More Quantitative Easing Ahead? GBP Slumps as UK Inflation Plummets

- Written by: Gary Howes

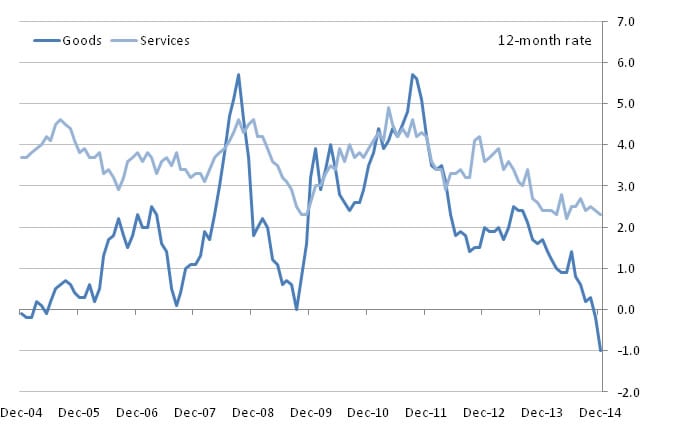

Above: CPI 12-month inflation rates for goods and services: December 2004 to December 2014

The British pound (GBP) has taken a hammering in mid-January as UK inflation falls closer to negative territory.

The rate of inflation faced by households is at the joint lowest level since records began in 1996.

The Consumer Price Index (YoY) reading for December fell to 0.5%, analysts expecations were for a fall to 0.7%, down from 1% a month previously.

The Bank of England Governorn will have to write a letter to the Chancellor of the Exchequer explaining why inflation is now well below the target level of 1%.

"Undoubtedly, Carney will blame the recent plunge in oil prices above all and also some other 'external' factors. More importantly for traders, a further sharp drop in inflation would mean the first BoE rate hike would be pushed further out, causing more pain for the pound," says Fawad Razaqzada at Forex.com.

The implications for the outlook of the pound sterling exchange rate complex are significant as the Bank of England will be under no pressure at all to raise interest rates.

The interplay between interest rates and global currency flows are key for the value of global exchange rates at the present time.

Indeed, there is even arguably more space for further unconventional easing measures to be put in place. Dr Dennis Novy is an Associate Professor of Economics at The University of Warwick tells us:

“There is a risk for the UK economy. Inflation is inching close to the danger zone of outright deflation. Once prices stop rising, consumers and businesses delay spending and can pull down the economy. If that happens, it would be time for the Bank of England to have another look at unconventional measures such as quantitative easing.

"They cannot allow inflation to drop much further. So what are their contingency plans? Are they planning to launch further quantitative easing? Are they planning asset purchases? The Bank of England cannot cut interest rates much further, so they would have to look at unconventional measures."

Below: Sterling dollar slumps following inflation figures.

Outlook for the Pound Dollar Rate

"In the interim, we continue to expect a consolidative tone around 1.5200 with risks still tilted towards the recent lows around 1.5035," says Emmanuel Ng at OCBC in Singapore commenting on the outlook for the pound dollar exchange rate.

"Studies all warn of downside risk, with support at the recent low of 1.5035," says Camilla Sutton at Scotiabank.

Analyst Luc Luyet at Swissquote Bank says:

"In the longer term, the technical structure is negative as long as prices remain below the key resistance at 1.5620 (31/12/2014 high). A full retracement of the 2013-2014 rise is expected. A strong support lies at 1.4814 (09/07/2013 low)."

Concerning the outlook for EUR/USD Emmenuel Ng tells us: "The pair may continue to orbit the 1.1800 neighborhood with EZ-related news flow still palpably negative with respect to potential QE from the ECB. At this juncture, risk-reward may continue to favor the lower reaches of a 1.1750-1.1900 zone."

Sutton is similarly bearish; "all signals warn of downside risk, and the RSI at 25 has not entered oversold levels. Accordingly we remain biased to be short EURUSD, looking for a test and break through last week’s lows of 1.1754."