Pound Sterling Rally against Euro and Dollar can Continue Near-term, say Analysts

- Written by: Gary Howes

Image courtesy of gov.uk.

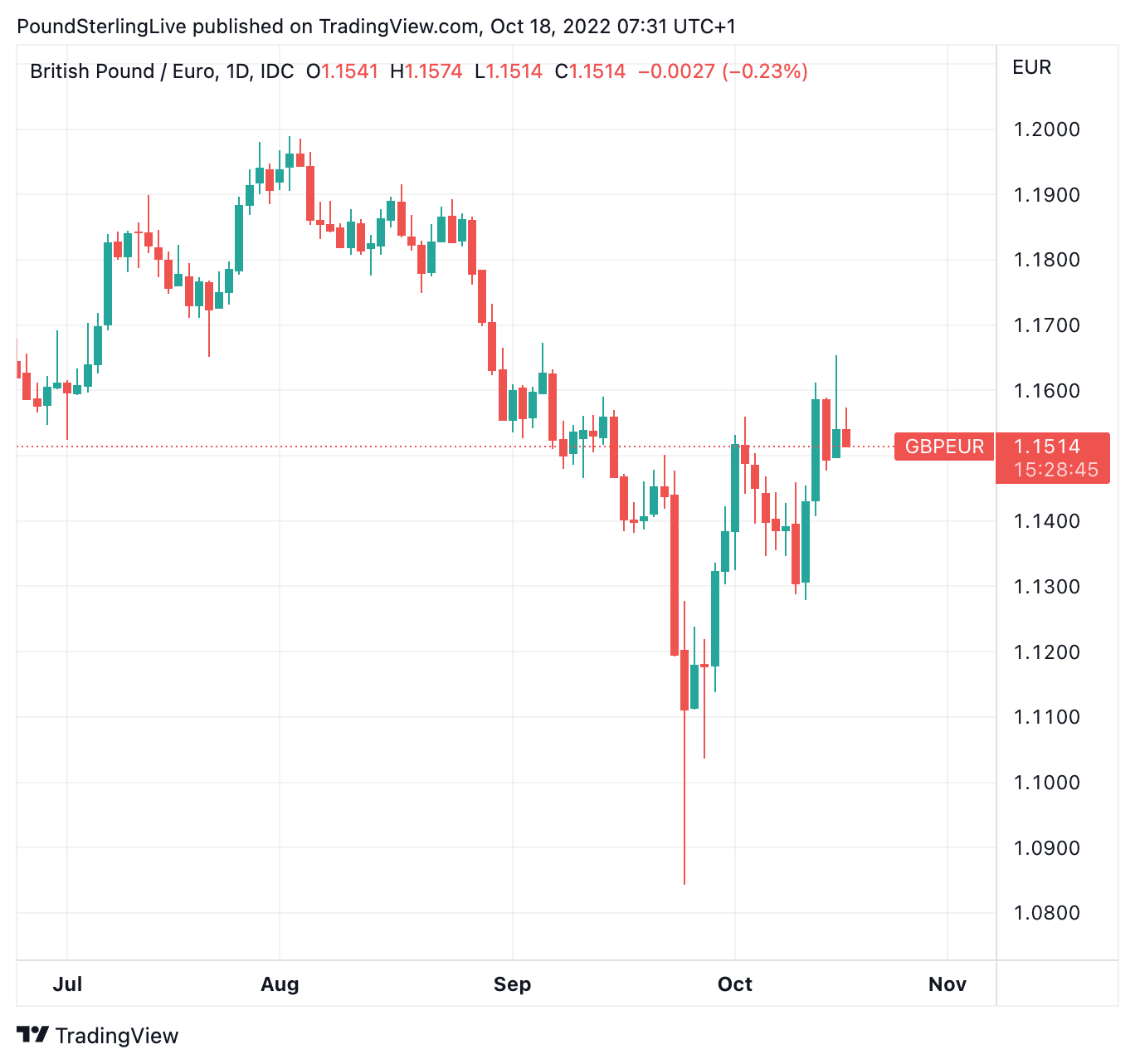

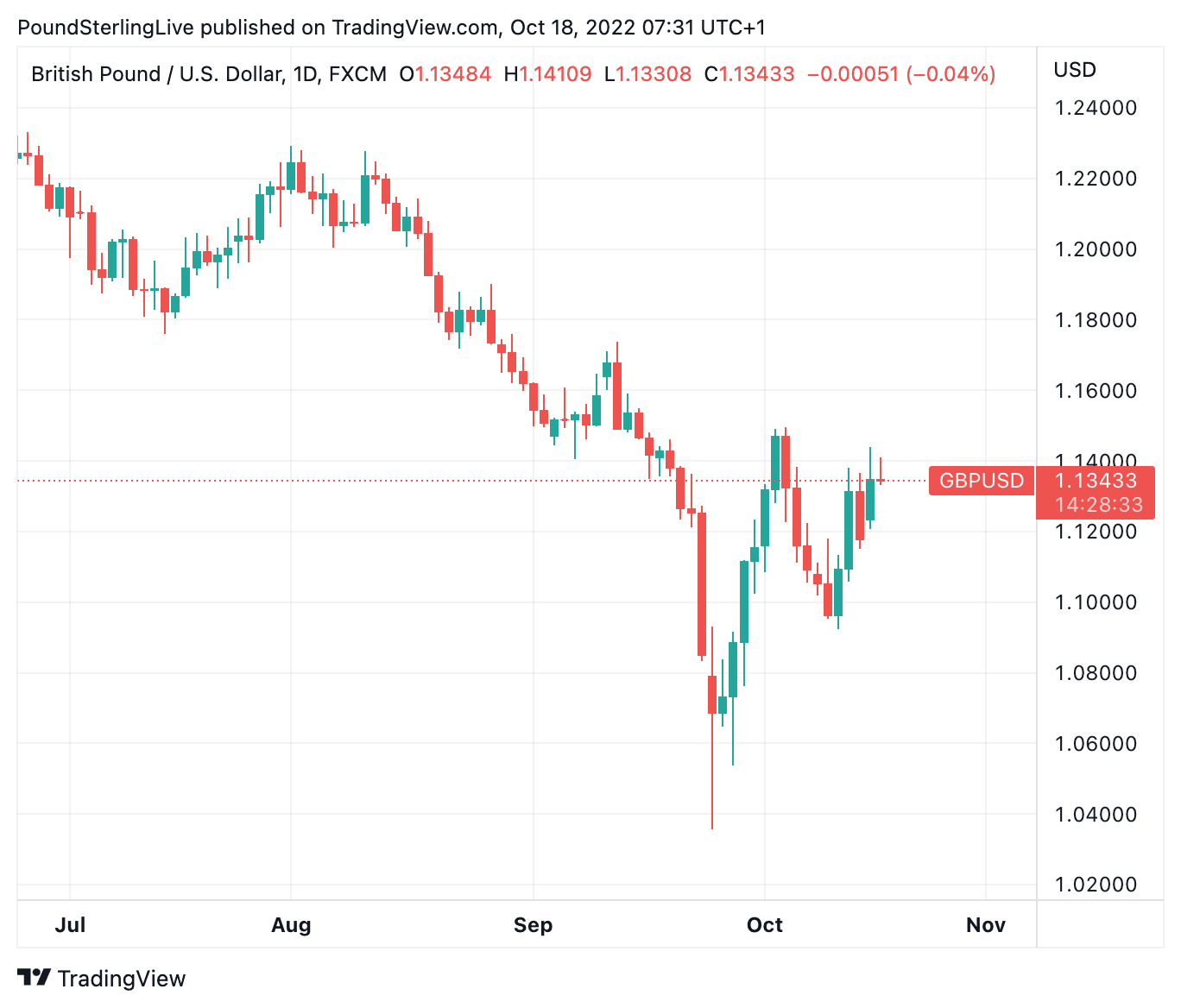

The British Pound rallied to a fresh six-week high against the Euro and approached October highs against the Dollar amidst broadly improved global investor sentiment and as markets welcomed the return of fiscal orthodoxy in the UK.

The Pound advanced on the Euro, Dollar and other major currencies after the new Chancellor of the Exchequer, Jeremy Hunt, reversed the majority of the tax cuts announced by his predecessor and said the government's decision to subsidise household energy bills would end in April.

The decisions put the UK's fiscal trajectory on a more sustainable and predictable outlook and provided reassurance to markets.

"The UK economy is set to benefit from a steady fiscal hand," says Kallum Pickering, Senior Economist at Berenberg.

