Pound / Dollar Rate Looks for Support after BoE Repricing Runs Course

- Written by: Gary Howes

- GBP/USD finds feet after test of major supports

- New restrictions fuel, vindicate repricing of BoE

- Odds favour no change in Dec, market eyes Feb

Image © Adobe Stock

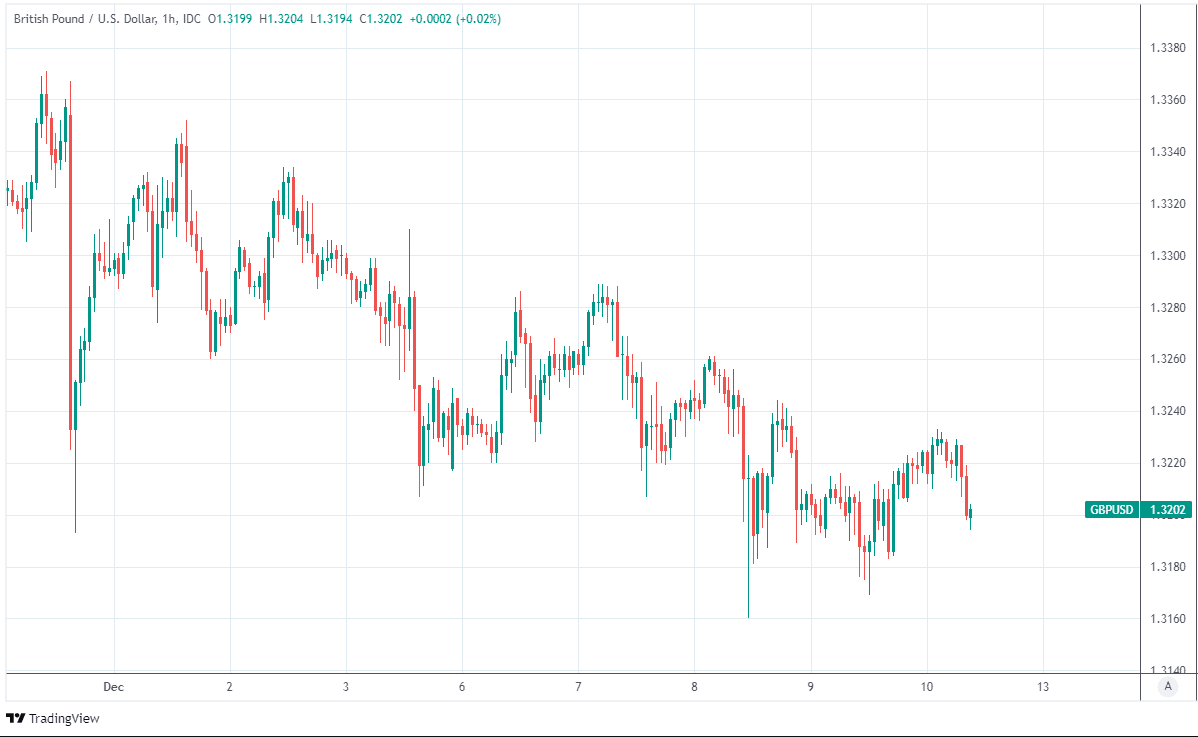

The Pound to Dollar rate was steadier on its feet in the final session of the week but remained in a position of technical vulnerability after being undermined previously by a market rethink of the Bank of England (BoE) interest rate outlook, which appeared to have run its course by Friday.

GBP/USD was close to breakeven for the week after edging back above 1.32 on Friday but had yet to draw an emphatic line under earlier losses that saw Sterling briefly testing a pair of major technical supports on the charts.

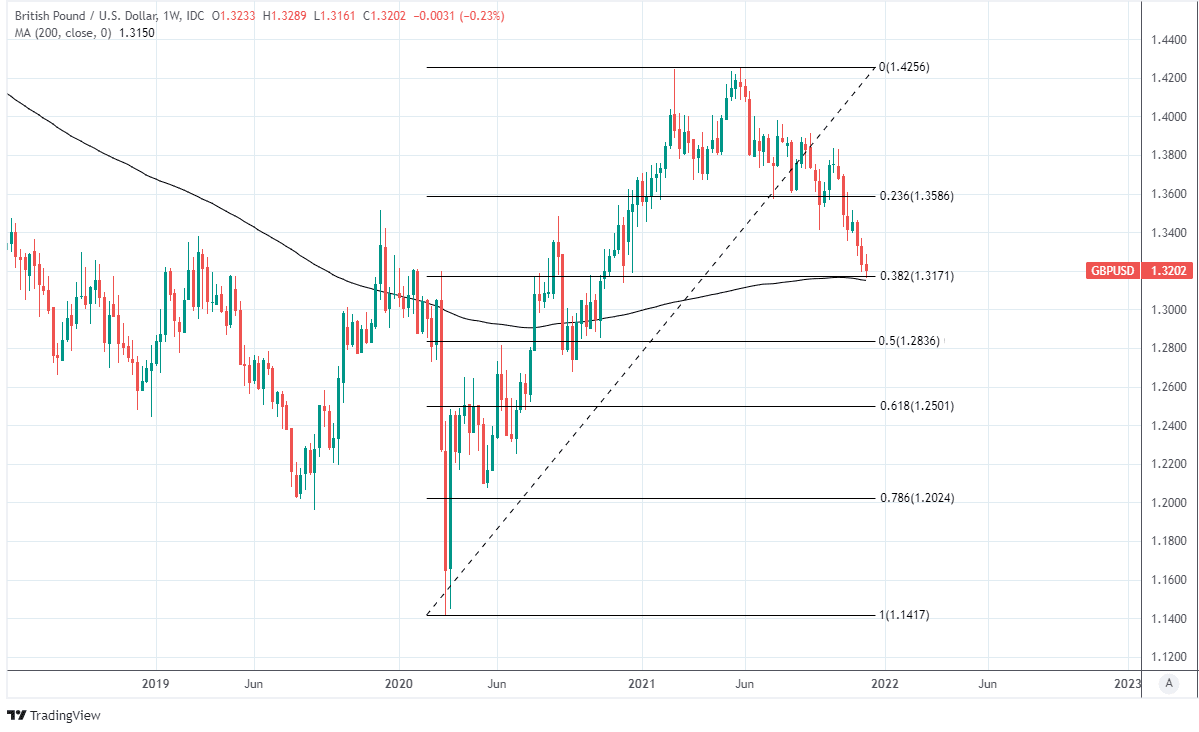

Earlier declines had seen the Pound-Dollar rate probing briefly below the 38.2 Fibonacci retracement of its recovery from March 2020’s lows, located around 1.3171, and almost brought it into contact with its 200-week moving-average at 1.3150.

This was after Wednesday’s announcement by the government that some new and old restrictions on activity would be reintroduced in the UK in a belated response to the arrival of the latest strain of coronavirus.

“Domestic political stress due to poor judgement and conduct of Johnson’s Cabinet and Downing St staff has accelerated the decision to adopt more stringent Covid restrictions,” says Tim Riddell, a London-based macro strategist at Westpac.

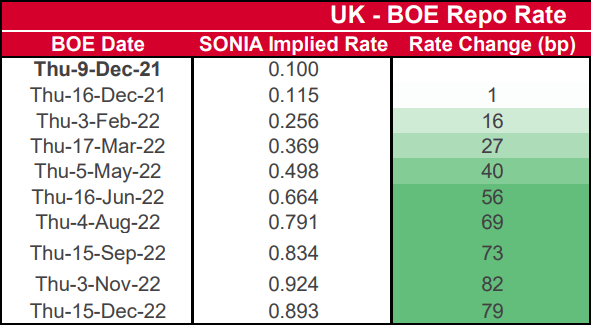

Above: Westpac table showing market implied BoE Bank Rate for various months and implied change measured in basis points.

- Reference rates at publication:

GBP to EUR: 1.1658 \ GBP to USD: 1.3202 - High street bank rates (indicative): 1.1430 \ 1.2932

- Payment specialist rates (indicative: 1.1600 \ 1.3136

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

For interest rate markets the new restrictions decisively undermined any last residual notion among investors that an interest rate rise could be announced following next Thursday’s Bank of England meeting, and also had the effect of crimping expectations for the BoE’s February 2022 decision.

“A December rate hike would require the Monetary Policy Committee (MPC) to be satisfied that the end of the furlough scheme was benign and that the Omicron variant won’t derail the recovery,” says Andrew Goodwin, chief UK economist at Oxford Economics.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“The majority have likely seen enough to be sure of the labour market recovery but will want more evidence on Omicron,” Goodwin said on Thursday.

While some economists and analysts retain more optimistic outlooks, Thursday’s market-implied Bank Rate of just 0.115% for December 16 implied that investors see barely a 10% probability of the benchmark being lifted to 0.25% next week, down from a 33% implied probability on Monday.

Above: Pound-Dollar rate at hourly intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“By the 16th Dec meeting we reckon there will be sufficient information for the BoE to at least be comfortable with a 15bp hike, and that short-£ is now in a phase of under-pricing this risk,” says Peter McCallum, a rates strategist at Mizuho Bank.

Expectations for the BoE’s February meeting were also downsized in the same price action, with the implied rate slipping from 0.31% to 0.25% and leaving it in line with the level that would prevail following a non-standard 15 basis point increase back to 0.25%.

While expectations of a December policy change had ebbed steadily already since last Friday when the BoE’s most hawkish rate setter, Michael Saunders, suggested the arrival of the Omicron coronavirus strain in the UK could merit a delay to any decision to begin lifting Bank Rate.

Deputy Governor for monetary policy Ben Broadbent also said on Monday that he was unsure of how the new strain would affect his decision about Bank Rate next week, further discouraging the market from anticipating a rate rise next week.

“Renewed restrictions should outweigh data near term. GBP/USD has met 1.3150-75 retracement support. Failure to sustain rebounds (stops above 1.3300?) could trigger slides towards 1.2825-50,” Westapac’s Riddell warned on Thursday.

Above: GBP/USD at weekly intervals with 200-week moving-average and Fibonacci retracements of 2020 recovery indicating likely areas of support.