Sterling, UK Stocks Heavily Undervalued, Now an "Attractive Proposition" says Soc Gen

Image © Adobe Images

- Market rates: GBP/EUR: 1.1111 | GBP/USD: 1.3590

- Bank transfer rates: 1.0903 | 1.3309

- Specialist transfer rates: 1.1030 | 1.3495

- More about bank-beating exchange rates, here

The British Pound, stocks and other UK-linked assets are said to be notably undervalued by one of Europe's largest investment banks.

As a result of this undervaluation, analysts at Société Générale say in a recent research note, "UK Equities can rise for a while with a recovering Sterling."

Kit Jukes, Macro Strategist with Société Générale in London says Sterling is one of the most undervalued currencies on all metrics: undervalued by 10% on purchasing power parity (PPP), and even 14% on the real effective exchange rate (REER).

"Sterling offers very attractive upside potential with diversification benefits for those investors who want to protect portfolios from a falling USD," says Alain Bokobza, Head of Global Asset Allocation at Soc Gen.

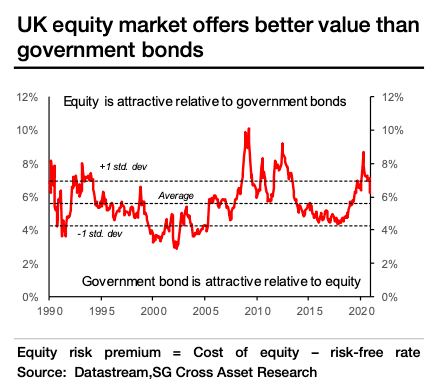

UK stocks are meanwhile said to be "a remarkable 6.2%" undervalued by Bokobza, an undervaluation that is significantly above long-term averages, "indicating equities offer much better value than sovereign bonds in the UK, the rotation has already started".

Rotation refers to the switch in investment preferences by investors from 'growth' stocks - which are typically in the technology sector - to more traditional stocks that have been left undervalued by the covid-19 crisis.

A potential revival in investor demand for UK assets could be lead by the banking sector, which was given the green light by the Bank of England on December 14 to resume paying out dividends.

"UK Banks are to restart paying dividends with more flexibility than in Europe and this will help the market dividend yield to gradually normalise after the 2020 Covid shock," says Bokobza.

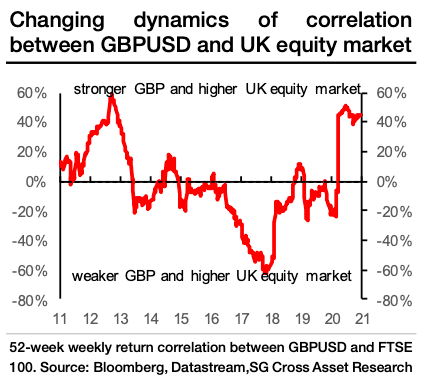

UK stocks have often tended to show a negative correlation with Sterling, tending to fall when Sterling is rising and gain when the currency reverses. This is understandable given that a stronger Pound makes UK assets more expensive when currency changes are factored in.

However, both assets and the Pound could ultimately deliver gains in 2021 says Soc Gen.

"UK equities have constantly underperformed their peer group in spite of a weak sterling over the last years, they can trend reverse for a while. Climbing a wall of worries may prove to be the new scenario, and the post Brexit greener growth agenda may prove to be an attractive proposition – early vaccine strategy and intensively using the fiscal policy again in 2021 may otherwise enforce curve steepening on gilts and heavy sector and style rotations in equities," says Bokobza.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}