Pound Sterling in Biggest Daily Drop in 3 Months against Euro Amidst Spike in 'No Deal' Expectations

- GBP in sharp decline Thursday

- EU sets out contingency plans for 'no deal'

- "GBP would have a long way to fall " on no deal - Nomura

Image © European Union

- GBP/EUR spot rate at time of publication: 1.0956

- Bank transfer rate (indicative guide): 1.0673-1.0750

- FX specialist providers (indicative guide): 1.0810-1.0880

- More information on FX specialist rates here

The British Pound experienced its biggest one-day drop in three months against the Euro amidst increasing signs a 'no deal' Brexit is the most likely outcome to trade talks between the EU and UK.

Sterling has come under sustained pressure since UK Prime Minister Boris Johnson and EU Commission President Ursula von der Leyen confirmed on Wednesday night that a significant gulf still existed between the two sides.

The publication of 'no deal' contingency plans by the EU on Thursday meanwhile amplified the message that the EU saw little prospect of a deal being agreed, while UK Prime Minister Boris Johnson said in an a media interview that the the UK was heading for an Australia-style Brexit because the two sides appeared unable to bridge the impasse.

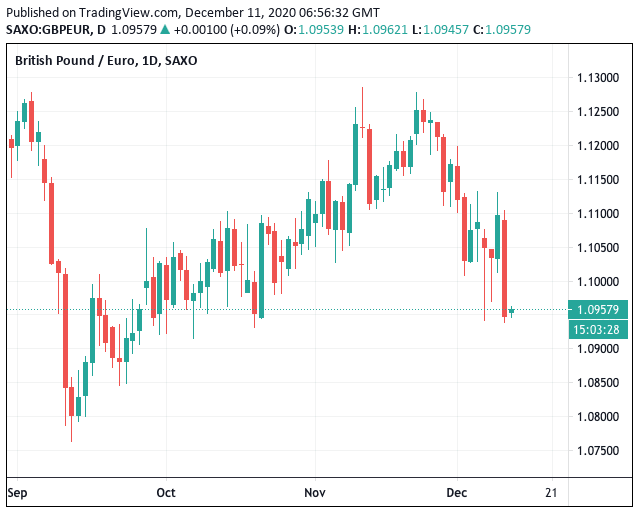

The Pound-to-Euro exchange rate fell 1.30% on Thursday to close at 1.0950, a level it finds itself at on Friday.

"With just three weeks until the UK exits the implementation period, it seems that the negotiations on the UK’s future trade relationship with the EU have come down to a final four days of negotiations. With the UK economy materially impacted by Covid well into Q1, we remain sellers of any broad GBP rallies. For now we remain beholden to Brexit headline risk, watching for the von der Leyen debrief to EU leaders today and into the weekend," says analyst Jeremy Stretch at CIBC Capital Markets.

Above: GBP/EUR suffered its largest daily drop since September on Thursday Dec. 10.

A prominent newswire is reported on Thursday that negotiations are on course to end without a trade deal barring a dramatic last-minute intervention, citing officials with knowledge of the discussions.

"We continue to expect a deal to be the final outcome, the timing is the tricky issue. If we are wrong and the UK opts for a no-deal Brexit, GBP would have a long way to fall and we would have to review our forecast for next year," says Jordan Rochester, a foreign exchange strategist with Nomura.

The EU and UK have set Sunday as a new deadline for the talks on a post-Brexit trade agreement, although an agreement by Johnson and von der Leyen to keep negotiating offered a ray of hope that a deal can ultimately be reached.

The two sides confirmed they remain far apart on key issues after UK Prime Minister Boris Johnson dashed across the channel on Wednesday night to try and add impetus to stalled talks.

"The pound weakened in the absence of a breakthrough during the talks," says Khatija Haque, Head of Research & Chief Economist at Emirates NBD, "growing Brexit concerns continue to weigh on the GBP."

Johnson met EU Commission President Ursula von der Leyen for discussions over dinner, with the two leaders joined by their lead negotiators.

Both sides confirmed the gaps between them remained substantial, but agreed that negotiations should continue.

{wbamp-hide start}

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

Despite Sunday being touted as a deadline, a closer reading of the various texts shows that it is on Sunday that the two sides will consider whether it is worth continuing negotiations.

It is therefore by no means a cut-off date, with December 31 being the only true hard deadline.

Indeed, the UK will likely benefit from running the clock down as long as possible given it will be able to put any legislation into law relatively easily when compared to the EU which has a complicated ratification process involving the EU Parliament and member states. Speaker of the House of Commons Sir Lindsay Hoyle said on Wednesday the UK parliament could sit into the Christmas period, if need be.

By letting the clock run down the UK could also prompt the more 'dovish' EU states into prodding the more 'hawkish' members into movement.

The tone from Ireland has been supportive of compromise.

"Irish PM Micheal Martin, who is somewhat of a Brexit 'dove', calls on his EU colleagues to do 'everything possible' to clinch a UK-EU trade agreement," notes Joe Barnes, Brussels Correspondent for The Express.

Martin said today on his arrival at the European Council summit: "it’s important for the citizens of Europe we do everything we possibly can to get an agreement".

"There can be no winners or losers in these negotiations from now on. There has to be a common purpose in terms of getting a deal over the line, because it makes sense to get a trading deal."

Mairead McGuinness, Ireland's EU Commissioner, said in an interview on Ireland's national broadcaster RTÉ that "there is a deal to be done".

She said Wednesday's meeting will have clarified where the faultlines in talks lie, "if we take the heat" out of the talks there was "one glimmer of hope" in the EU statement.

"We gained a clear understanding of each other´s positions, qualifying that by saying both sides remained far apart," said McGuinness.

"We never had great expectations that there would be a breakthrough over dinner, but the fact that there was a discussion, lively and interesting...and that there was a clear understanding of each other's positions, doesn't mean that there will be a breakthrough but it's certainly better than a statement suggesting otherwise. I would expect those three very difficult issues will be discussed in detail again to see where a compromise might be found," she added.

If the EU and UK do find a way forward and strike a deal the Pound is widely expected by foreign exchange analysts to strengthen into year-end and through 2021 as a cloud of lingering uncertainty is finally lifted.

Nomura's Rochester says volatility in the Pound would decline drastically and demand for downside hedges against Sterling declines will no longer be needed.

This would spark a rally in the Pound-Dollar exchange rate to 1.3650 and higher, according to Nomura and buying the Pound would likely become a consensus 'long' trade for the market into 2021 with 1.40 or higher in mind.

Nomura are meanwhile holding an end-2021 forecast of 1.1364 and an end-2022 forecast for 1.1628, or higher.