Dour Pound Sterling Left Behind by the Euro and Dollar

- Written by: Gary Howes

- GBP fades from favour

- At risk of relinquishing May's gains

- As Euro's start starts to shine

- Germany set for "golden" post pandemic period

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1550 | GBP/USD: 1.4160

- Bank transfer rates: 1.1320 | 1.3860

- Specialist transfer rates: 1.1470 | 1.4060

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound risks relinquishing the gains it has made against the Euro and Dollar over the course of May if a current bout of weakness extends through to month-end.

The UK currency has fallen three-quarters of a percent against the Euro already this week while Tuesday's session saw this week's small gain against the Dollar overturned.

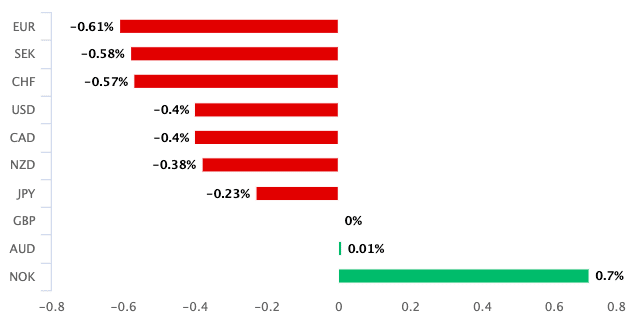

But it is not just against the Euro and Dollar where weakness is setting in, if we look at the performance of Sterling over the course of the past week it becomes clear it is one of the market's laggards with only the Krone saving it from further blushes:

Above: GBP has fallen against the majority of its peers over the course of the past week.

Frustratingly for those looking to transact in Sterling there is no clear news or data to pin the recent declines on, and therefore identifying any potential triggers that might turn the tide on Sterling's performance is a difficult task.

The most useful explanation of this recent tepid performance is that the news and data spotlight has moved away from the UK this week and focus is shifting to other currencies where conditions for appreciation exist, most notably the Euro.

"The failure of GBP to keep pace with the EUR is consistent with our view that much of the good news on the UK economy is already in the price of GBP," says Daragh Maher, Head of Research, Americas at HSBC.

This "good news is in the price" concept is not new to regular readers of Pound Sterling Live who will have noticed this observation has been cropping up more regularly amongst analysts in the second quarter of 2021.

"Having been vocal GBP bulls at the start of the year we are now turning bearish," said foreign exchange analysts at Deutsche Bank just last week.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Deutsche Bank - one of the largest dealers of foreign exchange in the world - said in a new strategy brief that while "the stars have aligned so far this year for sterling", "a lot of good news is in the price".

The Pound-to-Euro exchange rate (GBP/EUR) rallied to a 2021 high at 1.18 on April 05 but has subsequently fallen back and is now consolidating in the 1.1470-1.1680 range as investors look for a new reason to bid the UK currency.

The Pound-to-Dollar exchange rate (GBP/USD) is meanwhile looking more constructive and as recently as Tuesday forayed back above 1.42.

However, much of this move has come courtesy of broader weakness in the Dollar, underpinning the view that the Pound is lacking distinctive upside drivers.

"The rise in EUR-GBP is especially interesting as it occurred despite additional good news for the UK economy last Friday (strong retail sales and PMI readings) and dovish comments from the ECB’s Lagarde," says Maher.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Analysts at JP Morgan say the market has been "well positioned" on Pound Sterling's good news stories regarding vaccinations and reopening of the economy for some time now.

"This would leave GBP susceptible to the re-opening of other major economies and a consequent re-balancing of interest rate differentials," says Meera Chandan, foreign exchange analyst at JP Morgan.

This view appears particularly relevant against the Euro which appears to be the current darling of the currency market, with investors snapping up Eurozone assets in anticipation of the region's recovery.

Chandan says UK economic data has generally surpassed expectations (the UK Economic Activity Surprise Index is currently +47 vs 23 in the Euro area and 0 in the US), but this has not necessarily translated to any obvious additional upward pressure on UK-rated expectations in recent weeks.

It is these expectations for higher interest rates that matter as when interest rates in the UK rise the Pound tends to find support.

For UK rate expectations to rise the market must become increasingly convinced that the Bank of England (BoE) is looking to bring forward the timing of the first interest rate hike of the next cycle.

But all those BoE policy makers who have talked on the subject of late have been resolute in the view that there is no hurry to push rates higher.

While inflation might be heating up in the UK, BoE Governor Andrew Bailey and some of his colleagues told the Treasury Select Committee on Monday that inflationary pressures will likely be transitory.

Until they shift this view the Pound is unlikely to find any significant upside impetus.

The BoE's Chief Economist Andy Haldane gave an unsurprisingly upbeat testimony to the Committee but Bailey, Jon Cunliffe and Michael Saunders were of the view a surge in inflation will be temporary in nature.

Maher says when the rest of the BoE's Monetary Policy Committee agree with Haldane's call to "start tightening the tap", "then GBP may enjoy some renewed support. For now, we think they will avoid such a hawkish tone."

This is all the more likely given Haldane is due to depart his role as the BoE's Chief Economist.

For now the Pound will be left to the devices of the global market and it is what happens elsewhere that will most likely influence movements in the currency.

While the Pound has been an underperformer, the Euro finds itself near the top of the leaderboard having advanced against all the major G10 currencies apart from the Swiss franc over the course of the past week.

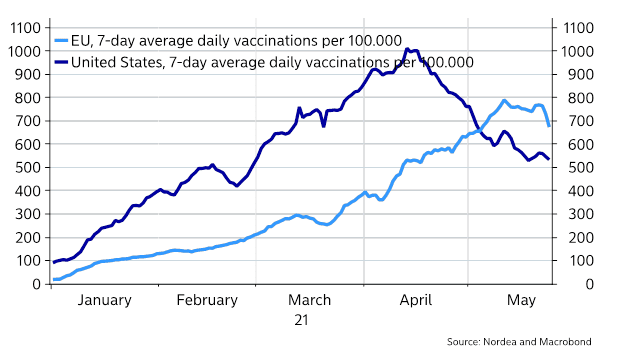

Euro appreciation comes amidst a rapid acceleration in the rollout of vaccines in the Eurozone: the vaccine trade is a popular one for currency markets in 2021 and while the Pound benefited in the first quarter it would appear the Euro is now currying favour with investors as the European vaccination programme accelerates from a lacklustre start.

"The EU is catching up upon the US in terms of the percentage of the population that has received at least one dose," says Carl Christian, analyst with Nordea Markets.

The relative vaccine trade has been a prominent theme on currency markets in 2021, with the British Pound being favoured in the first quarter as the UK started the firing gun on the global race to vaccinate and ultimately exit the Covid-19 crisis on a sustainable basis.

With the EU now starting to catch up to the UK and U.S. the Euro has found itself better supported.

Optimism towards the Eurozone was further boosted on Tuesday by data showing the German economy was set to undergo a sharp economic revival over coming months.

Germany - the powerhouse of the European economy - reported a 1.8% quarter-on-quarter contraction in the first three months of 2021, however, "the German economy is on track for a strong rebound in the second and third quarter," says Holger Schmieding, Chief Economist at Berenberg Bank.

"Pent-up demand from consumers, a need to raise capacities to tackle supply shortages in industry, a fiscal expansion and buoyant export orders will drive the recovery," adds Schmieding.

According to the Ifo survey, also out Tuesday, Germany’s business climate improved strongly again in May to 99.2 after 96.6 in April, surpassing the Bloomberg consensus of 98.0.

Berenberg forecast the German economy to grow by at least 3.8% this year and by 4.4% in 2022.

"Germany could – like other parts of the advanced world – enjoy golden twenties after the pandemic," says Schmieding.