New Covid Strain, Brexit Impasse Send Pound Sterling Sharply Lower Against Euro and Dollar

Image © Adobe Images

- Market rates: GBP/EUR: 1.0893 | GBP/USD: 1.3297

- Bank transfer rates: 1.0688 | 1.3025

- Specialist transfer rates: 1.0817 | 1.3204

- More about bank-beating exchange rates, here

Closed ports and harsh new lockdowns across most of the UK have combined with a lack of progress in Brexit trade negotiations to send the British Pound sharply lower at the start of the new week.

The Pound experienced its largest one-day drop since March after EU countries on Sunday closed their borders with the UK over fears that a new strain of covid-19 would travel from the UK onto the continent.

France initiated the strictest measures by blocking entry to UK hauliers, causing notable tailbacks at Dover and threatening UK exporters. France's Transport Minister however said late morning on Monday that they are intending to, in the coming hours, set up a European wide mechanism to allow traffic with the UK to resume.

Alarm over a more contagious strain of SARS-CoV-2 (the virus which causes the covid-19 disease) is believed to have originated in the South East of England and scientists say it is up to 70% more contagious than other strains. However, some reports out on Monday say it was first identified in Brazil earlier in the year.

"The risk from this strain is at the very worst that current vaccines may not prove as effective (this is as yet unknown), but at the very least that it makes any level of activity normalisation that much more difficult until vaccinations are sufficiently rolled out," says John Hardy, Head of FX Strategy at Saxo Bank.

It is believed the initial series of travel bans instituted by European countries would last 48 hours, at which point they would be reviewed.

The developments comes after the UK government put the majority of England's population into a new harsh Tier 4 lockdown at the weekend, while Northern Ireland, Wales and Scotland also announced a tightening of restrictions.

For Sterling, the economic hit of this latest phase of the covid-19 pandemic combined with a lack of movement in Brexit trade negotiations made for a notably weaker start on Monday.

"GBP is taking centre stage this morning as the Brexit talks drag on and a more virulent mutant strain of the virus discovered in London has caused many European countries to cut all incoming traffic from the UK," says Marshall Gittler, Head of Investment Research at BDSwiss Group.

The Pound-to-Euro exchange rate dropped by over a percent to trade at 1.0900 while the Pound-to-Dollar exchange rate dropped by 1.50% to trade at 1.3270.

Above: The Pound-Euro exchange rate 15-minute chart showing recent decline.

"GBP/USD is down over 2% near 1.3200 because of ongoing Brexit uncertainties and tougher UK lockdown measures. The UK government introduced tougher lockdown measures and international travel links to the UK have been suspended because of the discovery of a more infectious variant of the coronavirus," says Elias Haddad, Senior Currency Strategist at CBA.

"We continue to expect GBP to underperform in a G10 context, and think Sterling will barely make gains even against a broadly soft USD in the months ahead," says Dominic Bunning, Head of European FX Research at HSBC.

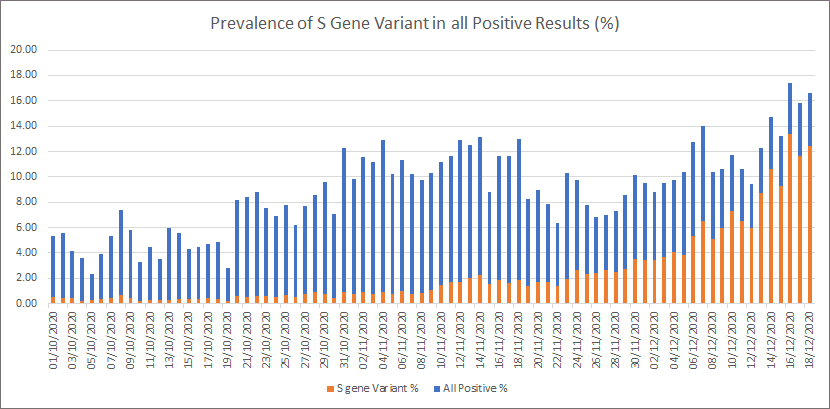

The B.1.1.7. strain of SARS-CoV-2 has rapidly become the dominant form of coronavirus in the South East of England and Wales and it is said to be more contagious than earlier dominant forms of the virus:

While there is a belief the new strain is more contagious there have been no suggestions that it triggers more severe symptoms.

Covid developments come as the EU and UK miss another deadline for trade talks amidst protracted deadlock over the matter of post-Brexit fisheries access.

Richard Pace, a Reuters market analyst says the market odds of a 'no deal' Brexit appear to have risen over the weekend as a result.

According to the Smarkets betting exchange, odds of EU/UK trade deal in 2020 have fallen back below 50%, probability of a deal now 47% - it was 72% on Friday, notes Pace.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Talks remain stuck on the matter of fisheries, with The Telegraph reporting France is unwilling to concede ground to the UK as President Emmanuel Macron is nervous of how it might impact his political fortunes in 2021.

The newspaper reports that France is calculating a chastened UK will return to the negotiating table willing to accept the deal on offer early in 2021, having experienced the negative impacts of a 'no deal'.

The risk for Pound Sterling is that the brinksmanship leads to a 'no deal' as neither side blink.

Negotiators have already failed to meet the EU Parliament's deadline for a deal to be agreed by Sunday night, which would have allowed them to ratify any deal before year end.

There is no indication that a deal will be agreed in the near-future at the time of writing on Monday, therefore the Pound is liable to remain under pressure.

"I think the virus crisis will force UK PM Johnson to compromise on Brexit. A Brexit disaster coinciding with this virus disaster is just too many disasters at the same time. On the other hand, he might reason that raising nationalistic fervour against the perfidious EU would be a good way to deflect anger away from his disastrous handling of the virus. All told, it looks like a pretty grim combination for GBP," says Gittler.

Marios Hadjikyriacos, Investment Analyst at brokerage XM, says the latest series of misfortunes to befall the UK could inject a new sense of urgency into the Brexit talks.

"The negotiations are now stuck on fishing rights, which is a thorny political issue, but quite insignificant economically. It’s a close call, but a last-minute deal still seems like the most likely finale. Both sides desperately want to avoid a deeper economic shock, and it is difficult to imagine a deal falling apart because of fisheries of all things," says Hadjikyriacos.

With regards to the impact on Sterling of any breakthrough in talks, Hadjikyriacos says a "Brexit deal can turn the tide for sterling here... especially if it lands over the coming few days when liquidity will be in short supply, amplifying any moves."