Pound Sterling Slides as Bank of England says Peak Interest Rates Close

- Written by: Gary Howes

- GBP/USD falls to three-month low

- GBP/EUR back below 1.17

- Bailey says peak interest rates close

- Says inflation to fall sharply over coming months

Above: Governor Bailey appears before the Treasury Select Committee on September 06. Image courtesy of Parliament TV.

A tough day for the British Pound was made tougher by the Bank of England Governor Andrew Bailey who was keen to stress the end of the interest rate hiking cycle was now close at hand.

Appearing before members of Parliament, Bailey said the Bank of England was "much nearer now to the top of the cycle", which meant he believed the peak in interest rates was close.

"I'm not saying we’re at the top because we’ve got a meeting to come, but I think we are much nearer to it on interest rates on the basis of the current evidence," he said.

The call reaffirms market expectations that another 25 basis point interest rate hike in September could prove to be the final hike of the current cycle.

The Pound was struggling ahead of Bailey's appearance before Parliament's Treasury Select Committee and his observations triggered renewed selling.

The Pound to Euro exchange rate fell 0.45% on the day to 1.1665, the Pound to Dollar exchange rate meanwhile fell half a per cent to test the key 1.25 marker as a run of weakness looked set to extend.

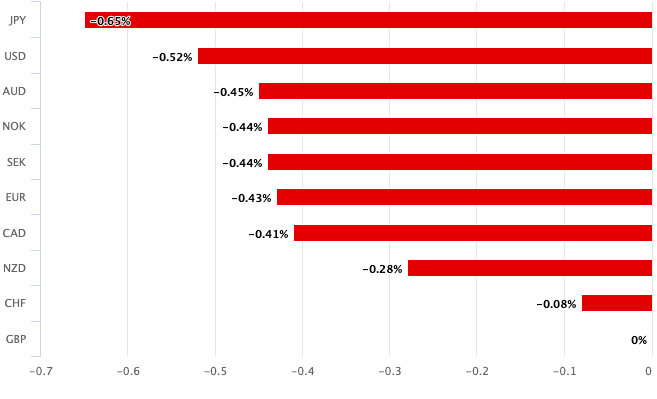

Above: GBP relative performance on September 06.

Bailey said he expects a marked fall in inflation from here. "The fall in inflation will continue... and I think will be quite marked by the end of this year."

Looking back to when inflation was above 10% Bailey said “it was clear that rates needed to rise going forward and the question was how much”. But he told lawmakers “we’re not in that place any more”.

The market entered the testimony by Bailey and Monetary Policy Colleagues expecting a full 50 basis points of interest rate hikes before the end of the year.

But the comments will draw doubts on whether a November rate hike will follow that of September, which remains a sure bet amongst market participants.

The fall in the Pound reflects these waning expectations.

The UK nevertheless has the highest headline inflation rate in the developed world and the Bank of England has signalled interest rates are likely to remain at high levels for an extended period of time.

As such, Bailey and the MPC will guard against any significant repricing lower in interest rate expectations, particularly if the market brings forward expectations for interest rate cuts, ensuring September's policy decision and guidance won't necessarily be the 'dovish' event sellers of the Pound might expect.

"We expect sticky inflation will delay the first rate cut until the summer of 2024, months later than the Fed and ECB," says Andrew Goodwin, Chief UK Economist at Oxford Economics. "High wage growth means that the Bank of England is likely to maintain a restrictive monetary policy stance."

The Bank will also be watching the Pound's fall against the Dollar, which exacerbates the rise in fuel prices for motorists and businesses at a time of rising oil prices and is therefore inflationary.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes