Little Economic Spare Capacity Left for the Bank of England to Toy With

- Written by: Gary Howes

Despite a recent run of good data currency markets have opted to focus on the Services PMI disappointment of Wednesday the 4th of March.

We argue that the UK economy is starting to generate its own organic inflationary pressure - just the sign that should trigger the Bank of England into an interest rate rise.

The unravelling of sterling in the wake of the data confirms March will be a tricky month and the recent good run could be due a period of consolidation.

57.5 was forecast from the Markit/CIPS PMI Services series and currency markets sold the GBP after a recording of 56.7 in February was released. This is a slow-down compared to January’s 57.2.

The negative reaction is interesting as we have seen two blow-out figures from the Construction and manufacturing sectors so far this week - on both occasions the market declined to give sterling a pat on the back.

This suggests to us the upward path for GBP is starting to get harder to climb; maybe owing to the fact that the uptrend is getting tired and stretched.

It must also be noted that the services sector is by far the largest component of the UK economy and this number was always going to be the most relevant of the three PMI’s for the UK currency.

New business Increased at Sharpest Pace for Three Months

Foreign exchange movements are dictated by how expectations are met by economic data and events.

When a miss on expectations is delivered the currency under scrutiny either adjusts higher or lower.

This is the case with the GBP as the Services data was actually rather robust.

Reading into the data we find that this is actually an incredibly positive report for the longer-term outlook of the British pound.

These are two important points to take note of:

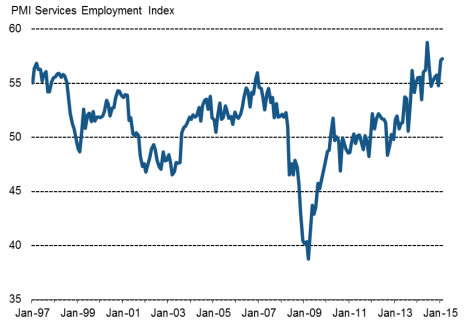

- New business increased at sharpest pace for three months while employment rises at second-fastest rate in the survey’s history.

- Input and output prices both increase at sharper rates.

Falling employment and rising prices indicate ‘spare capacity’ has done more than fall - we see it is starting to be constrained.

We saw and emphasised this in our coverage of the Construction PMI data on Tuesday where we picked up on an almost depleted labour pool.

Note how the March report shows inflation is starting to rise in the services economy because of wages and bullish sentiment:

“An increased willingness of suppliers to raise their charges combined with evidence of higher wages being paid led to an accelerated rate of input price inflation during February. That was despite ongoing reports of lower fuel bills restricting the degree to which operating costs were increasing.”

Above: The second sharpest rise in employment in the survey's history was seen in February.

We argue that the UK economy is starting to generate its own organic inflationary pressure - just the sign that should trigger the Bank of England into an interest rate rise.

Indeed, members of the BoE are already communicating that they are seeing little slack left, the question ahead of the March meeting is whether more members of the MPC are taking note.

If the Bank of England acknowledge this in coming months expect the pound sterling to rocket higher.

Currently markets are still pricing an interest rate rise for 2016, we see risks skewed to a much earlier rate rise.

Expect More Bank of England Fence-Sitting

Despite signs that the UK economy is starting to generate inflation we must remind ourselves that the Bank of England is heavily biased in favour of keeping interest rates as low as possible for as long as possible.

Andy Scott at HiFX has picked up on where the easing bias at the Bank could well be argued for:

“The dramatic fall in energy prices and the continued price war among supermarkets should help support consumer spending with wages now rising in real terms, but weaker overseas demand could still be an area of weakness.

“The Bank of England will be monitoring developments closely to gauge whether a rate hike will be needed this year, or whether they can postpone it until 2016.”

We see the rate setting committee remaining worried about the Eurozone as potential future weight on the British economy.

Pound Euro Rate Strong

While the GBP complex fell overall, we note the picture against the euro remains firm.

While we dither over the Bank of England’s viewpoints no such uncertainty over the thinking at the European Central Bank exists.

With the ECB about to unleash its sovereign quantitative easing we predict sterling euro should remain well bid.

Scott confirms this:

“GBP/EUR dipped back from over 1.3800 to 1.3780, having hit a fresh seven-year high of 1.3820 this week as the euro comes under pressure ahead of the expected launch of Q.E. by the ECB on Thursday.

“Despite unemployment dropping to 11.2% in January and the threat of deflation having eased in February, the euro remains under pressure with potential for GBP/EUR to move above 1.40 in the weeks ahead.”