Pound Sterling in Strong Rebound against Euro, Dollar, Could Yet Trip Up

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling has recovered against key levels against the Euro and Dollar as month-end approaches, but the coming days pose events and data that could yet see it trip.

Overnight the British Retail Consortium reported "inflation brought to heel" as its latest survey showed shop Price annual inflation eased to 0.8% in April, down from 1.3% in March. This is below the 3-month average rate of 1.4%. Shop price annual growth is its lowest since December 2021.

The developments suggest the Bank of England can soon consider cutting interest rates; however, the reality of services inflation running close to 6.0% has led analysts at BCA Research to warn investors are still expecting too many interest rate cuts in 2024.

"Market expectations of BoE rate cuts in 2024 look too optimistic. Expect fewer cuts this year and more cuts in 2025," says Robert Robis, Chief Fixed Income Strategist at BCA. "Look for opportunities to go long the British pound versus the euro, Canadian dollar, and Swedish krona on pullbacks in those crosses."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

BCA Research says the problem the Bank of England faces in bringing inflation lower is wages; they are simply too elevated and it will require a sizeable increase in unemployment to rectify the situation.

The latest Lloyds Bank Business Barometer shows that the jobs market could be improving: Staffing expectations regain momentum with nearly half of firms planning to hire. What's more businesses' own price expectations climbed this month, pointing to a re-broadening of upward price pressures among domestic firms.

BCA says it will require interest rates to remain elevated for longer to slow activity and bring down inflation.

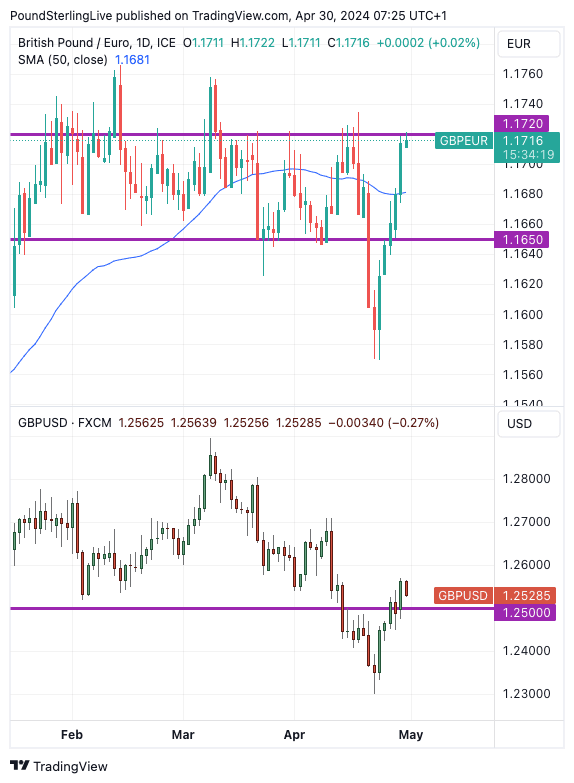

Markets tend to agree with this assessment, which explains the Pound's renewed resilience: The Pound to Euro exchange rate has recovered above 1.17 while the Pound to Dollar exchange rate has recovered above 1.25.

Above: GBP/EUR (top) and GBP/USD at daily intervals. Track GBP with your own custom rate alerts. Set Up Here

The Pound's recovery against the Euro will be tested with the release of Eurozone inflation figures mid-morning. However, recent falls in Euro exchange rates suggest the market is already prepared for a softer-than-forecast outcome.

This is because inflation data already released in Germany and Spain undershot expectations, pointing to a potential soft print for the wider Eurozone area.

The ECB has long signalled it is prepared to cut interest rates in June, and based on these inflation data, there is little reason for the central bank to disrupt markets by disappointing with another decision to hold interest rates.

What will matter greatly for Euro exchange rates is whether the central bank delivers a follow-up July cut.

We would anticipate the single currency to weaken if this idea gathers traction. Should the disinflation process continue, a July cut can be increasingly viewed as likely.

The Pound to Dollar exchange rate meanwhile awaits the midweek Federal Reserve interest rate decision, where policymakers are likely to confirm strong data means imminent rate cuts are not likely.

The market is already resigned to the idea that rates won't rise anytime soon, now seeing December as the start date. Given the scale of the repricing - and Dollar strength - it is hard to see how the Fed can deliver anything new that materially boosts the USD.

This should ensure Pound-Dollar remains relatively well supported into the new month.

Friday's non-farm payroll update will be the final major market event of the week, and another above-consensus print could well send the Dollar higher and 'high beta' currencies lower as markets start to consider the likelihood of the first cut only coming in 2025.

But, as analysts at Barclays note, "the bar is already high — and rising — for large data surprises."

Any undershoot in the figures could accelerate the recent rebound in Pound-Dollar and other USD-based exchange rates.