Pound Set for a Poor Year-end says Capital Economics

- Written by: Gary Howes

Image © Adobe Images

The British Pound will remain under pressure over the remainder of 2022 as the Bank of England fails to meet increasingly elevated expectations imposed on it by investors, according to new analysis from independent research consultancy Capital Economics.

Market data shows the Bank is now expected by investors to 'outhike' all other major central banks over the remainder of 2022, the U.S. Federal Reserve included, and Capital Economics say a reversal of such expectations could have downside implications for the UK currency.

"We think the Bank of England will hike interest rates by less than money markets now discount, which in turn should keep the pound under pressure," says Kieran Tompkins, Associate Economist at Capital Economics.

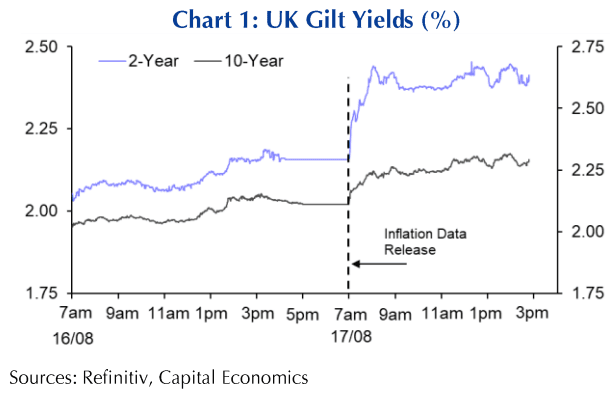

While inflationary pressures are falling back elsewhere they are increasing in the UK and bond markets have reacted accordingly by rising.

The yield paid on ten-year gilts rose roughly 25 basis points following mid-week inflation data, while the yield paid on two-year bonds rose around 40bp.

Rising yields are often associated with a stronger currency as international investors buy assets that offer increased returns. "But this has not fed through to the pound," says Tompkins.

Image courtesy of Capital Economics.

Capital Economics anticipates the Pound to remain under pressure during the remainder of 2022 as a consequence of recent developments and market dynamics that includes an unwillingness to respond to rising yields.

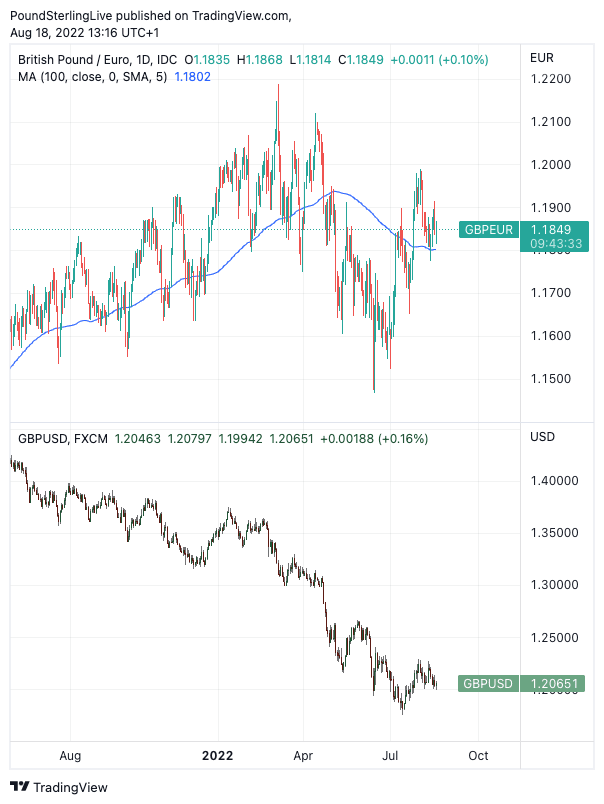

The Pound to Euro exchange rate remains supported around its 100-day moving average near 1.1850, a performance that reflects the market's sceptical outlook for both the Eurozone and UK.

But it is the Pound to Dollar exchange rate that is likely to bear the brunt of the market's disappointment, according to Capital Economics.

Above: GBP/EUR (top) and GBP/USD (bottom) at daily intervals. Set your FX rate alert here.

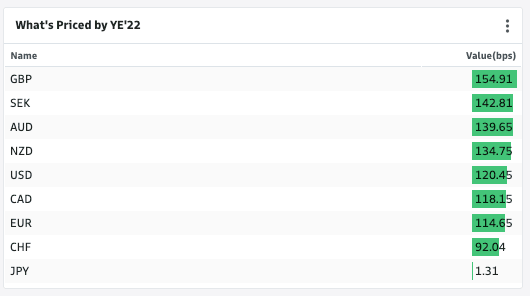

According to money market data, the Bank of England must hike more than any other G10 central bank over the remainder of 2022 if it is to satisfy market expectations.

Following this week's UK data releases money market pricing now shows investors to be geared for 154 basis points of hikes by the end of the year.

That is more than is asked of the two typically hawkish antipodean central banks and the pace setting Federal Reserve.

Above: Market expectations for the major central banks, image courtesy of Goldman Sachs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

It implies three 50 basis point hikes are required at the three remaining Bank of England Monetary Policy Committee meetings in September, November and December and a peak Bank Rate near 4.0%.

Given the Bank has set a precedent by raising by 50bp in August this is an achievable target.

The implications for Pound Sterling are significant: if it meets this target the currency would likely remain supported, but another 'dovish' pivot from the Bank that disappoints against expectations could send it lower.

"We suspect that investors have probably got a bit ahead of themselves by expecting the Bank of England to raise rates to close to 4.0% and, ultimately, will have to pare back those expectations," says Tompkins.

A look at the following pricing shows investors have ramped up their expectations from the Bank through August:

Image courtesy of Goldman Sachs.

As can be seen in the below, Bank of England expectations have risen more than those in the U.S.:

image courtesy of Goldman Sachs.

And more than in the Eurozone:

image courtesy of Goldman Sachs.

The need to raise rates further than the Bank had expected as recently as the August 04 policy update comes on the back of this week's solid labour market data that showed wages increased by a greater amount than markets were expecting.

But it was inflation data which revealed annual inflation had reached 10.1% growth that pumped expectations.

The Bank itself projects inflation will peak at around 13% later in the year following the next round of energy price rises and has committed to tackling inflation "no ifs, no buts", in the words of Governor Bailey.

Adam Cole, Senior Currency Strategist at RBC Capital Markets, also observes a rise in rate hike expectations, but he uses a different measure and charts against the Pound's value:

image courtesy of RBC Capital Markets.

He notes this pick up in expectations has not benefited the Pound against the Euro and Dollar to any meaningful degree.

It suggests GBP exchanges rates have decoupled from rate expectations.

Of course the Pound might play catch up and go higher over coming days and close the gap.

But expectations for a marked slowdown in UK economic growth is likely keeping buyers at bay for now and the gap between interest rate expectations and GBP exchange rates could remain large.

It is also worth noting in the above charts that the downslope on the Bank of England chart (2nd chart) is bigger than any of the others, therefore the Bank will likely cut more in 2023 than its peers.

Perhaps, that is what matters most for forward-looking markets and therefore the Pound is finding little benefit to the sharp rise in near-term money markets.

"Investors continue to anticipate a quick turnaround in policy from rate hikes to rate cuts," says Tompkins.

Capital Economics forecasts the Pound-Dollar exchange rate will edge lower to 1.18, with risks to the downside.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes