Pound Pares Advance Against Euro and Dollar as Investors Position For Bank of England

- Written by: Gary Howes

- GBP retreats as investors take money off the table

- Moves follow strong start to 2024

- Points to risks of a decisive policy 'pivot'

Image © Adobe Images

The British Pound retreated from recent highs against the Euro, Dollar and other G10 currencies as investors took money off the table ahead of Thursday's Bank of England decision.

The decision, which will also see the Bank update its forecasts and guidance, carries added risks for currency and fixed income markets as investors believe a pivot in policy is approaching.

Until now, the Bank has maintained a line that it will raise interest rates again if needed, but the Bank is now expected to drop this commitment and offer the slightest hints that interest rate cuts will be likely in the future.

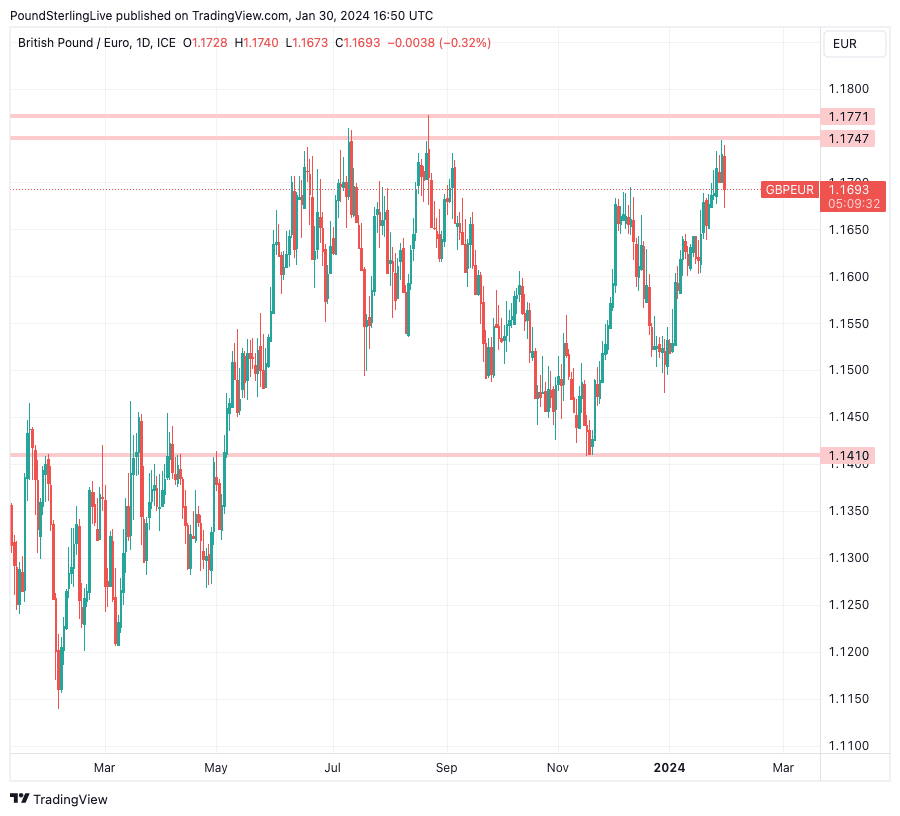

"GBP/EUR has risen above €1.17 for the first time since September and has recorded its fifth weekly appreciation in a row," says Boris Kovacevic, Global Macro Strategist at Convera. "The risk is now to the downside as we don’t expect the BoE to live up to hawkish expectations on Thursday."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

We saw how European Central Bank (ECB) President Christine Lagarde prompted a Euro selloff at last week's policy meeting, with her comments prompting markets to raise expectations for an April rate cut in Europe.

The Pound will also decline if Governor Andrew Bailey prompts a similar repricing in the UK rate outlook.

Markets are wary of such an outcome, and this can explain why the Pound to Euro exchange rate has fallen by over a third of a per cent to just below 1.17, while the Pound to Dollar exchange rate has declined by a quarter of a per cent to 1.2677.

"In our base case we expect EUR/GBP to move higher on softer guidance and updated projections," says Analyst Kirstine Kundby-Nielsen at Danske Bank. "Overall, we see relative rates as a negative for GBP and see the recent rebound as attractive levels to sell GBP."

Danske Bank forecasts EUR/GBP strength to extend to 0.89 (Pound-Euro lower to 1.1240).

Above: Has the GBP/EUR rally failed at the upper band of resistance? Track GBP with your own custom rate alerts. Set Up Here

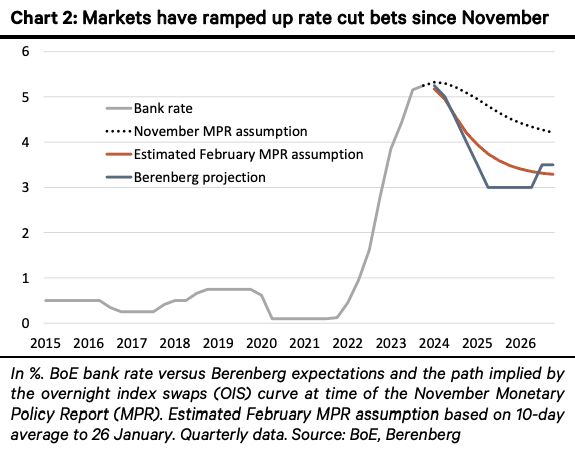

Your view on the Pound will ultimately be determined by your expectation of when the first rate cut is delivered.

Danske Bank's bearish stance on Sterling rests with a bet that the first rate cut will fall in May, with a further 75 basis points of rate cuts to come over the remainder of the year.

If the Bank comes across as more 'hawkish' than markets were expecting and the timing of the first rate cut lands in June or August, Pound Sterling can recover any pre-meeting losses and extend its 2024 outperformance into February.

Economists at Berenberg say February will see a "soft signal" that the Bank is turning "less hawkish", but as many as three Monetary Policy Committee (MPC) members could still vote for an additional rate hike, which would frustrate the pivot narrative.

Berenberg economist Kallum Pickering says December's uptick in inflation to 4.0% from 3.9% could mean "the hawks" on the MPC "may not even budge this time around."

"While split decisions are not unusual, we doubt the BoE can fully shift towards neutral guidance until all policymakers agree that rates are sufficiently high," he explains.

If this is the case, the Pound's pre-Bank of England sell-off might be unwound on the day, and the currency can advance into February.

Economists at Barclays expect the MPC to start removing its hawkish bias at this week's meeting, with a shift in the voting pattern to 7-2.

"Although this could weigh temporarily as a May cut comes into focus, we remain constructive on sterling's outlook. This is because activity data continues to hold up, as evidenced in the sizable upside surprise in both services and manufacturing PMIs in January," says Barclays.

Evelyne Gomez-Liechti, Multi-Asset Strategist at Mizuho International, says economic developments since the December meeting have been mixed, and while inflation progress has been better than the MPC expected, services and core inflation remain sticky.

Wage growth has decelerated, but only modestly.

"The unexpected CPI progress will likely translate to a dovish shift in the vote split - we see risk of a three-way split. However, we also think that the BoE will likely prefer to keep their optionality open – we expect forward guidance to remain unchanged," says Gomez-Liechti.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes