Pound Sterling: Don't Rule out a 2021 Rate Hike Just Yet

- Written by: Gary Howes

- Expectations for Dec. rate hike fall to ~10%

- This makes a hike a market-moving surprise

- GBP would jump

- AXA, Deutsche Bank See a hike

Image © Adobe Stock

The Bank of England would deliver a market moving-surprise if it goes ahead and opts for a 15 basis point hike on Thursday, given market expectations for such a move have slipped significantly over the past two weeks.

Pound Sterling would rise against the Euro and Dollar as the yield paid on UK government bonds shifts higher and attract inflows of foreign capital.

Pound Sterling Live reported on December 02 such a reaction by the UK currency was the most likely outcome given an ongoing scaling back of expectations linked to the emergence of the Omicron variant of Covid.

Indeed, since December 02 rate hike expectations have fallen further still and OIS markets suggest investors have all but priced out such an outcome.

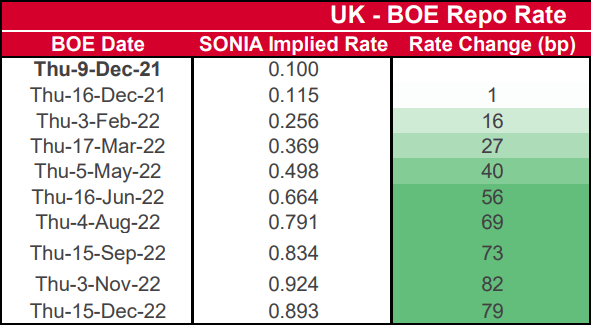

Above: Westpac table showing market implied BoE Bank Rate for various months and implied change measured in basis points.

- Reference rates at publication:

GBP to EUR: 1.1730 \ GBP to USD: 1.3273 - High street bank rates (indicative): 1.1500 \ 1.3000

- Payment specialist rates (indicative: 1.1670 \ 1.3200

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

Thursday’s market-implied Bank Rate of just 0.115% for December 16 suggests investors see ~10% probability of the benchmark being lifted to 0.25% next week, down from a 33% implied probability on Monday.

"By the 16th Dec meeting we reckon there will be sufficient information for the BoE to at least be comfortable with a 15bp hike, and that short-Sterling is now in a phase of under-pricing this risk,” says Peter McCallum, a rates strategist at Mizuho Bank.

But would the Bank have the appetite to deliver another surprise, given they took some flak for not hike in November despite strong guidance for such an outcome?

"Overall, the case remains for the need for “some modest tightening” over the forecast period, and so the decision on whether to raise interest rates next week is probably still finely balanced," says Hann-Ju Ho, an economist at Lloyds Bank.

David Page, Head of Macro Research at AXA Investment Managers says he is looking for a hike.

"The short-term uncertainty surrounding Omicron and the reimposition of modest restrictions associated with the government’s Plan B certainly provide the MPC with a reason to leave a decision on tightening until the February meeting – some value in waiting according to the BoE’s hawkish Michael Saunders," says Page in a note out December 10.

Members of the Bank's Monetary Policy Committee have signalled clearly that some tightening of monetary policy will be required in the near future.

"Beyond the political optics, we see merit in making the first 0.15% increase next week, while explaining that any further tightening will depend on future developments in the virus. On balance, we expect the MPC to begin a cautious tightening cycle next week, but acknowledge that this has become another close call," says Page.

Sanjay Raja, Senior Economist at Deutsche Bank is also looking for a rate hike.

"Despite the rise in uncertainty around the Omicron variant, we expect the MPC to raise the Bank Rate by 15bps to 0.25% at its December meeting," says Raja.

Deutsche Bank's economists find the Omicron variant has changed little on the medium-term economic outlook, even if the near-term outlook to growth takes a hit.

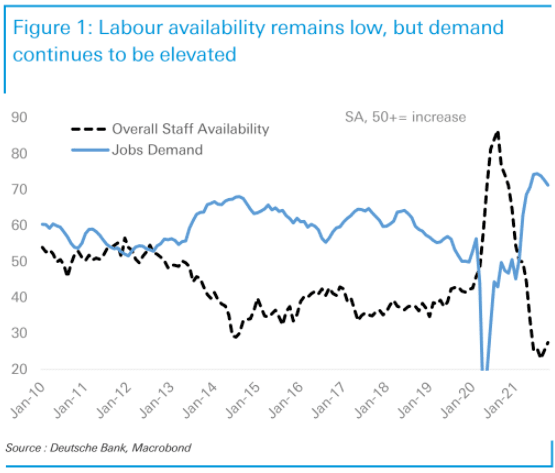

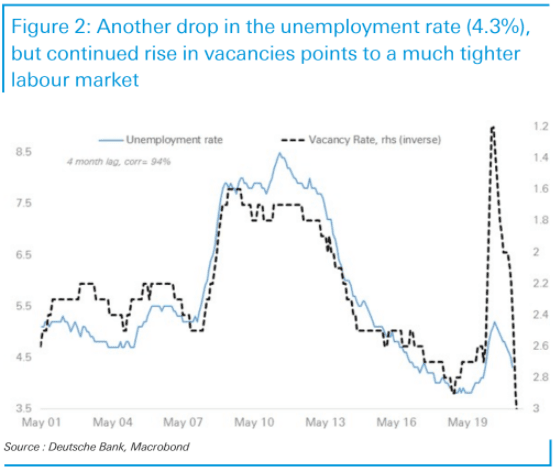

"The labour market remains as tight as it has been in recent memory, in spite of the furlough scheme ending on 30 September. And inflation continues to outpace staff forecasts, despite a sizeable upward revision in the November Monetary Policy Report," says Raja.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Deutsche Bank warns the potential disruption from Omicron may lead to even more inflationary pressures in the medium term as supply chain bottlenecks and labour shortages/mismatches are further exacerbated, which would only heap pressure on the Bank of England to fulfil its mandate and return inflation towards the 2.0% level.

Just days ahead of the December 16 policy update a survey showed the public's satisfaction in the Bank of England had fallen sharply, according to the Bank of England/Kantar Inflation Attitudes Survey for November 2021.

When asked to assess the way the Bank is "doing its job to set interest rates to control inflation," the net satisfaction balance – the proportion satisfied minus the proportion dissatisfied – was 14%, the lowest since 2012.

Rate setters will take note that the same survey showed median expectations of the rate of inflation over the coming year were now up 3.2%, up from 2.7% in August 2021.

This suggests inflation expectations are settling materially higher.

"In the end, a 15bps hike would do little to disrupt the recovery, given the lengthy lag in monetary policy transmission," says Raja.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Deutsche Bank still sees the Bank Rate rising to 0.5% by May-2022, triggering a stop to all APF reinvestments thereafter.

They also maintain a call for a third rate hike in February 2023 (25bps) and now see one further rate hike coming in November 2023, taking the terminal rate up to 1.0%.

However, Karsten Junius Chief Economist at Swiss Bank J. Safra Sarasin Ltd says expectations for a rates rising to 1.0% might be too optimistic, and this is one reason why they are stating clear of the Pound in 2022.

"With the trajectory for policy rates looking too aggressive, the massive yield curve flattening in recent months has probably gone too far too quickly. Consequently, we expect longterm UK bonds to underperform intermediate maturities over coming months as some of the recent move is reversed," says Junius.

His colleague, strategist Claudio Wewel says despite the British Pound’s resilient performance in 2021, he thinks the Pound faces headwinds against the Euro in 2022.