Best-in-Class Euro Pushes Pound Sterling and Dollar into Defensive Stance

- Written by: Gary Howes

- GBP supported but due "a breather"

- EUR enjoys period of outperformance

- But EUR gains could ease ahead of June ECB meet

Image © European Central Bank

- Market rates at publication: GBP/EUR: 1.1598 | GBP/USD: 1.4180

- Bank transfer rates: 1.1370 | 1.3883

- Specialist transfer rates: 1.1516 | 1.4080

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

Pound Sterling retains a broadly robust stance on global foreign exchange markets and is the second-best performing currency in the G10 complex over the course of the past month, but it is the Euro that looks set for a period of short-term outperformance.

Analysts retain a bullish stance on the UK currency in the near-term owing to the UK's exit from lockdown conditions and expectations for the final June 21 easing of restrictions to proceed.

"We maintain our supportive view on the GBP in the near term," says a weekly currency research note from Barclays.

"We expect economic rebound to continue in the near term, but in the medium term it may face some setbacks from the tapering of government support. This week should not bring any market moving macroeconomic data releases," the note adds.

The Pound was bid in the previous week on a slew of supportive economic data releases that confirmed analyst expectations for a rebound in domestic economic growth courtesy of the significant unlocking phases that have already come into force.

However, with no major economic releases due over coming days the Pound might find the spotlight has moved elsewhere.

"The UK pound steadied as it consolidated a three-week winning streak against the greenback that pushed it to three-month highs. A dearth of UK economic events this week could see the pound take its cues from underlying risk sentiment and global stock movements," says Joe Manimbo, Senior Market Analyst at Western Union.

Sterling might struggle to get a grip on the Euro in particular as the Eurozone's single currency steps on to the front foot and is forcing its peers into a defensive pose.

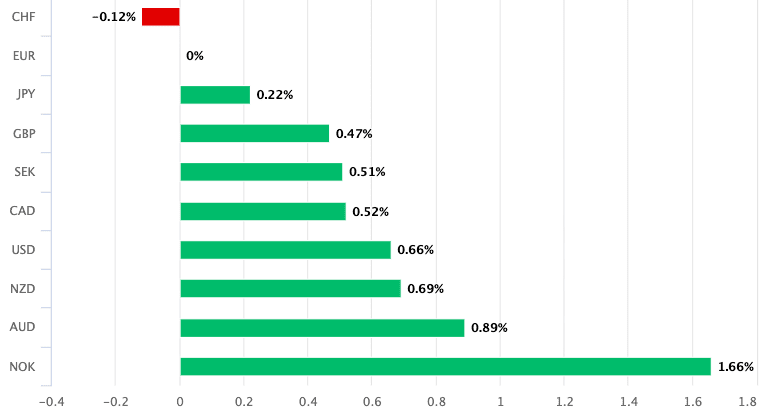

In fact, over the course of the past week the Euro has advanced against all the major G10 currencies apart from the Swiss franc, which was battered in the first quarter of the year and due some breathing space from the heavy selling.

Above: The Euro is outperforming on the one-week timeframe.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The best Pound-to-Euro exchange rate for sellers of Sterling seen over the past four weeks was the high of 1.1681 reached on May 12, but the gains have since reversed in light of the Euro comeback and resides towards 1.1585, with a 0.30% loss being registered on May 24.

The Euro-to-Dollar exchange rate meanwhile rose to a high of 1.2245 last week and the Euro looks intent on breaking to fresh highs, according to our week ahead forecast.

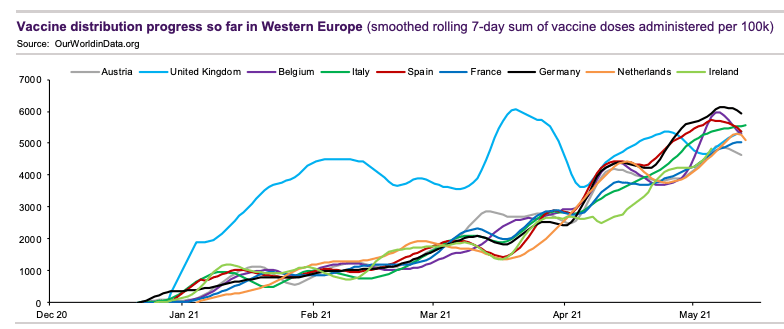

Euro outperformance comes amidst a rapid acceleration in the rollout of vaccines in the Eurozone: the vaccine trade is a popular one for currency markets in 2021 and while the Pound benefited in the first quarter it would appear the Euro is now currying favour with investors as the European vaccination programme accelerates from a lacklustre start.

"Recent vaccine development and looser restriction in the Euro area are supporting the EUR," says Barclays.

European countries have now caught - and in some cases surpassed - the vaccination rates of the UK and U.S., as evidenced in the following graphic from NatWest Markets:

The development will allow likely ensure the European Commission finds itself on course to vaccinate all eligible adults by July, further allowing for the easing of Covid-19 restrictions in Eurozone countries and accelerating economic growth.

The improved sentiment comes just weeks ahead of a key European Central Bank (ECB) meeting at which policy makers will issue their latest guidance on interest rates and quantitative easing while revealing their latest strategic objectives.

A positive assessment of the outlook by the ECB could well tempt markets to bring forward the timing of an expected ECB interest rate rise; a development that would typically be expected to prove supportive of Euro exchange rates.

However, strategists at Barclays say they expect the Euro's outperformance to ease in the run-up to the June 10 ECB meeting as investor nerves start to build.

Indeed it is this important risk event that could ensure any further losses in the Pound-to-Euro exchange rate are ultimately relatively contained.

"Looking ahead, we expect EUR to trade sideways as the market should shift its focus from macroeconomic data to June’s ECB decision, when the ECB should decide on the pace of its PEPP purchases," says Barclays.

"Ongoing economic recovery might suggest that the ECB may retrace to a Q1 pace of purchases, but ongoing tightening of financial conditions suggest that very accommodative policy may be preferred by the ECB," adds the note.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The "tightening of financial conditions" mentioned in the above refers to the rise in yields paid on Eurozone government bonds over recent weeks, which in turn pushes up the cost of financing for governments, companies and consumers.

This is a situation the ECB might want to avoid as it is counterproductive to its objective of supporting the Covid ravaged Eurozone economy.

Therefore the ECB Governing Council might strike a cautious tone on the outlook for monetary policy, a development that could in turn lower bond yields and also take the Euro down alongside.

The recent rise in yields has been cited by analysts as a driver of Euro exchange rate gains, therefore a reversal in yield direction could undermine the currency.

"EUR continued to appreciate last week on the back of rising German bund yields, easing COVID restrictions amid good vaccination progress," says Barclays.