so the space for policy uncertainty in the near term is relatively limited as well.

"It would be difficult to argue that news of the forthcoming election is having a negative effect on the pound," says Jane Foley, Senior FX Strategist at Rabobank. "It remains our view that the pound will retain its very slow recovery that has been discernible since the start of last year over the medium-term. This assumes that prudent budget policies will be maintained irrespective of which party wins the UK election."