Pound Sterling to Remain Under Pressure against Dollar and Euro as Fed Hike Fails to Boost Dour Investor Sentiment

- Market meltdown extends

- GBP loses further ground vs. EUR and USD

- Gains vs. AUD, NZD and CAD

- Bank of England could act soon

- Dash for cash to keep USD supported

Image © Bank of England

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

The British Pound starts the new week under pressure against the Euro and U.S. Dollar amidst another meltdown in global stock markets and growing expectations for another Bank of England interest rate cut.

Global markets continue to sell off as governments around the world roll out their respective responses to the coronavirus outbreak, with investors realising strict and unprecedented containment measures are likely to trigger a deep, and potentially long-lasting, global recession.

In response to global slowdown fears, the Federal Reserve on Sunday announced a cut of 100 basis points to their target interest rate which is now at 0.-0.25%, while they restarted their quantitive easing programme which will see the central bank buy up to USD700bn worth of securities and bonds.

The move at the Fed followed an unscheduled decision by the Reserve Bank of New Zealand (RBNZ) to cut interest rates by 75 basis points, while on Friday the Bank of Canada (BoC) cut interest rates by 50 basis points.

The moves have however failed to stem market anxiety over the economic impact of the coronavirus outbreak, with Asian markets trading in the red and European and U.S. markets all looking to be set to register declines when they open.

The spill-over into the foreign exchange market has however thus far been relatively muted, "FX moves this morning are surprisingly well contained, given the magnitude of news markets have had to digest at the Asian open," says Adam Cole, Chief Currency Strategist at RBC Capital.

We do however note that the British Pound remains under pressure against its two major partners in the current environment:

The Pound-to-Euro exchange rate is quoted at 1.1089, at the same point last week the pair was at 1.1523 while the Pound-to-Dollar exchange rate is now quoted at 1.2352, it was at 1.32 this time last week.

We noted a sharp fall in the value of Sterling around the start of the European stock market opening, confirming our belief that investor flows of capital are currently working against the currency:

Above: GBP/EUR dips again as European markets begin trading

The Pound has tended to show weakness against the Dollar and Euro in the current environment of investor fear and we suspect a large drawdown in UK investments by international investors is responsible.

The UK runs a sizeable current account deficit as the the country imports more than it exports, meaning a sizeable pillar of support for Sterling is provided by the inflow of foreign investor capital.

The UK is an attractive investment destination owing to its sizeable financial services sector, timezone, legal certainty and general ease of doing business. However, when the global investment community is running scared foreign investments turn from a source of support into a source of weakness for Sterling.

However, against the likes of the Australian, New Zealand and Canadian Dollars the Pound is faring better as these currencies are even more prone to negative shifts in global investor sentiment. The decision to cut interest rates at the RBNZ, RBA and BoC has also meant that these currencies no longer enjoy the benefit of belonging to countries where central banks maintain high interest rates, a situation that has in the past attracted inflows of foreign exchange.

The global investor community remains scared and we would expect the current trends to remain locked in place until there are signs that the virus has done its worst. For now, this turning point looks some way off and as such we expect the current trends of Sterling weakness against the EUR and USD but strength against the likes of the AUD, NZD and CAD to extend.

Bank of England Likely to Cut Rates / Boost Quantitative Easing

The Bank of England is likely to follow its peers and cut interest rates further, or if it opts to keep interest rates at 0.25% it will announce a boost to its quantitative easing programme.

A move being made before the scheduled March 26 meeting cannot be ruled out owing to the intensity of the coronavirus crisis.

The Pound tends to underperform when the Bank of England cuts interest rates and boosts quantitative easing, and we therefore expect expectations for further action to keep Sterling under pressure over the near-term.

"Andrew Bailey will take over from Mark Carney as Governor of the Bank of England. He has come in at a crucial time for the Bank and due to his experience, is seen by many as a 'safe pair of hands'. It will be interesting to see if the Bank of England make another rate cut at their monetary policy meeting next week, or even before then," says Erin Harding at Smart Currency Exchange.

Bailey told BBC news on Monday the Bank stood ready to act when need be; "you will see prompt action from the Bank of England again when we need to take it."

"The move by central banks is a strong signal of coordination," Bailey added. "We will see what effect of swap lines will be in the coming days. We are very keen to ensure long-term economic damage from coronavirus is minimised."

The Global Dash for Cash to Keep Dollar Afloat

The Dollar is likely to remain well supported as businesses, individuals and investors across the world place a premium on cash. The Dollar is the world's reserve currency and therefore tends to benefit when demands for cash rise as is the case when uncertainty on the general business outlook rises and economies shift into recessionary territory.

"For the next few months, cash is going to be the single most important factor as only cash will allow affected businesses to survive the very sharp (but temporary) decline in their revenues," says Dr. Richard Windsor, an independent research producer. "The knock-on effect of a wave of loan defaults and bankruptcies could be very serious as Western economies are more indebted now than they have ever been, (more than 2008) with very little put aside for a rainy day."

"It is not just raining now, it is a torrential downpour meaning that the effort to prevent economic collapse has to be focused on the small businesses most affected by the lockdown as raining cheap money on consumers is not going to help in any way at all.

This is because consumers are at home and they will not be going anywhere except to the supermarket or the pharmacy for a couple of months. What these consumers need is to know that their employers will still be paying their salaries despite the massive decline in their revenues and it is here where the economic support needs to be focused. It is the fear of a global credit crunch combined with the uncertainty that the outbreak represents that is really driving the market as safe havens such as gold are also suffering because everyone is rushing to raise cash," adds Windsor.

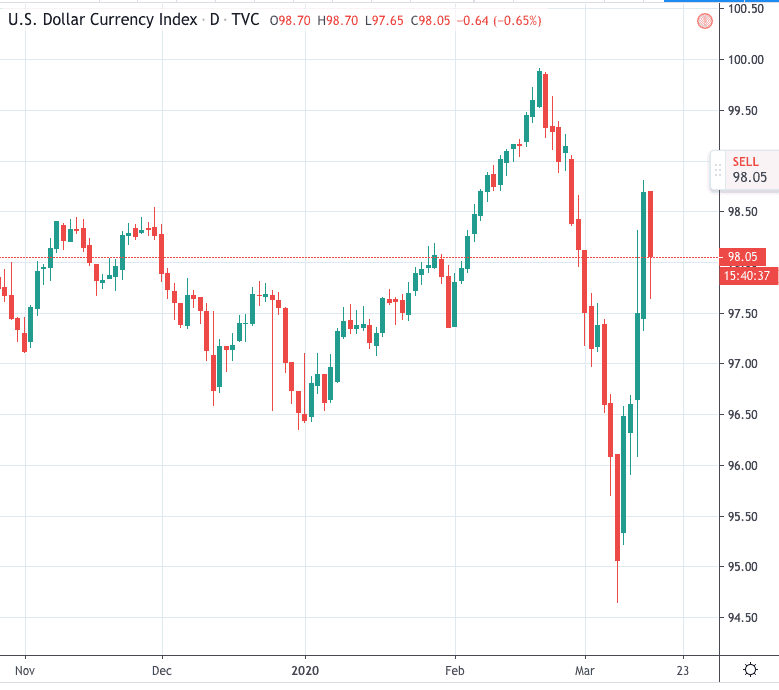

The Dollar index - a broad-based measure of U.S. Dollar performance - has shown investors and businesses started placing a premium on cash around March 10, when the index performed a u-turn and began to rise once more:

The Dollar registered strong gains through the course of last week but we do notice the currency is lower on Monday, most likely in response to the sizeable announcement from the Federal Reserve on Sunday.

Whether or not the Fed has the ability to halt the Dollar's rise would however ultimately come down to whether the global economy believes the actions to supply cheaper money is enough to limit the impact of the coronavirus meltdown.

We doubt this will be the case as the virus continues to spread and medical experts expect the peak impact on Western economies to be some weeks away should provide substantial uncertainty.