Easing of Restrictions on June 21 Still Likely to Go Ahead Despite India Variant Concerns

- Written by: Gary Howes

- Vaccines work against India variant

- GBP firm amidst economic rebound

- GBP/USD can break new highs: ING

- EUR seen underpinned by strong EZ rebound

File picture of Health Secretary Matt Hancock by Tim Hammond / No 10 Downing Street.

- Market rates at publication: GBP/EUR: 1.1613 | GBP/USD: 1.4153

- Bank transfer rates: 1.1370 | 1.3857

- Specialist transfer rates: 1.1540 | 1.4054

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound could continue to increase in value over coming days according to analysts we follow, however advances against the Euro will likely be harder to achieve given the improving economic outlook for the region.

Sterling is the second-best performing major currency of the past month, lagging only the Canadian Dollar, an outperformance that nods towards the economy's ongoing rapid rebound from Covid-19 restrictions.

A key debate that could influence how the Pound trades over coming days is whether or not the Government will proceed with the final lifting of all Covid-19 restrictions on June 21.

Such a move would encourage further economic activity and underline the current positive investor sentiment underpinning UK assets, including the Pound.

Confidence about a full lifting of restrictions on June 21 has been thrown into doubt of late by the emergence of the Indian Covid-19 variant, which has started to push the country's case rate up.

Some analysts say Sterling could have done better last week but was, "marked down by increased concerns over how long the Bank of England will choose to look through inflation pressures in the UK and just how prevalent the so-called Indian variant of the virus remains," says Jeremy Thomson-Cook, Head of FX Strategy at Equals Money.

However, a report out over the weekend from Public Health England (PHE) confirmed both of the major vaccines being deployed in the UK are effective against the variant.

"This study provides reassurance that 2 doses of either vaccine offer high levels of protection against symptomatic disease from the B.1.617.2 variant," said Dr Mary Ramsay, Head of Immunisation at PHE. "We expect the vaccines to be even more effective at preventing hospitalisation and death."

Health Secretary Matt Hancock described the new data on vaccine effectiveness as "groundbreaking", adding he is "increasingly confident" England is on track for the government's coronavirus roadmap.

The release of the country from restrictions is translating into a solid economic rebound, with Friday's PMI survey providing confirmation that economic activity is rapidly improving.

The Pound was bid against the Euro and other major currencies after IHS Markit PMI data confirmed the rate of economic expansion was the fastest since the UK Composite Output Index began in January 1998, reflecting strong contributions from both manufacturing and services activity.

"The strong UK May PMIs have underlined the optimistic case for the UK economic outlook and it is a clear tailwind for GBP," says Petr Krpata, Chief EMEA FX and IR Strategist at ING Bank.

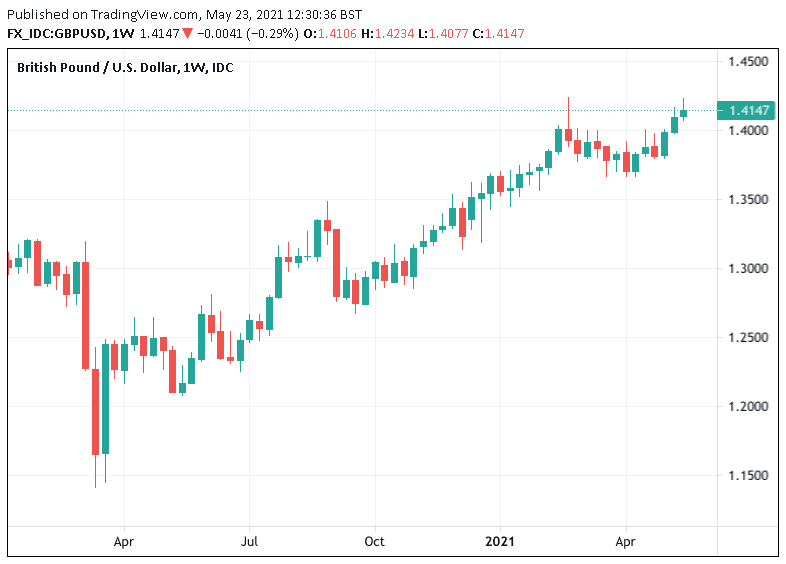

The Pound has advanced against the Dollar for three weeks in succession now, with the previous week seeing a 0.38% gain, an advance that might have been a great deal bigger were it not for stronger Dollar on Friday that took 0.30% off the advance.

Above: GBP/USD weekly.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"GBP/USD managed to shake off the recent USD rebound quite well and in line with the other European FX it now continues grinding higher," says Krpata.

"Although domestic data are unlikely to provide much boost to GBP next week, as long as the soft USD environment remains in place, GBP/USD is likely to breach the multi-year high of 1.4237 quite soon and head towards the 1.44," he adds.

ING hold a one-month Pound-to-Dollar forecast of 1.44.

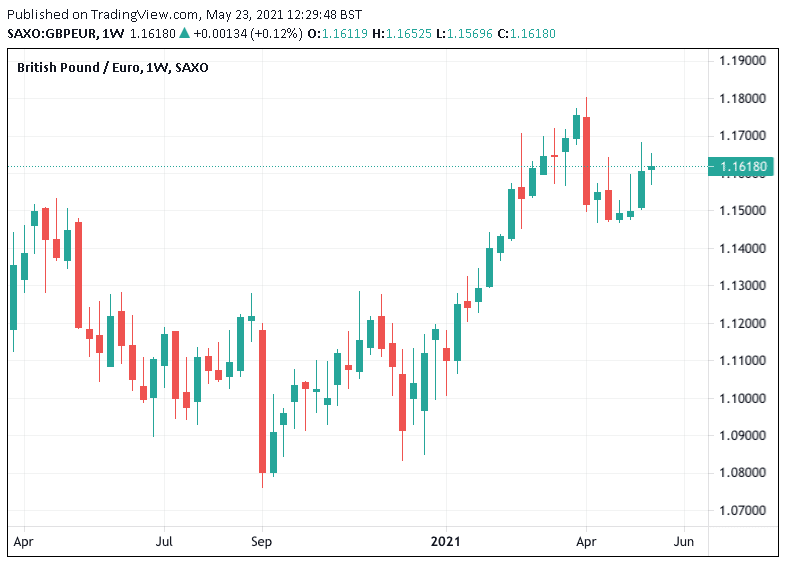

The Pound was mixed against the Euro, recording a negligible weekly advance of 0.11%, nevertheless over the past fortnight the UK currency has appreciated by a percent against its continental peer.

Context is important here though as in the week commencing April 05 Sterling lost a little over 2.0% in value against the Euro, therefore the advances over the past month mean only about half the big weekly drop have been recovered.

Progress for those wanting a stronger Pound from which to transact is therefore certainly slow.

Above: GBP/EUR weekly chart.

The Euro is finding broad-based strength thanks in part to an ongoing economic recovery in the Eurozone, driven in part by the region's accelerated vaccination drive.

"A key story here is probably the rotation into European asset markets as confidence in the recovery intensifies," says Krpata.

ING data shows that in local currency terms Eurostoxx has outperformed the S&P 500 and flow data suggests US investors are increasingly interested in Eurozone equity ETFs.

The Euro found support against a host of currencies at the close of the previous week after IHS Markit PMI surveys suggested that key continental industries returned to growth in May.

Indices measuring an agglomeration of indicators suggested that Germany’s services sector returned to growth this month while activity among manufacturers cooled, albeit with activity and output from the latter industry having reached record highs already in recent months.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

But it was French industry which surprised most and contributed the lion’s share to an upturn in PMI indices for the Eurozone as a whole, with the French services PMI rising to one of its strongest levels for years while manufacturers benefited both from a loosening of restrictions on activity at home as well as recoveries elsewhere.

France’s manufacturing PMI rose from 58.9 to 59.2 this month - a record high - while the services sector may have returned to growth with the PMI rising comfortably above the 50 level which indicates the difference between industry expansion and contraction for the first time since July last year.

For the Eurozone overall, manufacturing industry recoveries levelled off this month with the IHS PMI edging down from a record high of 62.9 to 62.8, although just like in France and Germany the continent’s services sector appeared on course for a return to growth.

"We have been recommending that investors position for a European rebound as the economy starts to reopen from relatively strict lockdowns," says Zach Pandl, an economist and strategist with Goldman Sachs. "With the recovery now underway, we think investors should lean into this theme by going long EUR/CHF."

The Eurozone economic rebound has been underscored by the easing of restrictions and returning investor and consumer confidence which comes on the back of a surge in vaccinations across the bloc.

"Recent vaccine development and looser restrictions in the Euro area are supporting the EUR," says Marek Raczko, a foreign exchange analyst and strategist with Barclays.

The European Commission's President Ursula Von Der Leyen says she is increasingly confident that the area was on target to reach 70% of all adults by the end of July.

"This is almost the same target as the one the U.S. has set," von der Leyen told a news conference.