"Sterling is rising and the febrile atmosphere of last week seems like a distant memory – calm has returned. All of this is due to the screeching handbrake turn in the Truss economic motorcade now that a new driver is at the wheel. Chancellor Hunt’s immediate efforts to get out on the front foot, bring forward his plans, and importantly, more openly, is a stark contrast with the previous Chancellor’s almost embarrassed, muffled, and tone-deaf performance," says Charles Hepworth, Investment Director at GAM Investments.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The reversal of tax cuts would deliver an additional £32BN to Treasury coffers per year, Hunt said in a televised statement.

"If the combination of spending cuts, tax hikes and a downsizing of the government’s energy market intervention look and sound a bit like austerity, that is because it is. But the market reaction to the announcement suggests this is the right decision," adds Pickering.

The Pound to Euro exchange rate rose to as high as 1.1655, but pared the advance to 0.40% for the day, it is back at 1.1523 at the time of writing on Tuesday.

The Pound to Dollar exchange rate rose 1.64% on the day and is at 1.1352 at the time of writing Tuesday.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"Jeremy Hunt, arguably de facto PM of the UK, has steadied the fiscal ship of state, and perhaps sets the stage for more GBPUSD gains above $1.13 for a while. But like the broader rally in stocks, this bounce in cable probably has a relatively short shelf-life," says Chris Beauchamp, analyst at IG.

Above: GBP/EUR at daily intervals. To better time your payment requirements, consider setting a free FX rate alert here.

However, Dr Ganesh Viswanath-Natraj, Assistant Professor of Finance at Warwick Business School, says the Pound could be set to appreciate further.

He says Government debt is on a sustainable path, leading to a more stable demand for gilts by investors.

