Pound Sterling: Surprise House Price Rise Offers Support Near Recent Highs against Euro and Dollar

- Written by: Gary Howes

- UK house prices in unexpected rise in April

- Underpins expectations for May 11 Bank of England hike

- GBP/EUR churns water near 1.1375

- GBP/USD poised near 2023 highs

- ECB and Fed form this week's FX focus

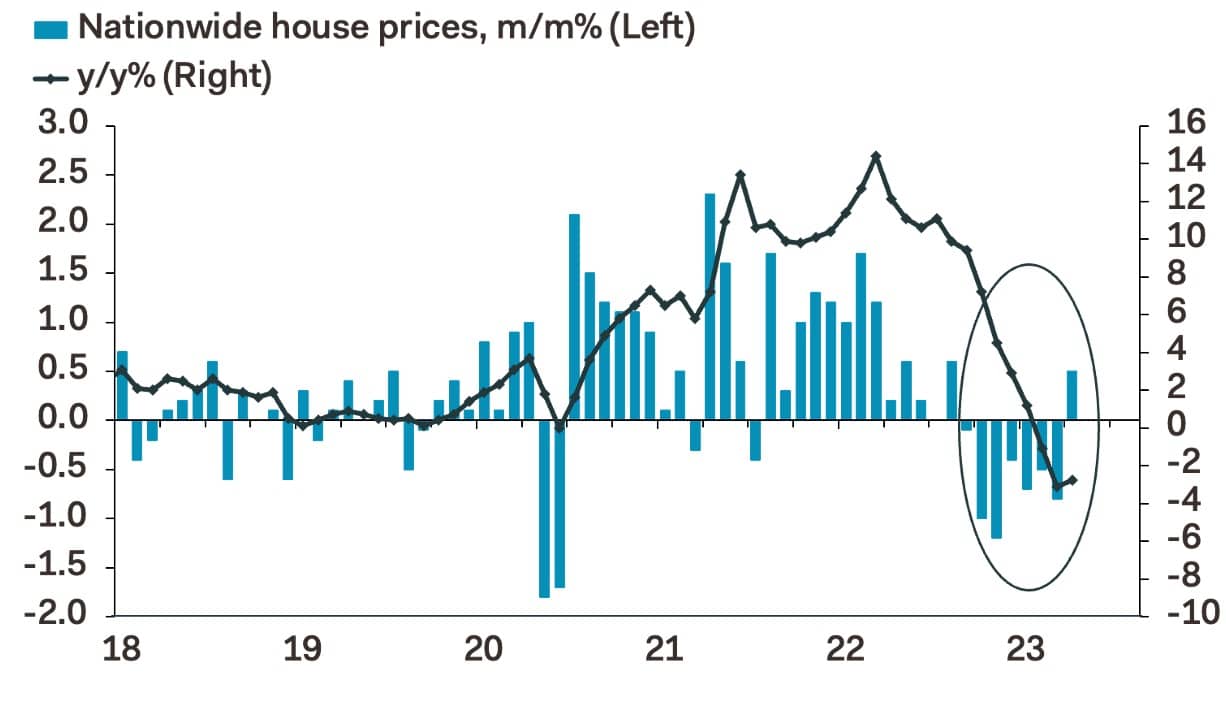

Above: Nationwide house price index, image courtesy of Pantheon Macroeconomics.

The British Pound can remain supported around current levels against the Euro and Dollar thanks to further signs the UK economy is proving more resilient than economists had anticipated.

UK house prices rose in April as a multi-month run of declines ended, said Nationwide, one of the UK's largest mortgage lenders.

April saw a 0.5% rise in house prices after seven consecutive falls, meaning the annual figure read at -2.7%, up from -3.1% previously.

This defies consensus expectations for a -0.4% month-on-month read and a further slide in the annual rate to -3.6%, suggesting a slide in the value of the UK's single most valuable asset (housing accounts for over 60% of the UK's net worth) could be bottoming

Following the data the Pound to Euro exchange rate was at 1.1375 and the Pound to Dollar rate at 1.25, meaning Sterling holds fort near the previous week's highs.

To be sure, the Pound is in the back seat this week as both the European Central Bank and U.S. Federal Reserve command the FX market's focus, but Nationwide's findings will have implications for the Bank of England's May 11 interest rate decision.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Tentative signs of a recovery in the property market come despite fears in some quarters that the Bank of England's run of interest rate hikes will lead to a protracted property downturn.

Indeed, Bank of England data show the number of mortgages approved for house purchase in February was nearly 40% below the level prevailing a year ago, and around a third lower than pre-pandemic levels.

"However, in recent months industry data on mortgage applications point to signs of a pickup," says Robert Gardner, Chief Economist at Nationwide.

Gardner says signs of improved sentiment in the housing market chime with the recent improvement in consumer sentiment.

Although confidence remains subdued by historic standards, GfK's long-running survey shows people believe their personal financial position will improve over the next twelve months as will the economy.

"If inflation falls sharply in the second half of the year, as most analysts expect, this would likely further bolster sentiment, especially if labour market conditions remain strong," says Gardner.

"This, in turn, would also be likely to support a modest recovery in housing market activity," he adds.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

But some are arguing for caution: Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says this "probably is just a blip away from its downward trend rather than a sign of emerging stability in the market."

He says other near-term surveys point to weakness while mortgage rates will likely edge up over the coming months, given that risk-free rates have increased recently and spreads already are tight by past standards.

"As a result, demand likely will remain weak enough to ensure that the stock of unsold properties continues to creep up and prices continue to fall," says Tombs.

The Nationwide data are just the latest in a string of better-than-expected economic releases that show the UK economy to be in a better position than the majority of economists were forecasting at the start of the year.

As a result, the Bank of England is widely tipped to raise interest rates again in May, with another 25bp hike expected thereafter, as it tries to get a decisive grip on inflation.

This can support UK bond yields, which can support the Pound.

Nevertheless, this week's focus will be on Wednesday's Federal Reserve policy update, the outcome of which will potentially send GBP/USD above 1.25 and into new highs for the year.

However, expect near-term weakness if the Fed raises rates by 25 basis points and pushes back against the market's current expectations for cuts to commence later in 2023.

Likewise, a 50bp hike from the ECB on Thursday, with guidance that more such hikes are likely, will boost the Euro.

But, a 25bp hike and a commitment to be reactive to data could disappoint against hawkish expectations, prompting the Euro to drift lower.

"For the time being, however, expect EUR/GBP to trade around the 0.88 area and be buffeted by all the inputs into Thursday's ECB decision. It is also hard to see GBP/USD moving much away from 1.2500 in the short term," says Chris Turner, Head of FX analysis and strategy at ING Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks