Pound Sterling Sell-off vs. Euro & Dollar Accelerates as Johnson Digs in Over Level Playing Field

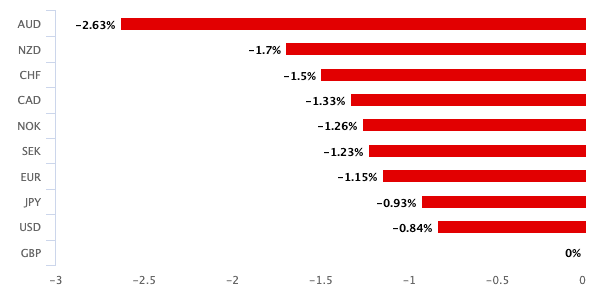

- GBP is biggest loser this week

- Johnson says UK should prepare for no deal

- Says EU insistence on dynamic alignment key stumbling block

- But vows to keep negotiating

Above: Boris Johnson meets with Ursula von Der Leyen. Brussels. The Prime Minister Boris Johnson with Ursula von Der Leyen and Michel Barnier after their dinner at the European Commission in Brussels to continue with Brexit talks. Picture by Andrew Parsons / No 10 Downing Street.

- Market rates: GBP/EUR: 1.0898 | GBP/USD: 1.3216

- Bank transfer rates: 1.0693 | 1.2946

- Specialist transfer rates: 1.0822 | 1.3123

- More about bank-beating exchange rates, here

The British Pound has fallen by over a percent against the Euro, Dollar and all other major currencies over the course of the past week amidst fears the EU and UK are not bluffing about the need to prepare for a 'no deal' outcome to post-Brexit trade negotiations.

Sterling's losses extended into Friday with traders gearing up for a potentially explosive start to the Monday session as negotiators will work through the weekend with the EU and UK to decide on Sunday whether it is worth continuing talks.

UK Prime Minister Boris Johnson raised the prospect of talks failing when he spoke to the press overnight and said it was time to prepare for an Australia-style Brexit, which is his term for a 'no deal' outcome.

"GBP continued to exhibit volatile price action... after PM Johnson warned to prepare for no EU trade deal," says Kurran Tailor, an analyst with Citi.

Johnson honed in on the EU's insistence that the UK dynamically align with their rules in the future, showing this to be the key red line preventing a deal.

The dynamic alignment clause means that should the EU change its rules on business standards in the future, the UK must follow suit or risk being punished.

"It's vital that everyone now gets ready," said Johnson.

This is the first time Johnson has put so much focus on one specific area in talks, thereby making public his key red line and potentially preparing markets and the people of the UK for a 'no deal' outcome.

"It has become very clear that the main point remains the level playing field in negotiations and it must be said, there is just no movement here (as opposed to fisheries) it is looking increasingly precarious going into the weekend and even if we are to see white smoke eventually we could be in for some serious volatility in the currency should this weekend fail to produce it," says a note from JP Morgan's spot trading desk in London.

The messaging from Johnson will also be aimed at the EU and he will hope it prompts some movement, indeed a newswire reports on Friday that Johnson and his officials present at Wednesday's dinner with EU Commission President Ursula von der Leyen "were stunned at how inflexible" the EU side was "and how they refused to engage on suggestions for compromise."

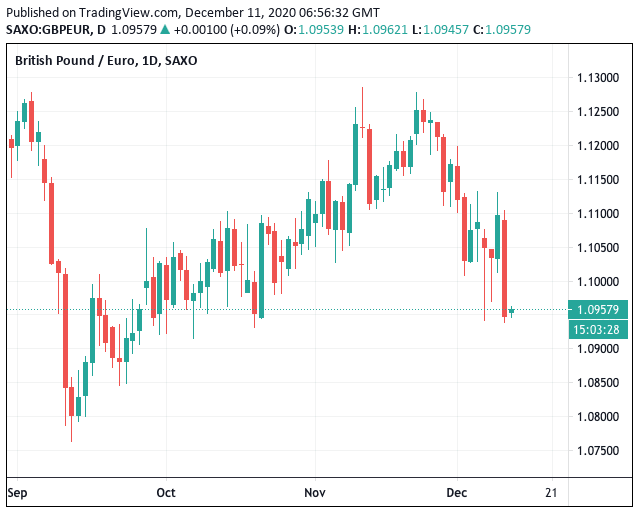

The Pound-to-Euro exchange rate fell by over a percent on Thursday amidst rising fears for a 'no deal', with the pair closing the day at 1.0945. Ahead of the weekend the exchange rate is at 1.0955 and looking prone to further decline.

The Pound-to-Dollar exchange rate is quoted at 1.3320 ahead of the weekend, having fallen 0.80% on Thursday.

"GBP was the big loser on a day where Boris Johnson warning Britain to prepare for a no-deal Brexit," says Kristoffer Kjær Lomholt, Chief Analyst, FX and Rates Strategy at Danske Bank. "The mood has really turned sour."

Above: GBP performance over the past week

The EU has meanwhile published their list of 'no deal' contingency plans, setting out the measures they would take to keep planes flying and vehicles crossing the channel in the event of a 'no deal' outcome.

All temporary deals are set to last for six months.

However, the EU also suggested the UK allow EU fishing fleets access to UK waters for 12 months.

The contingency planning is clear that the measures are designed to be temporary with the view that a broader deal will be eventually struck, suggesting the EU are expecting a chastened UK to come back to the table following a 'no deal'.

Despite the rapidly increasing odds of a 'no deal' outcome the Pound has proven relatively resilient, according to some analysts.

Research from RBC Capital Markets shows that the Pound is not tracking 'no deal' probabilities as closely as some might have expected, saying the 'beta' in Sterling to no deal has fallen. 'Beta' refers to the positive correlation between the Pound and no deal odds.

"GBP does appear to be following no-deal chances though with a very low beta. Since the start of December, the odds of a trade deal this year have almost halved, while a 50/50 basket of GBP vs USD & EUR is down <1%," says Elsa Lignos, an analyst with RBC Capital Markets.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Strategists at Citi, the world's largest dealer of foreign exchange, say they believe it is still too soon to sell the Pound as there is a strong chance both the EU and UK are bluffing and a deal will be reached.

CitiFX Strategist Adam Pickett points out that we began the week with The Sun floating that Johnson was ready to walk away from talks imminently, and now we’ve got confirmation that both sides are still at the table beyond the “make or break” moment.

"We do not think it’s worth selling GBP unless the EU calls talks off; a UK walkout is less credible judging by recent experience," says Pickett.

Indeed, Johnson has said he is willing to keep talking and will intensify efforts if required.

"I will go to Brussels, I will go to Paris, I will go to Berlin," he said in an interview broadcast late Thursday. "I will go wherever to try and get this home and get a deal."

"The big question is of course whether this is just the last push before a deal is finalised or whether a deal is really off the table, as we have seen this situation so many times before. That said, the risk of a no deal Brexit has definitely increased over the past week," adds Danske Bank's Lomholt.