Pound Sterling's 18-Month Highs against the Euro Aided by Buoyant Dollar and Renegade Bank of England

- Written by: Gary Howes

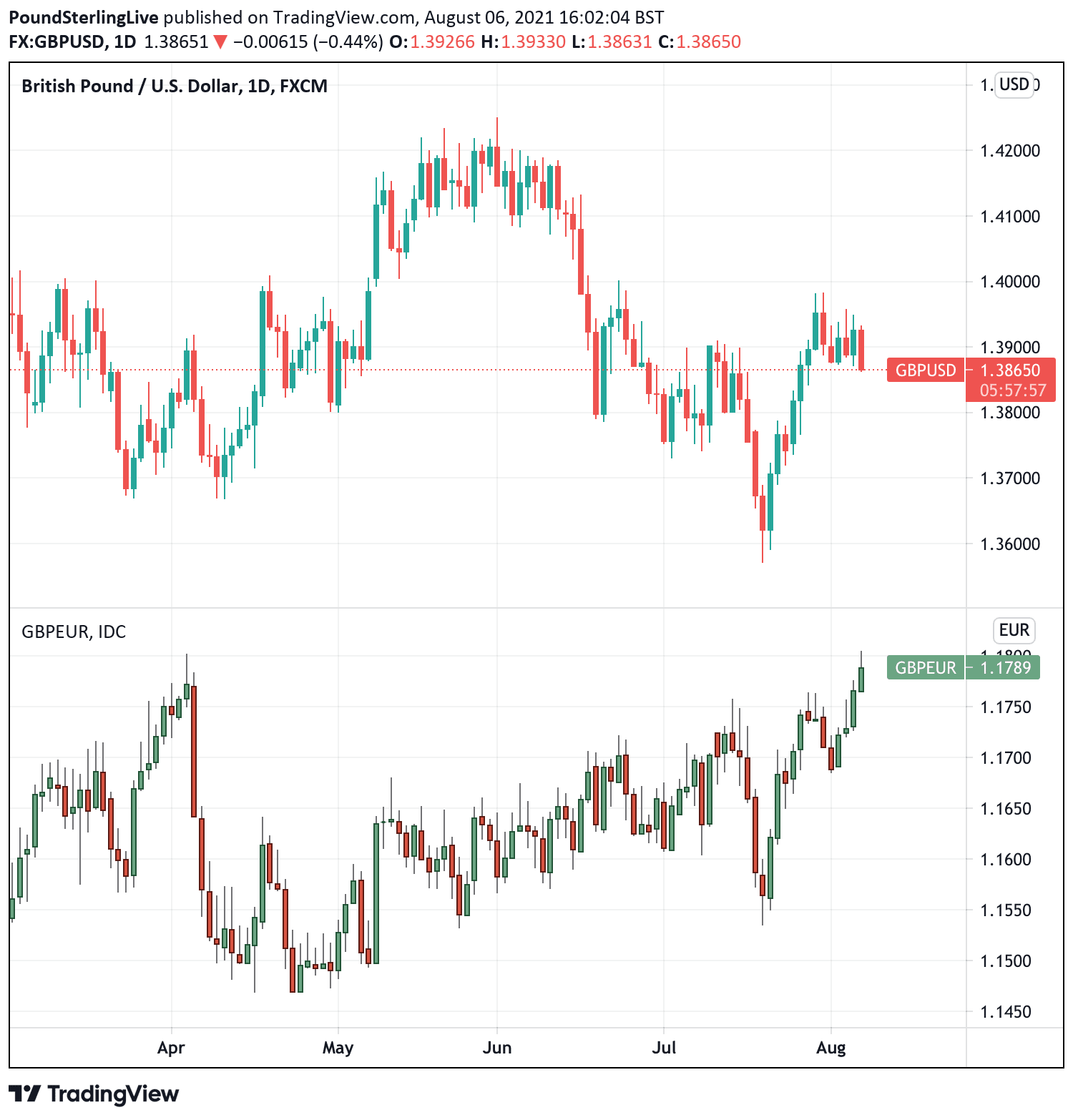

- GBP/EUR boosted by U.S. jobs report

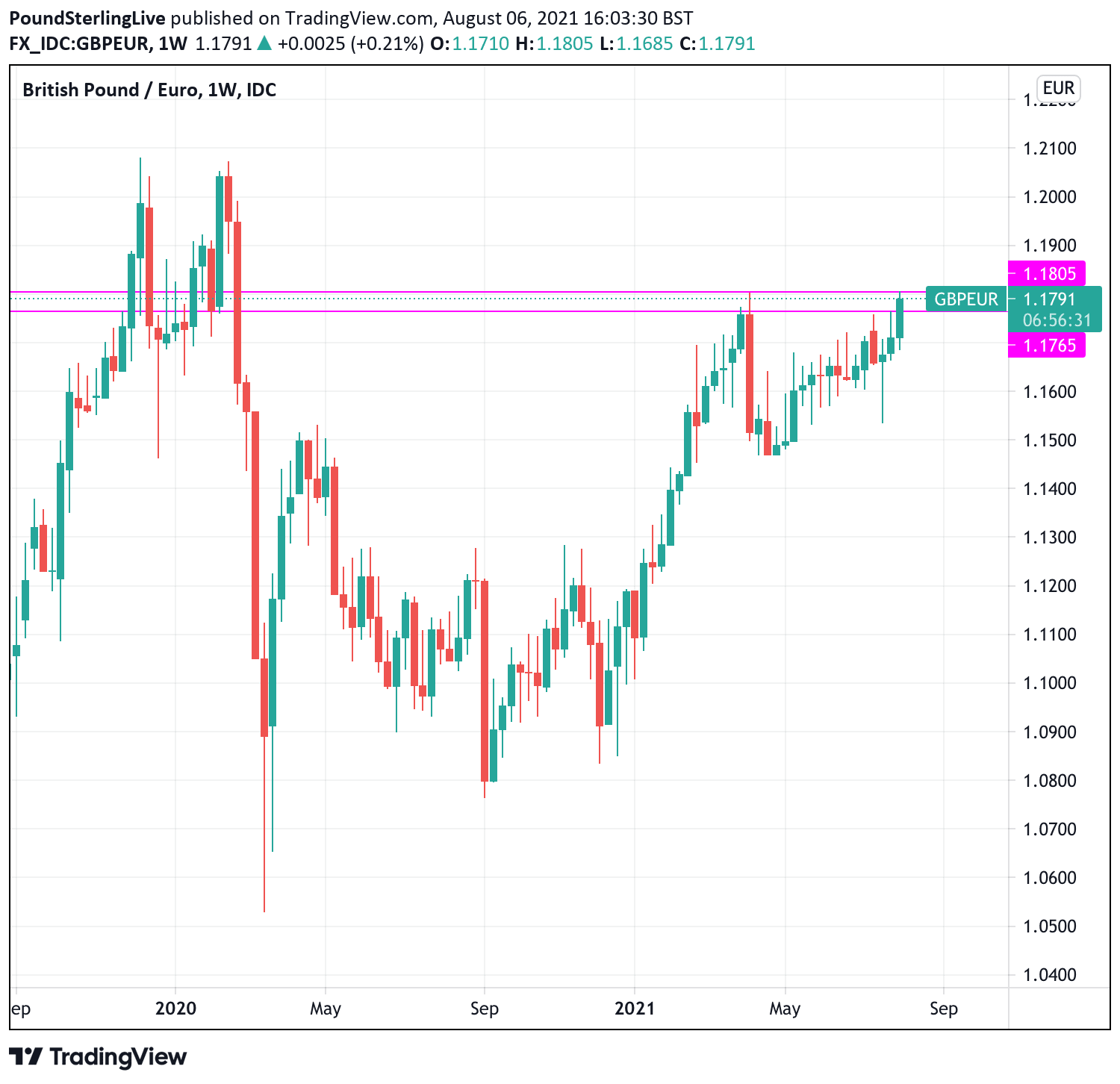

- Tests new 18 month high

- GBP/USD holds familiar range

- BoE's unusual policy approach supportive of GBP

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1797 | GBP/USD: 1.3870

- Bank transfer rates: 1.1567 | 1.3582

- Specialist transfer rates: 1.1714 | 1.3770

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound maintains its status as one of the top performing major currencies of 2021, aided recently by a Bank of England willing to explore fresh policy paths and a foreign exchange market that prefers both dollars and pounds to euros.

Investors expressed support for Sterling at the expense of the Eurozone's single currency following a strong U.S. labour market report out on Friday, a preference that is likely to be maintained over the near-term given existing central bank dynamics.

Ahead of the weekend we learnt the U.S. economy added over 900K jobs in July alone, growth that should allow the U.S. Federal Reserve to reduce its quantitative easing programme ahead of raising interest rates in 2023.

The data aided the Dollar higher against all its peers, but crucially the FX market showed a clear preference for the Pound relative to the Euro.

This dynamics was illustrated by a smaller decline in the Pound-Dollar exchange rate in the wake of the data than that experienced by the Euro-Dollar exchange rate.

This divergence left the Pound-to-Euro exchange rate bid by 0.20% which took it to 1.1805, a fresh 18-month high.

"We continue to expect a weakening of the pound in the run-up to the Fed’s tapering, but smaller than the euro’s, against which sterling should tend to strengthen as a result," says Asmara Jamaleh, an economist at Intesa Sanpaolo.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The dynamics impacting the Dollar, Euro and Pound confirms the currency market is focussed on the normalisation of interest rates at the world's central banks, favouring the currencies belonging to central banks that are leading the way in raising rates against the laggards.

While the Fed might be heading to a higher interest rate future, so too is the Bank of England.

The Bank revealed in its August policy report on August 05 it was likely to raise interest rates in 2022, two years ahead of current expectations for a similar move at the European Central Bank.

Economists say a crucial element of the Bank's August 05 update regards the future of the Bank's asset purchase programme, known as quantitative easing.

The Bank said once its key interest rate is pushed back to 0.5% it will stop reinvesting those bonds that mature on its balance sheet, "essentially draining liquidity out of the sterling market," explains Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

"This means that after two rate increases, the BoE will begin quantitative tightening (QT) like the Fed did back in 2017-2019, which is great news for the pound in the longer term," he adds.

And once the Bank Rate rises to 1.00% the Bank will look to actively sell bonds, the prior hurdle was 1.50%.

"I didn’t think any CB would be inclined to do it, but here we are," says Bipan Rai, North America Head, FX Strategy at CIBC Capital Markets.

"The Bank of England is the first central bank in the developed world thinking about contracting its balance sheet via asset sales as opposed to letting them roll off via maturities. This is a VERY new form of QT, and one that has obvious long-term implications for asset correlations/portfolio mixes/hedging strategies over the medium-term," he adds.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

To understand the Bank's thinking Rai says one must look back to Governor Andrew Bailey’s speech at Jackson Hole last year in which he argued that the UK’s experience with quantitative easing is highly state contingent.

"In other words, it’s effective during periods of market disfunction and illiquidity and less effective as a policy tool during periods of calm," explains Rai. "The conclusion from the speech is essentially that the BoE should release gilts back into the market when circumstances allow, providing more safe assets for purchase later if necessary."

What does this mean for the outlook of the British Pound?

"Higher," says Rai, "especially on the crosses against currencies of regimes going the other way on QE/balance sheet policy (yes, that means the EUR mainly)."

CIBC Capital Markets expect that going forward growth/inflation surprises in the UK will matter a lot more than they did before. Event risk weights for key data (employment, inflation, GDP) should increase.

CIBC meanwhile expect the push lower in EUR/USD to continue towards a forecast target set at 1.15, which should offer GBP/EUR upside provided the GBP/USD were to remain relatively supported.

"Should GBP/USD rate of decline be less than that of EUR/USD then GBP/EUR's trajectory remains higher," says Jamaleh.

Intesa Sanpaolo meanwhile tell clients that following the Bank's August update they are inclined to raise their Pound exchange rate forecasts.

"The BoE will reverse its policy well ahead of the ECB, and this should support the pound against the euro," says Jamaleh.