British Pound Upside Against Euro & Dollar Capped by Promise of Further Bank of England QE & EU's Hogan saying UK Doesn't Want Brexit Talks to Succeed

- Bank of England aids Sterling higher

- Markets expected to remain key driver of Sterling

- Brexit anxieties to cap upside

- EU's Hogan accuses UK of not wanting trade talks to succeed

Above: EU Trade Commissioner Phil Hogan. © Photographer: Pedro Rocha European Union, 2016. Source: EC - Audiovisual Service.

![]() - Spot GBP/EUR rate at time of writing: 1.1440

- Spot GBP/EUR rate at time of writing: 1.1440

- Bank transfer rates (indicative): 1.1140-1.1220

- FX specialist rates (indicative): 1.1230-1.1340 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2390

- Spot GBP/USD rate at time of writing: 1.2390

- Bank transfer rates (indicative): 1.2065-1.2140

- FX specialist rates (indicative): 1.2160-1.2280 >> More information

Pound Sterling received a boost ahead of the UK's long weekend thanks to a Bank of England decision to keep interest rates and quantitative easing levels unchanged, however the expectation of renewed Brexit anxieties and the grip of global market sentiment should keep upside potential limited.

The Bank said Thursday the UK economy could fall by as much as 14% in 2020 which would make for the fastest and deepest slump since the 1700s, but a sharp recovery in 2021 will most likely take place, which would make for the sharpest recovery since the 1700s! So there was some good news to be had.

Looking ahead, any gains are likely to be short-lived as the Bank looks committed to boost quantitative easing at some point in the future. This is good for the economy, but from a purely FX position the UK currency will find itself burdened by one of the largest quantitative easing programmes relative to the economy of any major currency.

"The pace of its QE operations is impressive and now has overtaken the Fed and the ECB in terms of % of GDP. As a result, UK real yields continue to decline and with it suggest GBP weakness versus both EUR and USD to come," says Jordan Rochester, FX Strategist at Nomura.

With the Bank of England's decision out of the way, the immediate domestic focus turns to the UK's planned exit from lockdown with Prime Minister Boris Johnson due to deliver a speech at 7PM Sunday.

"The Pound may start to retrace lower again from here. With PM Boris Johnson’s lockdown update this weekend, Brexit talks at an impasse and coronavirus uncertainty gripping markets, Sterling downside seems like the path of least resistance," says George Vessey, Currency Strategist at Western Union.

Vessey says the the Pound may fall if it appears the economy can’t get going again quickly, but if the message is overly optimistic, the Pound could climb. If you would like to speak to a dealer about clinching the current rates, please get in touch with our partners at Global Reach.

Boris Johnson told the Cabinet this morning that the Govt "will advance with maximum caution" over easing any lockdown restrictions. Any changes that the PM announces on Sunday will be "very limited", No10 say, as the UK is "at a critical moment".

— Tom Newton Dunn (@tnewtondunn) May 7, 2020

While eyes are on the domestic agenda we would remind readers that the Pound continues to take guidance from the broader market sentiment. In short, a rally in global stocks will likely trigger gains against both the Euro and Dollar while any decline in markets could weigh on the currency.

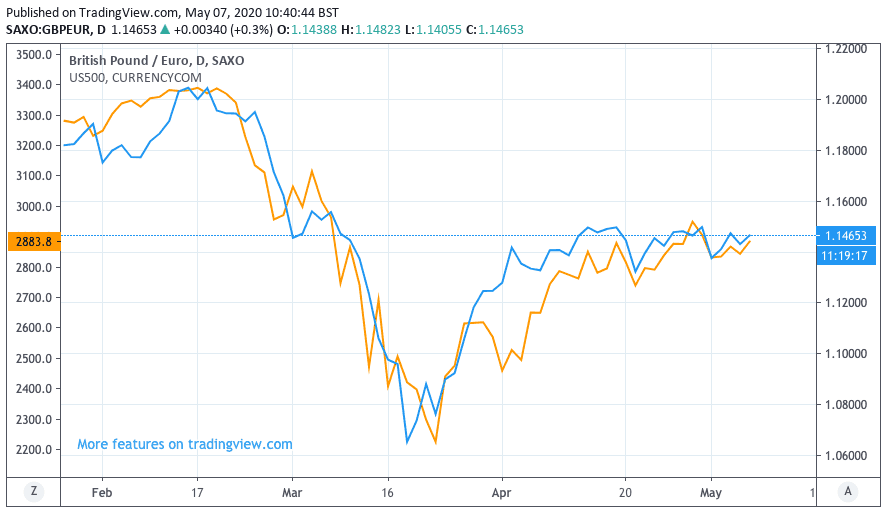

Just to hammer home the point of the market's impact on Sterling, taking a look at the following Pound-to-Euro exchange rate graph: it compares GBP/EUR performance with the performance of the U.S. S&P 500 index which is a good proxy for global investor appetite:

What we see is that when the stock market moves higher, so does Sterling.

This is particularly relevant for pairs like GBP/EUR, GBP/USD, GBP/CHF and GBP/JPY. But, when it comes to Sterling's chances against the Australian Dollar, South African Rand, New Zealand Dollar and developing market currencies we would expect Sterling to underperform.

This is because these currencies are more geared towards overall risk sentiment than Sterling is, therefore they would be expected to advance on the Pound should market sentiment result in higher stock markets and commodity prices.

Hogan Triggers Fresh Angst Over Brexit Trade Talk Negotiations

The British Pound's upside potential will also be capped by the perennial question of Brexit, with trade negotiations yet to make a substantive breakthrough ahead of a looming July 01 deadline for any extension to the talks to be agreed.

“Despite the urgency and enormity of the negotiating challenge, I am afraid we are only making very slow progress in the Brexit negotiations. There is no real sign that our British friends are approaching the negotiations with a plan to succeed. I hope I am wrong, but I don’t think so,” European Trade Commissioner Phil Hogan told Irish national broadcaster RTE.

"I think that the United Kingdom politicians and government have certainly decided that COVID is going to be blamed for all the fallout from Brexit and my perception of it is they don’t want to drag the negotiations out into 2021 because they can effectively blame COVID for everything," added Hogan.

In response to the comments, a UK government source told Brussels reporter Nick Gutteridge:

"We don't recognise suggestion we haven't engaged seriously in any area." Officials point out UK has been pushing "a fast-paced negotiation" & "rapid pace of rounds".

Furthermore the source said extending transition doesn't create light, just more tunnel.

The positions of the EU and UK appear to be far apart, but we would expect this to be the case as any breakthrough is inevitably made at the last minute.

The markets have cottoned on to how the game is played and therefore we would not expect any major stresses in Sterling exchange rates to be evident at this juncture.

We would however expect anxieties over the trade negotiations to keep a firm lid on any upside potential, while a clear breakdown in negotiations could rapidly introduce some substantive downside.

"Sterling rose from GBP/USD 1.23 to 1.24 following the BoE meeting, but pulled back subsequently, dropping as far as 1.22 on resurgent concerns over negotiations with the EU

(scheduled to resume on Monday), in the wake of statements by the EU Commissioner Trade, Phil Hogan, who expressed scepticism on the positive outcome of the talks," says Asmara Jamaleh, Economist at Intessa Sanpaolo.