Pound Sterling At Its Strongest Since the Brexit Carnage

- Written by: Gary Howes

Image © Adobe Images

According to Bank of England data, the British Pound is trading at its strongest levels since the infamous Brexit selloff, and analysts expect further outperformance in the near term.

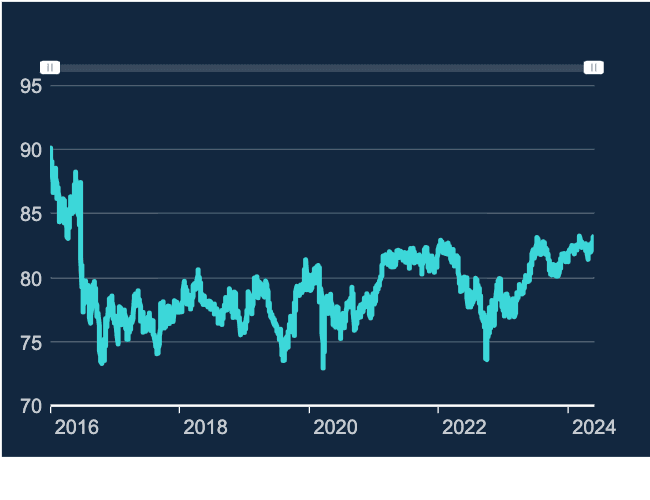

The Bank of England's measure of broad Pound Sterling value is the sterling exchange rate index. It measures the value of the Pound against a basket of major currencies, weighting these currencies according to their importance in trade.

As the Eurozone is the UK's largest trading partner, the Euro is the biggest counterpart. It is of little wonder, then, that the Pound to Euro exchange rate's rally to 21-month highs has contributed to the effective exchange rate reaching its highest level since June 2016.

The Pound is also withstanding U.S. Dollar strength better than its G10 counterparts as investors expect the Bank of England to hold interest rates at 5.25% until at least August.

Above: The sterling exchange rate index is at its highest level since the Brexit referendum.

"The pound is continuing to sharply strengthen on a trade-weighted basis with the move now taking the BoE TWI above the closing high recorded in March and to a level not seen since that infamous day on 24th June 2016 when GBP collapsed after the vote to exit the EU," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank's Global Markets Division.

The timing of the rally is interesting in that it coincides with the calling of a UK General Election and the high probability that the Conservative Party will be replaced by the Labour Party in government on July 05.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But Halpenny says this is unlikely to be the reason for the Pound's new highs. "In all likelihood this is more about yield!". He refers to the yield paid on UK government bonds, which have risen of late as markets expect the Bank of England to keep interest rates at 5.25% for longer than was expected just two weeks ago.

The most recent set of UK inflation figures disappointed by coming in at stronger-than-expected levels. At the same time, the election means the Bank of England can no longer cut interest rates in June without delivering a market-jarring surprise.

Because the Bank's employees are in a period of pre-election purdah, the speeches and commentary that were lined up before the June meeting, which would have allowed the Bank to prime markets for a rate cut, have been cancelled.

With no interference from the Bank, "a window has now opened that could see GBP continue to perform well," says Halpenny.

More broadly, MUFG says the UK economy continues to recover "as the UK finally works through the energy price shock from 2022-23". Falling inflation is also boosting activity, as evidenced by the recent BRC shop price index report that revealed inflation is back to "normal levels" after it eased sharply to a 30-month low at 0.6% y/y in May.

The CBI Distributive Trades Survey showed selling prices for retailers came down sharply in May from 54 in February to 20 in May, making for the second largest drop on record.

"This development is going to increasingly result in better sentiment data and then better economic data," says Halpenny.

An improving economy and low volatility in the markets, even with a looming election, leads MUFG's strategists to expect the Pound to continue benefitting from the UK's relatively high interest rates for some time.

Foreign exchange analysts at UBS also retain a constructive bias on the British Pound despite the recent announcement that a General Election will take place on July 04.

"We still favour GBP longer term as election looms," says Shahab Jalinoos, Head of G10 FX Strategy at UBS.

UK political risk has weighed on the Pound in recent decades, thanks to the post-Blair Labour Party's lurch leftward and the Conservatives bringing destabilising referendums on Scottish Independence and European Union membership.

But, the next General Election occurs in the context of a settled Brexit landscape and a centrist Labour Party holding a 20-point lead in the polls.

"Taking the politics in isolation, the bottom line is that a win for the opposition Labour Party is so fully priced in that pulling forward the election a few months is seen as posing very limited extra risk to GBP," says Jalinoos.