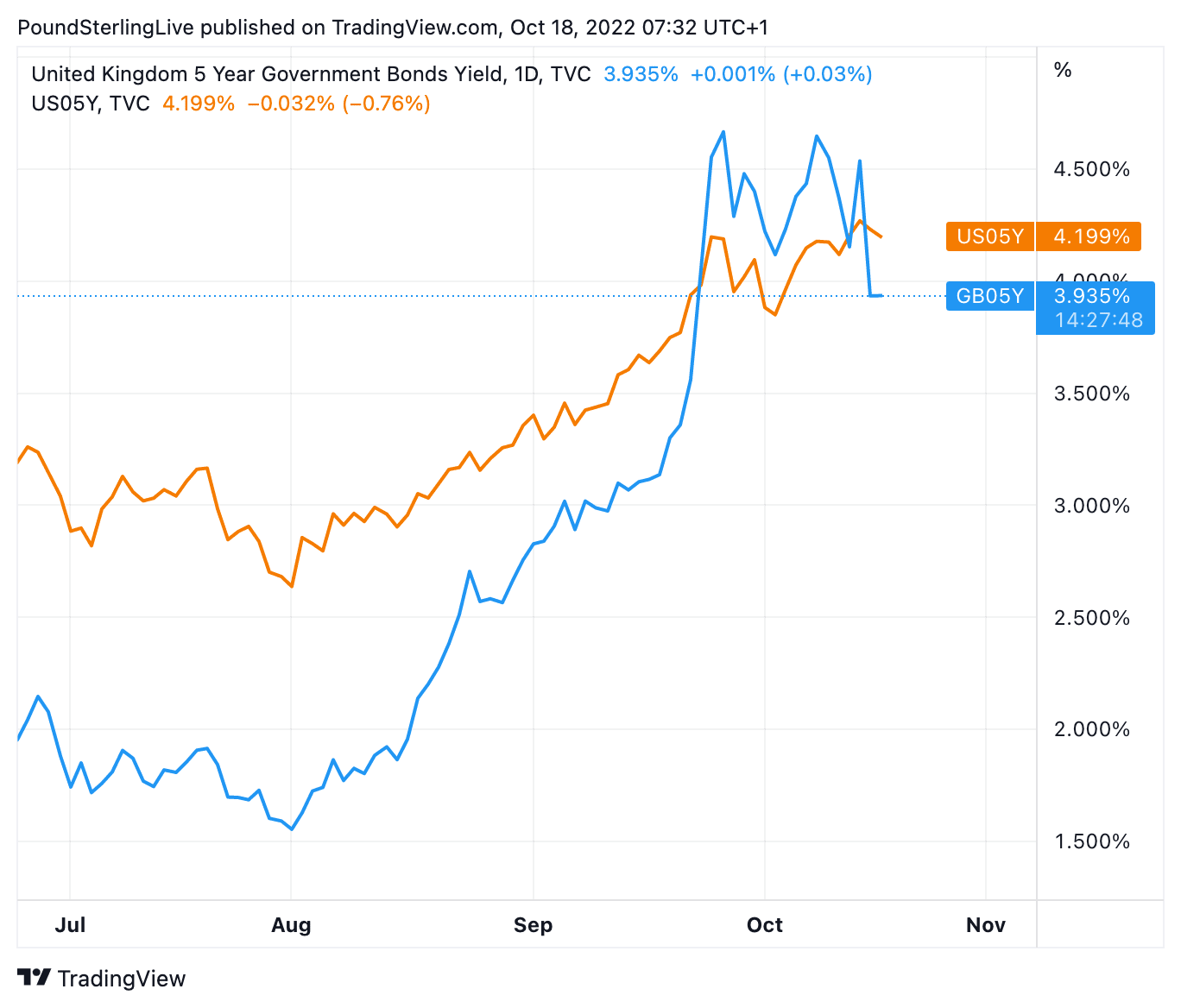

"In conjunction with this, the central bank is reining in its emergency bond-buying programme and has stated its commitment to further interest rate hikes in response to rising inflation," says Viswanath-Natraj. "This kind of tightening of monetary policy can help to maintain the pound's value as it makes sterling assets more attractive."

The market's welcome of a return to orthodoxy was reflected in UK bond markets, where the yield on bonds fell, ensuring the cost of borrowing across the economy was starting to come down.

"The market reaction to the Chancellor's announcements was positive, with sterling strengthening and gilt yields falling across the curve – the latter is particularly reassuring given the risk that the end of BoE intervention on Friday would trigger a rise," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Above: GBP/USD at daily intervals.

10-year gilt yields fell by 40bp to 3.92%, taking them below the US 10-year rate for the first time since the mini-budget.

Economists also said the developments take pressure off the Bank of England to hike interest rates by as much as would have been the case had no action been taken.

Money market pricing shows investors expect Bank Rate to now peak at 5% next spring, down from 6% two weeks ago.

"We think investors' expectations will continue to retreat, coming down closer to our forecast of a peak in Bank Rate of 4%," says Andrew Goodwin, Chief UK Economist at Capital Economics.

Above: The yield on UK 5-year bonds has slipped below to below those of their U.S. equivalent once more.

A lower Bank Rate will mean the upward pressure on borrowing will ease, which would limit the damage to household bank balances.

Indeed, some economists had warned that the recent rise in borrowing costs would make the coming recession one for the middle classes, given the impact to mortgage rates.

"In the wake of the financial market turmoil of the mini-budget, we lowered our forecasts for real GDP and inflation on the basis that tighter financial conditions would outweigh any positive benefits to demand from lower taxes. Following the big fiscal U-turn today, the situation is likely to be less bad than feared," says Pickering.

From a fundamental currency perspective, a shallower recession would imply less downside pressure on the Pound over the coming months.

After 4.1% growth in 2022, largely due to base effects from a weak 2021, Berenberg now expects the economy to contract by 1.3% instead of 1.6% in 2023.

But, Pickering cautions the risk to watch is that the government goes too far with austerity – beyond what would be needed to shore up confidence – which would hamper the recovery during 2023.

Looking at Hunt's measures, two policies were maintained, with Hunt saying in Parliament the only reason they didn't get the chop was because the legislative process to deliver them was so advanced:

- National Insurance increase will be reversed, as planned, at a cost of £17BN/annum.

- Stamp Duty cut remains, estimated to account for a smaller £1.5BN

The Chancellor said his tax reversals will raise revenues by £32BN/annum, these include:

- 1p cut in income tax (to raise £6BN)

- Dividend tax

- changes to IR 35

- VAT-free shopping proposal

- off-payroll work proposals

This is in addition to the first u-turn on the 45p tax band abolishment and Friday's reversal of 2023's planned corporation tax hike.

"Ex-Chancellor Kwarteng announced an energy support scheme estimated to cost around £150 billion and tax cuts worth £160 billion over the next five years, estimated at over 11% of GDP over five years. After today’s announcements that bill has dropped to around 4.5% of GDP over five years, plus whatever further energy support measures are added next spring," says David Page, Head of Macro Research at AXA Investment Managers.

"From a market perspective, today’s announcements have helped calm markets and reduced the risk of a further sell-off in gilts," adds Page.

"All else equal, this is good news for the economic outlook," says Goodwin.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes