Huge Jobs Miss Shakes the Dollar, Pound and Euro Lock Horns

- Written by: Gary Howes

- USD softer following NFP miss

- EUR outperforms GBP and USD

- Jobs market faces a soft few months

Image © Adobe Images

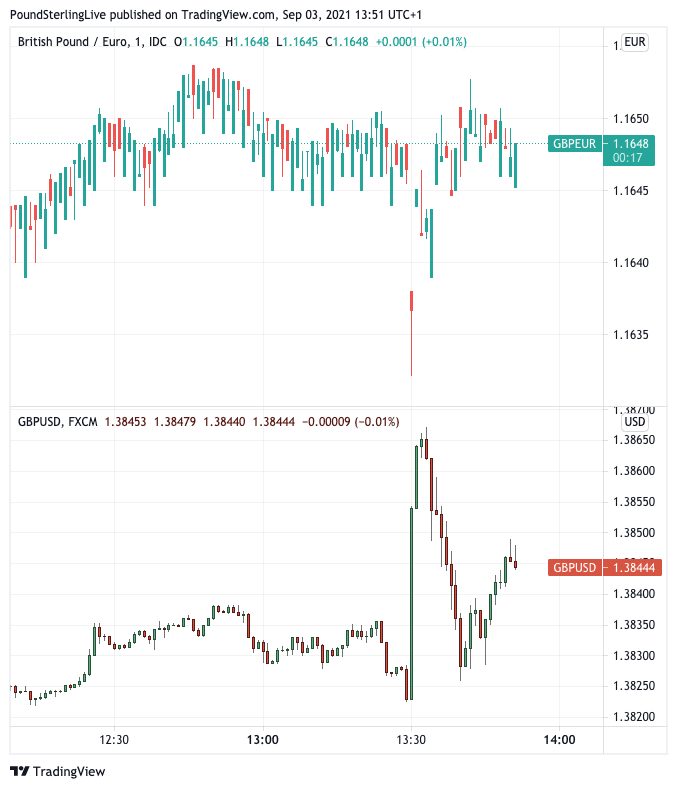

- Market rates at publication:

- GBP/EUR: 1.1648 | GBP/USD: 1.3853

- Bank transfer rates: 1.1420 | 1.3565

- Specialist transfer rates: 1.1590 | 1.3780

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound advanced against the Dollar but locked horns against the Euro following the release of some underwhelming U.S. jobs numbers.

In fact the non-farm payrolls report for August presented a huge miss to investors, coming in at 235K, which is far below the 750K the consensus was looking for.

The data serves as clear evidence that the U.S. economic rebound has slowed down under the weight of a resurgence in Covid 19 cases, driven by the spreading Delta variant.

Nevertheless, there were some positives to be taken in that average hourly earnings rose 4.3% year-on-year in August, ahead of the 4.0% consensus the market was expecting.

The unemployment rate meanwhile fell to 5.2% from July's 5.4%.

The Pound-to-Dollar exchange rate initially jumped following the release but soon reversed these gains, suggesting the market is not willing to read too much into the numbers in the context of what they mean for the outlook of U.S. Federal Reserve policy.

Above: Initial market excitement following the NFP release soon gave way to a retracement.

"Dollarwatchers are taking flight and the Greenback is on course to end the week deep in negative territory," says Sam Fuller, Director of Financial Markets Online, "the pace of job creation has slowed sharply."

The market has likely come to terms with the idea that the Fed will announce its intention to reduce its quantitative easing programme at the November FOMC meeting and commence this taper in December.

What matters more for the market right now is when the Fed will actually start raising interest rates.

Fed Chair Powell said in a speech last Friday that there was no need to rush a rate hike once quantitative easing had finished, something markets were not expecting, creating a great degree of ambiguity as to how data will input into policy decisions.

Therefore the market will struggle to divine what today's employment data means for interest rates over a longer-term period.

This haze might explain why the Dollar fell sharply lower but soon pared much of the initial decline.

"While the data is clearly weaker than expected, I don’t think it is a game changer in so far as the Fed’s policy is concerned. Thanks to the past sharp improvement in US jobs data, I reckon the Fed is still on course to announce the timeline for tapering QE at the November meeting," says Fawad Razaqzada, Market Analyst at ThinkMarkets.

Following the data release the Pound-Dollar exchange rate was quoted at 1.3842, the Euro-to-Dollar rate at 1.1882 and the Pound-to-Euro at 1.1650.

"The labour market continued to improve in August, but the employment growth was much slower than anticipated," says Knut A. Magnussen, Senior Economist at DNB Markets.

"This month there was no growth at all for the leisure and hospitality sector, most likely an effect caused by the Delta virus," he adds.

Average employment for 2021 stands at just below 600k per month and Magnussen says the trend is still very favourable.

But with the labour participation ratio unchanged many people remain outside the labour market.

DNB Markets says the continued improvement of the labour market implies that the Fed is likely ready to signal that tapering will start later this year and they foresee an announcement coming at this month's FOMC meeting.

Pointing the finger of blame at the Delta variant is data showing the leisure and hospitality sectors contributed no new job creations, having averaging just over 400K in June and July.

Industries not sensitive to personal contact fared batter with manufacturing adding 37K jobs.

"So much for the bad news. The good news? There isn’t any," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

"September likely will be weak too, and we’re becoming nervous about the prospects for a decent revival in October, given that behavior lags cases, and cases are yet to peak," says Shepherdson.

Shepherdson says before Delta he was looking for 1M-plus payroll gains in the fall, but that’s now going to be a real struggle, "suggesting that Chair Powell will be in no hurry to be pushed into tapering while the labor market picture so uncertain".

Offering a more optimistic spin on the data is James Knightley, Chief International Economist at ING who says underlying fundamentals are in good shape with businesses clearly wanting to hire, but they are struggling to find staff.

"Either way a September Fed taper looks unlikely," he concedes.

Knightley says Powell remains more cautious than many of his colleagues with the resurgence of Covid leading him to warn against implementing an "ill-timed policy move" at last week’s Jackson Hole Symposium.

"After today’s soft figure employment does indeed remain 5.33mn below the February 2020 peak so this will likely dampen the enthusiasm from several regional Fed Presidents for a September taper. Given our reasons for optimism November looks a decent date for that announcement with a December start point," he adds.

The foreign exchange market's reaction has been to sell the Dollar and buy Euros and Pound Sterling. Therefore, we could be seeing the end of a multi-month surge in the Dollar until such a time the U.S. economic rebound starts to outshine those in other regions.

The Euro seems to have the better of the Pound at present, which suggests that the market is currently inclined to view the Eurozone's strong economic rebound and relatively benign pandemic dynamics favourably.

However, any major directional moves in GBP/EUR remains unlikley given the similar picture in the UK.