Pound Sterling Eases Back on Softer than Expected Inflation Data

- Written by: Gary Howes

Image © Adobe Images

UK inflation data for April printed softer than expected, prompting the British pound to give back some recent gains.

The Pound edged lower after the UK's headline CPI inflation rate printed at 9.0% year-on-year, which is below the 9.1% the market was expecting, but up markedly on the 7.0% printed in March.

The bulk of the gains in inflation were linked to the jump in energy costs owing to the lifting of the Ofgem price cap in April and were therefore largely expected by economists.

The next lift to energy prices comes in October when UK inflation is expected to peak close to 10%, according to Bank of England forecasts.

Inflation remains undoubtedly hot, but that today's figures underwhelmed against expectations might offer a crumb of hope to under pressure households.

CPI inflation rose 2.5% month-on-month in April said the ONS, up from 1.1% previously, but underwhelming against the 2.6% the market was expecting.

Core CPI, which strips out energy effects and gives a more 'organic' feel for domestic inflation, rose an eye watering 6.2%, but this was in line with the market's expectations.

Month-on-month core rose 0.7% which actually undershot expectations for 0.8%.

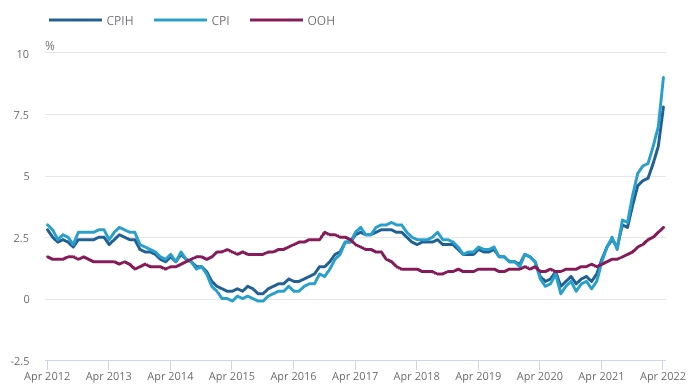

Above: CPIH, OOH component and CPI 12-month inflation rates for the last 10 years, UK, April 2012 to April 2022. "The annual CPIH inflation rate was last higher in April 1991" - ONS.

The data therefore does not represent a massive surprise and won't materially shift the market's expectations for future Bank of England rate hikes, therefore it will unlikely have a massive effect on Sterling.

Nevertheless, there was a knee-jerk move lower in the Pound following the release, understandable given many trading algorithms would be primed for such a move.

The Pound to Euro exchange rate edged lower to 1.1840 on the back of the data, the Pound to Dollar exchange rate fell back to 1.2474, giving back some ground gained in the wake of Tuesday's unexpectedly strong employment market data. (Set your FX rate alert here).

"The 9.0% rise in April consumer prices is in line with the BoE’s latest estimate and thus should not change its near-term reaction function or guidance – we continue to expect two more 25bp hikes this year," says Kallum pickering, Senior Economist at Berenberg Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

From a currency perspective the question is whether today's inflation data and yesterday's wage and employment data shift the dial on the number of interest rate hikes the Bank of England will deliver over coming months.

The stronger than expected wage data appeared to encourage markets to price in further hikes, which was reflected in a sharp move higher in the Pound.

Subsequent inflation data doesn't quite have the same effect.

Indeed, considering both sets of data leaves Pickering unconvinced the Bank will be inclined to hasten the delivery of higher interest rates.

"The big rise in wages in March was entirely due to outsized bonus pay rather than a sharp acceleration in underlying pay growth, and the big CPI surge is driven by the externally-driven rise in energy prices, BoE policymakers are likely to be less worried by the latest data than some headlines may suggest," says Pickering.

This could deny the Pound a fundamental narrative to go higher.

Inflation snapshots:

- A 54% increase in Ofgem's energy cap in April meant electricity and gas prices pushed the headline figure up 2.1 percentage points, from 0.7 points in March.

- Motor fuel CPI inflation increased to 31.4%, from 30.7% in March given petrol prices rose to a record high of £1.75 per litre.

- Food CPI inflation rose to 6.7%, from 5.9%.

- Recreation/culture inflation rose from 4.9% to 5.9%.

- Restaurant/hotels inflation from 6.9% to 7.9%.

What's Coming Next?

"Looking ahead, the headline rate of CPI inflation likely will edge down over the coming months, probably to around 8.5% by August, as the anniversary of very large increases in prices, as businesses reopened after the lockdown, is reached," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Tombs says the headline rate of CPI inflation will fall quickly in 2023, in response to recent falls in shipping costs, easing demand for goods that were desired during the pandemic, and stabilising energy prices.

"The absence of a wage price spiral—average weekly wages excluding bonuses rose just 4.1% year-over-year in March, despite a sharp rise in average weekly hours—suggests that the MPC will be able to focus on the subdued medium-term outlook for CPI inflation and stop raising Bank Rate sooner than investors currently think," says Tombs.

Paul Dales, Chief UK Economist at Capital Economics, says "things are going to get worse before they get better."

"We think the combination of a further 30% leap in the Ofgem price cap in October and increases in other costs (inputs and wages) will mean CPI inflation rises to around 10% in October," says Dales.

He says inflation will probably fall back after that, but the tight labour market and high wage growth suggests to us it won’t drop back to the 2% target on its own accord.

"We think interest rates will need to rise from 1.00% to 3.00% to do the job," says Dales.