British Pound Walloped by Euro and Dollar as Third "Meaningful Vote" Puts Brexit Bill On Course for Final Rejection

- Written by: James Skinner

Image © Pound Sterling Live

- GBP slips after "indicative votes" leave Parliament deadlocked.

- Conservative Party MPs u-turn to support PM May's agreement.

- But not enough of them and, crucially, DUP still rejects agreement.

- Leadsom says 3rd withdrawal bill vote will take place this Friday.

- Failure sees May choose between "no deal" and 2nd Art 50 extension.

- Further indicative votes set for Monday, on narrower choice of options.

- MUFG says Commons passing withdrawal bill best outcome for GBP.

The Pound fell sharply Thursday amid conflicting reports over whether Prime Minister Theresa May will put her EU Withdrawal Agreement before the House of Commons again on Friday, and as pundits speculated that the deal will be rejected by MPs when they come to vote on it again.

Friday marks parliament's last remaining opportunity to approve PM May's proposed model of exit from the EU. If the withdrawal agreement is not passed by the House of Commons the UK will receive an Article 50 extension that runs only until April 12.

At that point the Prime Minister will face a choice between the so-called "no deal Brexit" route out of the EU and requesting from Brussels a much longer Article 50 extension that would require UK participation in the next round of EU parliamentary elections.

That would prolong the cloud of uncertainty hanging over the domestic economy and could prevent the Bank of England from raising its interest rate this year. The BoE has suggested, and markets have bet, that it will lift Bank Rate once an orderly exit from the EU has been secured.

Andrea Leadsom, leader of the House of Commons, said Thursday the government will bring forward a third "meaningful vote" on the EU Withdrawal Agreement this Friday and that its motion "will comply" with the Speaker's ruling that the treaty must change meaningfully before it can be put to MPs again.

The House of Commons Speaker has since confirmed the vote will in fact go ahead on Friday, at 14:30 London time, because the government's decision to present only the withdrawal bill to MPs, leaving out the future relationship declaration, changes its substance.

Break - Theresa May has decided to put the Withdrawal Agreement alone to a Commons vote tomorrow, without the Political Declaration (1)

— Tom Newton Dunn (@tnewtondunn) March 28, 2019

Significant numbers of Conservative Party MPs U-turned Wednesday by claiming they will back the EU Withdrawal Agreement next time it is put to the Commons, after PM May pledged in a meeting of backbench MPs that she'll resign once the UK's exit is complete.

However, a large number of MPs still oppose the agreement and the Democratic Unionist Party (DUP) of Northern Ireland is so-far unmoved in its opposition to it. The withdrawal agreement will set the stage for negotiations on the future relationship so a change of Prime Minister would not address its deficiencies.

"Back in December 2017 we warned about the dangers of the backstop.

— DUP (@duponline) March 28, 2019

We cannot sign up to something that would damange the Union"

https://t.co/EWPco9NuFP pic.twitter.com/x1dTw25r3o

"The DUP’s ongoing opposition remains another key hurdle to passing PM May's deal. In these circumstances, it still looks difficult to pass her deal even if the probability of success is rising," says Fritz Louw, an analyst at MUFG. "We continue to believe that the best outcome for the pound in the near-term would be if PM May’s deal is surprisingly passed."

Leadsom's announcement came after MPs seized control of Wednesday's parliamentary agenda in a maneuver billed as enabling them to reveal their preferred route forward with the EU, through a series of "indicative votes".

The groundwork for that coup was done at a time when the government's Brexit strategy appeared to be dead in the water.

A range of amendments were put forward including those proposing a "permanent customs union" with the EU, another referendum and the revocation of Article 50, but all failed to secure a majority in the House of Commons, leaving parliament deadlocked over Brexit.

"A majority of MPs are staunchly against a hard Brexit. While this remains the default option come 12 April if the UK has not passed the withdrawal agreement or agreed with the EU a further delay, the clear result strengthens our view that, if need be, the UK would rather ask for a new Brexit delay than plunge into a hard Brexit," says Kallum Pickering, an economist at Berenberg Bank.

The Speaker has announced the results for today's #IndicativeVotes:

— UK House of Commons (@HouseofCommons) March 27, 2019

(B) - Ayes 160 Noes 400

(D) - Ayes 188 Noes 283

(H) - Ayes 65 Noes 377

(J) - Ayes 264 Noes 272

(K) - Ayes 237 Noes 307

(L) - Ayes 184 Noes 293

(M) - Ayes 268 Noes 295

(O) - Ayes 139 Noes 422 pic.twitter.com/z5jDqtMC11

"MPs were able to endorse or reject any number of options. If some of these options are taken off the table in a second round of voting – expected on Monday, the calculus may change for a significant number of MPs so that a majority in favour of one of the options that almost made it tonight could emerge. 320 votes guarantees a majority," Pickering adds.

Indicative votes came after Conservative Party MPs Oliver Letwin and Dominic Grieve, as well as opposition MP Hilary Benn, won control of Wednesday and the coming Monday's parliamentary business. The number of amendments before parliament is expected to narrow substantially on Monday.

Above: Pound-to-Euro rate shown at hourly intervals.

The Pound-to-Euro rate was -0.50% lower at 1.1630 at the London close Thursday, but is up 4.6% for 2019. Meanwhile, the Pound was -0.67% lower at 1.3063 against a stronger Dollar, but is up 2.5% this year.

Above: Pound-to-Dollar rate shown at hourly intervals.

Prime Minister Theresa May needs 320 votes in favour of her EU Withdrawal Agreement in order to guarantee it a majority in the House of Commons but she only has 316 voting MPs in parliament and 10 DUP votes to rely on if she can convince them to back the agreement.

PM May's exit plan was rejected by the House of Commons for a second time on March 12, by a majority of 149. PM May has since said it won't be put before the house again unless the government can be confident it will pass. It's far from clear whether she will able to get the numbers.

The previous Withdrawal Agreement vote resulted in a record-breaking landslide of opposition to what is the government's signature piece of work. 432 MPs voted against the bill on January 15, with only 202 in favour of it, making for a rejection by a majority of 230 votes.

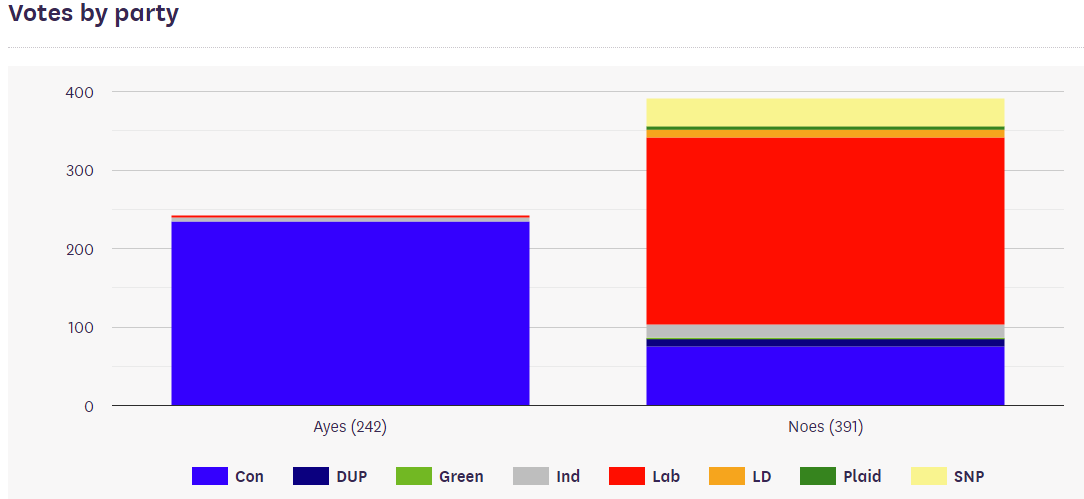

Above: House of Commons votes for and against EU Withdrawal Agreement, March 12, 2019.

Most of its opponents object to the withdrawal agreement because of party-political reasons, but the DUP and other unionists have concerns about the treaty because of the so-called Northern Irish backstop inside of it.

The backstop enshrines in an international Treaty a commitment that will see the government forced to impose on the UK many existing and yet-to-be-made EU laws on a potentially-indefinite basis and without any ability to influence those laws or EU institutions. The UK will also form part of the EU's customs territory.

That's unless, of course, the UK is willing to allow Northern Ireland to be effectively annexed by the EU in the event the backstop is activated, in which case only Northern Ireland will be subjected to that treatment.

Once May's agreement is in force, the backstop could only be circumvented through the Prime Minister of the day satisfying the EU's demands as they relate to the "integrity of the single market" and adherence to the Belfast Agreement in the next stage of the negotiations.

Such a structure could be said to create an incentive for the EU to remain perpetually unsatisfied with UK proposals for the future relationship. This is why many MPs have expressed deep-seated opposition to the EU Withdrawal Agreement and some have even gone so far as to describe it as a trap.

LATEST⬇️⬇️ pic.twitter.com/Y91C4aA09Q

— DUP (@duponline) March 27, 2019

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement