Sterling Higher as Inflation Slump – Outlook Sees GBP/USD Strength Returning

- Written by: Gary Howes

The pound dollar exchange rate pairing (GBP/USD) has headed yet higher as it continues to suggest a multi-month downtrend is ending.

While the longer-term outlook still favours the USD we note near-term developments advocate for further GBP strengthening.

The decline in the US dollar comes despite a positive US Federal Reserve meeting in which the Fed made it clear it feels the US economy is in a healthy position, hinting at openness towards raising interest rates at some point next year.

The USD has strengthened through much of 2014 on the assumption that the first rate cut will come mid-year with the risk to dollar buyers being that the rise is delayed.

Meanwhile the rise in the pound sterling comes despite signs that UK inflation is falling at a faster-than-expected rate. Usually falling inflation is a GBP negative. However, when combined with a growing economy, rising employment and rising wages we see the positive economic implications that the data has.

UK Inflation Falls

The headline inflation rate, Consumer Price Index (YoY) (Nov), fell to 1%. Analysts had been expecting a fall to 1.2% showing what a surprise the decline has proven to be for traders.

Dennis de Jong, managing director at UFX.com, comments on UK inflation

“UK inflation looks set to continue falling over the next few months as the impact of low oil prices takes hold. Although this is good news for struggling households at Christmas, the Bank of England expects inflation to fall even further than the current 1% early next year and that is a real concern.”

“We’ve seen what ‘lowflation’ has done to the eurozone in recent months and unless wages start to rise significantly in the UK consumer spending will fall off. Mark Carney certainly can’t rely on computer game sales to do the trick every month.”

However, we would point out that low inflation in the Eurozone has different drivers to the low inflation in the UK. Where the EZ economy is stagnating the UK is growing at between 2% and 2.25% in 2014-2015 according to the IMF.

Downward Trend Being Tested

Turning to the outlook for the sterling dollar rate we note a multi-month downtrend is being tested.

If the GBP/USD can break above the declining line, shown below, then we could well see further buying interest take hold as markets call the end of the downtrend on technical considerations.

Why is the Pound Sterling Higher?

We see the climb in GBP/USD as being more of a function of the general weakness seen in the US dollar complex towards the close of 2014.

Driving the dollar lower is the euro – and it is for this reason that we would suggest external factors could actually be driving sterling dollar at the present time.

The euro exchange rate complex has shot higher in the pen-ultimate week of 2014 on some strong economic news out of Germany.

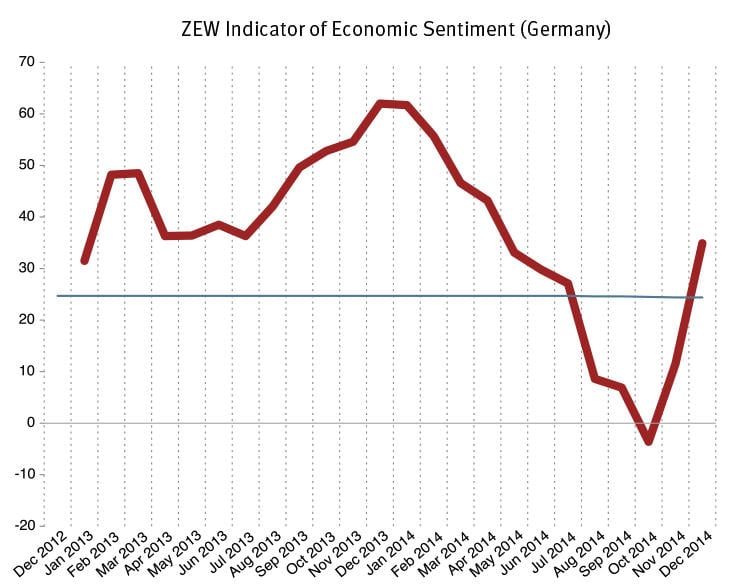

The ZEW Indicator of Economic Sentiment for Germany gains 23.4 points in December 2014. Increasing for the second consecutive time, the index now stands at 34.9 points (long-term average: 24.4 points), the highest reading since May 2014.

The euro has powered higher against a host of other currencies on news that the Eurozone economy could have seen the worst.

"Confidence in the German economy seems to be slowly returning among the financial market experts surveyed by ZEW. This increase is related to favourable economic conditions such as the weak euro and the low crude oil price. The recently published German export figures already show a positive trend. However, we should be aware that the current optimism is fuelled by factors that might change even over the short term", says ZEW President Professor Clemens Fuest.

As long as the dollar remains weak elsewhere we see the chance that the pound to dollar exchange rate extends its climb.