Market Rally Boosts Pound Sterling Against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Images

The British Pound has rallied against the Euro, Dollar and other G10 currencies as the foreign exchange market engages a classic 'risk on' gear to rising expectations that the Federal Reserve will cut interest rates in September.

Just last week, the market was only fully priced for a December rate cut, but Wednesday's softer-than-expected set of U.S. inflation data was the latest underwhelming economic report out of the U.S. that encouraged market participants to raise expectations for earlier rate cuts.

Global stock markets rallied to fresh records as investors cheered the hope of lower interest rates, while the Krona, Australian and New Zealand Dollars were the winners of this renewed optimism.

The Franc and the U.S. Dollar - the two go-to safe havens - were the major losers.

The Pound is a mid-tier player in the risk stakes, meaning while it lost against the high beta names, it gained against the Dollar and Franc. The Euro is also a mid-tier player, but the Pound is widely considered to have a higher beta, meaning the Pound to Euro exchange rate staged a decent recovery of 0.16% to 1.1650.

"The weaker dollar pulled the pound up through 1.26 towards 1.27, while it was slightly firmer versus the euro," says Hann-Ju Ho, an analyst at Lloyds Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pound-Euro has been highly sensitive to the ebb-and-flow of Bank of England policy expectations, which makes the gains registered on Wednesday and into Thursday interesting.

We note that the odds of a potential June rate cut at the Bank of England also increased midweek, with money markets betting that earlier Fed rate cuts will encourage more members of the Bank's Monetary Policy Committee to cut rates.

Money market pricing shows investors now see more than a 50% chance of a June rate cut. "Financial markets are pricing a high chance of June interest rate cut from the Bank of England," says Carol Kong, a strategist at CBA. "In the UK, a rate cut is fully discounted for August, with a June cut currently seen as a close call," says Lloyds Bank's Ho.

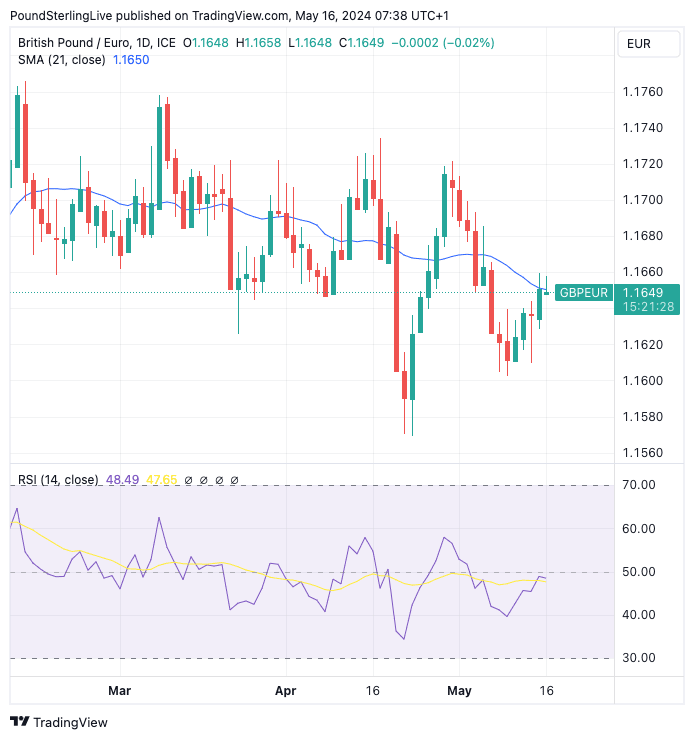

Above: GBP/EUR's technical setup is improving. Track GBP with your own custom rate alerts. Set Up Here

The Pound's gains suggest the prospect of a June rate cut is less of an overhang for the Pound than has been the case in recent weeks.

We have quoted numerous analysts warning that as the odds of a June rate cut grow, the odds of a deeper retracement in the Pound grow too.

But, if we are switching to a more notable risk-on / risk-off regime, the broader market sentiment might be of greater importance to Sterling in the coming days. Any retrace in recent market optimism therefore puts it at risk.