Poorly Pound Sold Down by Central Bankers in Q2, IMF Data Suggests

- Written by: James Skinner

Image © Adobe Images

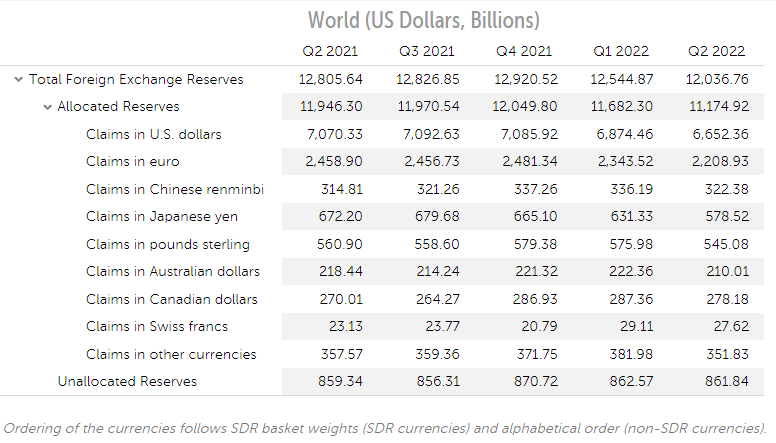

The Pound has had a volatile year with some of its heaviest losses seen during the second quarter and newly released International Monetary Fund (IMF) data suggests this was also a period in which central bank managers of official reserves reduced their exposures to a range of currencies including Sterling.

Sterling fell by just more than seven percent against the Dollar over the three months to the end of June while UK government bond prices also declined as the full scale of the international economic fallout and interest rate policy implications of the war in Ukraine became unavoidable for financial markets.

During this period losses for the Pound were larger than the 5.37% decline in U.S. Dollar denominated holdings of Sterling that were declared to the IMF at the end of September for inclusion in its second quarter Currency Composition of Official Foreign Exchange Reserves (COFER) report.

This would suggest the Pound proved more popular with reserve managers as it grew cheaper during the second quarter if the data are reported according to IMF guidance that suggests using end-of-period exchange rates to convert reserve holdings into the U.S. Dollar reporting currency.

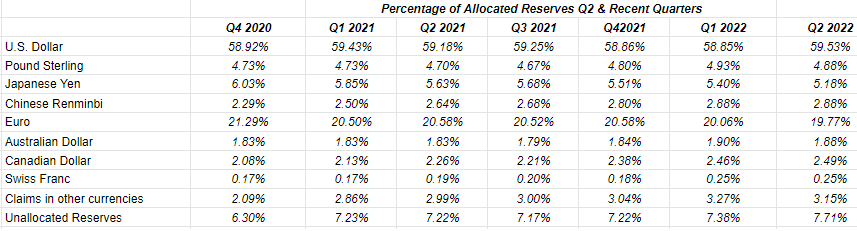

But the rub for the Pound and other currencies is that holdings of Sterling actually shrank when measured as a percentage share of allocated reserves.

Source: International Monetary Fund Currency Composition of Official Foreign Exchange Reserves (COFER) report.

The latter is a sign of central bankers cutting back their exposure to the Pound and a range of other currencies including the Japanese Yen and Euro.

Sterling was one of the biggest G10 fallers over the second quarter although the Japanese Yen, Euro, Swedish Krona and Norwegian Krone also fell heavily.

Measuring changes as a portion of allocated reserves suggests that central bank investors of official savings added to holdings of U.S. and Canadian Dollars during a period in which they featured as the best G10 performers.

The U.S. Dollar's overall share of allocated reserves rose to 59.53% during the second quarter, from 58.85%, and despite that more than $500BN U.S. Dollars were sold down over the period in what may have been central bank attempts to protect their own currencies from the strengthening U.S. Dollar.

The strengthening Dollar can raise the cost of imported goods including energy commodities with prices that have risen substantially in 2022 of their own accord and for reasons relating to the conflict in Ukraine.

This has seen European gas supplies disrupted by coercive actions from Moscow and the destruction of the Nordstream 1 pipeline while most recently the oil market has been impacted by a pending G7 attempt to cap oil prices.

Source: Pound Sterling Live calculations.