Pound Sterling's Outlook Brightens as "UK Economy in Better Shape than Feared"

- Written by: Gary Howes

Image © Adobe Images

The British Pound could be better supported over the near-term courtesy of a strong economic growth report published this week which increases the odds for a 50 basis point rate hike at the Bank of England in August.

Potentially more significant, the data sends a message to a market that has become increasingly bearish on Sterling and the UK economy in recent months and any sentiment shift could bolster demand for the currency.

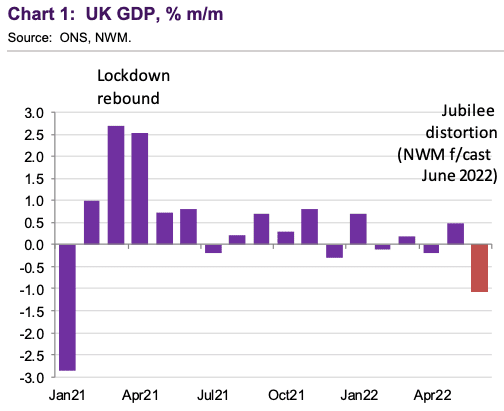

UK GDP printed 0.5% in the month to May said the ONS, beating expectations for growth of 0.1% and a return to growth having posted -0.2% in April.

In the three months to May the economy grew 0.4% which bettered a consensus forecast of 0%.

The data beat highlights how negative investor and analyst sentiment to the UK has become of late, which analysts say has contributed to Pound Sterling underperformance over the course of 2022.

"May GDP and revisions to past data lifted the Q2 carryover from -0.4pp to +0.2pp and painted a much more comforting picture of the economy than feared after the April print," says Fabrice Montagné, economist at Barclays.

Disrupting the vortex of negative economic sentiment amongst analysts and investors could assist the Pound in reversing some its recent weakness, particularly against the likes of the Euro.

"The news will help ease some of the concerns about the health of the UK economy... Sterling jumped from $1.1895 to $1.1936 on the news as the markets priced in an increased probability of a 50-basis point hike from the Bank of England," says Marc Cogliatti, Principal in the Global Capital Markets team at Validus Risk Management.

The Pound to Euro exchange rate went as high as 1.1870 in the wake of the GDP release but has somewhat pared the gain to 1.1816, but the lows of 1.1586 reached in mid-June look safe as Sterling breaks out of a short-term downtrend.

Above: Daily GBP/EUR chart showing the April-July downtrend.

The Pound to Dollar exchange rate went as high as 1.1966, but the charts confirm this is a mere blip in the face of the Dollar onslaught and there is no technical evidence available to suggest the trend is turning:

Above: Daily GBP/USD chart showing a long-term downtrend that ultimately remains in place.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"It’s hard to be too bullish on sterling in the short term although longer- term, we remain optimistic given the pound is now significantly undervalued on a purchasing power parity metric," says Cogliatti.

In the wake of the surprising GDP data Barclays says it is revising up its second quarter UK GDP forecast to -0.2% quarter-on-quarter.

"This contrasts with softer data so far and feeds into the BoE's "forceful" narrative," says Montagné.

The "forceful narrative" is a reference to the Bank of England's message in its June policy meeting that it stood ready to take a more robust approach to combating inflation.

This was widely read by markets as a hint by the Bank it was prepared to break a preferred convention of hiking rates in 25 basis point increments and opt for a 50 bp hike.

Foreign exchange markets have held this to be a broadly supportive development for the Pound, and this is reflected in a better supported UK currency against most majors, apart from the U.S. Dollar.

The rule of thumb in currency markets is that a central bank that is hiking is one that is supporting its currency. To be more specific, a central bank that hikes into economic strength is one deemed to be supportive of this currency.

The Pound failed to garner support when the market believed the Bank of England was hiking into slowing growth.

The magic ingredient for a stronger Pound therefore is, as always, economic growth; something the UK economy continues to offer despite fears of a rapid slowdown.

"The strength in May was fairly broad-based, with positive growth in services, production and construction," says economist Steffan Ball at Goldman Sachs.

"Folding in both the back revisions and the surprising jump in activity in May boosts our estimate of Q2 GDP growth from -0.7% to +0.3%," says Ball.

Goldman Sachs assumes some of the positive momentum will continue into the coming months, which leads them to expect third quarter GDP to increase by +0.4% (vs +0.1% previously).

"Given we no longer estimate Q2 growth to be negative, we are lowering our recession probability for the year ahead to 35% (from 45% previously)," says Balls.

This is now just slightly higher than in the U.S. where odds of a recession sit at 30%.

Bank-beating exchange rates, get up to 5.0% more currency when you transfer with Horizon Currency. Get a free quote here.

But the odds are lower than in the Eurozone where Goldman Sachs' economists price odds of a recession at 50%.

On paper such divergent economic trends offers a bullish prognosis for the Pound relative to the Euro.

Bank of England Governor Andrew Bailey on Tuesday pledged to bring down inflation to the Bank's 2.0% target, "no ifs or buts", a comment currency analysts took as confirmation a 50 basis point hike was likely in August.

"There are more options on the table than another 25 basis points," he added.

"With BoE Chief Bailey yesterday raising the possibility of larger rate hikes, we now suspect EURGBP is unlikely to push beyond 0.8700 as we had initially expected, and instead see it now centred close to 0.8450," says Shahab Jalinoos, Head of FX Strategy at Credit Suisse.

But Ross Walker, Chief UK Economist, at NatWest Markets, says the Bank won't respond to the May GDP data by going for a 50 basis point hike, an outcome that would deflate Sterling exchange rates given elevated hiking expectations.

NatWest forecasts the UK economy will contract in the second quarter and pen in a reading of -0.1% to -0.2% q/q.

"Whilst this contraction would probably exaggerate the underlying deterioration, the economy continues to falter as the cost-of-living squeeze intensifies and businesses become more defensive," says Walker.

Watch Gas Prices Near-term

Global investor sentiment will remain an ongoing background driver for the Pound given the currency's high beta status that means it rises alongside equity markets against currencies such as the USD, JPY and often the EUR.

With global markets in a bear trend, rallies against these names could prove to be short lived.

Gas prices are also proving a headache for the Pound, as we have noted on numerous occassions already.

The Pound struggled midweek on news of limited Norwegian gas supplies and we would be wary of further such disruptions.

For the Pound-Euro exchange rate Norway is more important to the UK while Russian supply matters for the Eurozone.

Therefore gas price squeezes that impact UK gas contracts (via Norway) are more important to Sterling than are European contracts that are largely driven by Russian supply.

Any easing in gas market worries could boost one currency relative to the other, while a more generalised pullback should benefit both against the Dollar.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes