Pound Sterling to Hit Historic Lows against Euro and Dollar before March says Leading FX Analyst

- Written by: Gary Howes

© Gov.uk

- Post-referendum lows in sight for GBP in December.

- Historic lows to be seen before March 2019 as parliament feuds.

- But variables mean final Brexit outcome is too difficult to predict.

The Pound will hit historic lows against both the Euro and Dollar before March, according to analysts at a leading global investment banking name, because Prime Minister Theresa May's Brexit proposal looks almost certain to be rejected by parliament.

According to MUFG, a rejection of the Brexit deal brought back from Brussels by May this December would see markets fret that a so-called 'no deal' Brexit has become all but inevitable.

Such a rejection could be viewed as likely, given the scale of parliamentary opposition to May's proposals and that the Prime Minister herself said Thursday, the choice is between her proporsal and an exit from the EU where the UK would default to trading with it on World Trade Organization terms.

Should parliament reject the Brexit deal the Pound is forecast to endure a decisive break out of recent ranges and head lower.

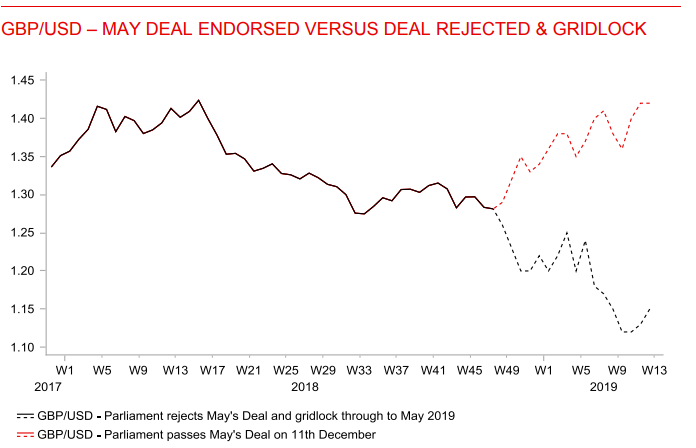

Above: MUFG scenarios for Pound-to-Dollr rate from December 2018 onward.

However, these moves would be just the beginning of a protracted period of depreciation for the Pound, that would push up inflation once again and reduce real GDP growth in the process. Exactly as the earlier depreciation did in the wake of the 2016 vote to leave the EU.

Sir Michael Fallon, a Conservative Party MP and former defence minister, said Tuesday that May's deal covering terms of the U.K.'s exit from the EU is "doomed" and that it should be renegotiated because too many of the government's parliamentarians oppose it. More than 200 Conservative MPs are said to oppose the deal.

This is a bad omen for the deal itself, the Pound and the Prime Minister. Halpenny says parliament's rejection of the Withdrawal Agreement will open up a "Pandora's Box" but that there are too many variables to reliably predict the final Brexit outcome from the parliamentary pandemonium that might ensue.

Halpenny and the MUFG team have told clients that if parliament cannot unify around one particular position, there will be significant volatility in the markets and some damage to the economy.

"Based on a failed parliamentary vote, and assuming spot then is trading around today’s level we would expect GBP/USD to drop quickly toward the 1.2000 level. Our year-end GBP/USD forecast on a failed parliamentary vote is 1.2200," says Derek Halpenny, European head of markets research at MUFG. "For the Pound versus the Euro there would be a notable difference too but the range perhaps a little less given EUR/USD would be impacted to some degree."

Halpenny says the Pound-to-Euro exchange rate would fall back to its post-referendum low around 1.0867 before year-end if parliament votes down May's proposals. The Pound-to-Euro is a cross rate calculated at its most basic level by dividing the GBP/USD rate over the EUR/USD rate, which would also fall, explaining the lesser move in the Pound-to-Euro rate.

He projects this will ultimately lead parliament to request an extension of the Article 50 period, although it's not possible to say if this request would be approved by the EU or if it would rescue Sterling from historic lows.

The call comes as Sterling sees growing pressure amidst fears a 'no deal' Brexit will transpire. However a look at price charts suggests the market is not yet in panic mode:

Above: Pound-to-Dollar rate shown at weekly intervals, capturing referendum depreciation.

The Pound-to-Dollar rate is quoted 0.38% lower at 1.2789 at the time of writing and is down 5.2% for 2018. It is still more than 11% below the 1.45 rate that prevailed on the night of the June 23, 2016 Brexit referendum.

The Pound-to-Euro rate is at 1.1226 and is down -0.17% for 2018. It is still more than 12% lower than the 1.29 rate that prevailed back in June 2016, before the referendum result became known.

Above: Pound-to-Euro rate shown at weekly intervals, capturing referendum depreciation.

Advertisement

Bank-beating GBP exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

GBP Weakness Could be Here for a Long Time

PM May could go back to Brussels and attempt to renegotiate the deal if it fails in parliament, or she might attempt to buy further time to get it past lawmakers by asking for an extension of the article 50 period Halpenny says.

The UK parliament might also decide to push for an alternative to May's Brexit proposal, such as the so-called Norway option where the country would remain in the EU's legislative orbit but outside the customs union.

A second referendum or another general election are also both possible outcomes. And of course, so too is the much-maligned "no deal" route out of the EU.

"Predicting the FX reaction from 11th December to the end of December to the binary outcome of a successful or failed parliamentary vote is a lot easier than outlining FX direction in Q1 2019 as certain scenarios laid out above start to unfold. The worst of the scenarios we outline is that parliament is simply unable to come together around one single plan and each faction remains entrenched in their view," Halpenny says.

MUFG still expect a last-minute extension of Article 50 to be agreed to avoid the disaster of 'no deal' but given the numerous different scenarios outlined here and how they could crossover with each other, "it is certainly conceivable that a failure in parliament results in some form of resolution coming very late in the day that would have consequences for the economy and a significant increase in volatility," Halpenny warns.

October's reports that May had reached an agreement covering terms of the UK's exit from the EU had originally boosted Sterling but opposition to the deal from the Conservatives' confidence and supply partner, the Democratic Unionist Party, saw those gains quickly unwound.

And since opposition to the agreement has become more widespread, and now exists on a cross-party basis including among members of the governing Conservatives, weakness in Sterling exchange rates has become more persistent. Halpenny's forecasts suggest that weakness is here to stay for the time being.

"GBP/USD would likely be trading in the mid-1.1000’s as we move into the month of March, which would be broadly consistent with the market having priced 10% of the 15% drop the BoE assumes under the “disruptive” Brexit scenario. For EUR/GBP we could certainly assume by March with parliament in gridlock and no obvious outcome ahead that parity would be in sight," Halpenny projects.

A handful of lawmakers have already made a failed bid to topple Prime Minister Theresa May after she returned from Brussels with agreements that they say, rather than "taking back control" from the EU, could actually enfranchise it with even more power over the UK.

The Brexit Deal: What's the Problem?

The future relationship declaration sets out what purports to be a joint ambition for a Canada-style free trade agreement between the UK and EU that would take effect at the end of a transition period currently scheduled to run between March 29, 2019 and the end of December 2020.

However, in order to get to that "trade deal", it must first be negotiated with the UK inside a "transition period". By that time, the U.K. will already have signed up to an international treaty called the "Withdrawal Agreement" that could see the country forced into an unenviable position should PM May prove unable to satisfy EU negotiators.

That unenviable position would see the government choose between remaining in "transition", during which time little about the relationship will change, and life under a so-called backstop arrangement. Until the EU decides otherwise.

Permanent transition would see the UK continue to make payments to the EU and remain under its legislative auspices, while being denied representation in EU institutions and influence over relevant legislation.

The purported backstop would see the UK held within a customs union with the EU, entailing much of the aforementioned, but with the Northern Irish province subjected to "Northern Ireland specific regulatory alignment".

The PM and EU negotiators claim the arrangements are intented to ensure any future trade arrangements will not compromise the EU single market and lead the EU to impose a physical border that divides the island of Ireland.

But Brexiteers say there are other ways of avoiding a division of Ireland and that the proposals hand the EU something close to a veto over the UK's departure from the union, while committing the country to paying a £39 billion "Brexit Bill" from the outset. Many claim they'll vote against it in parliament.

Northern Irish lawmakers, on whose support the Prime Minister depends for a majority in parliament, say the proposals will undermine the province's union with Great Britain and have also pledged to vote against it in the House of Commons.

The opposition Labour Party has said it will vote down the deal too, suggesting PM May will not be able to co-opt lawmakers from the opposing benches in order to get the relevant bills onto the statute book.

Labour leader Jeremy Corbyn says the party "categorically rules out" leaving the EU without a deal. But he also says May's deal is unnaceptable, and that he could negotiate a better alternative.

Corbyn claims the proposed agreement does not ensure "frictionless trade" and that it does not protect "workers' rights and jobs" in the UK. He is yet to say how he or the Labour Party would negotiate their proposed alternative.

Advertisement

Bank-beating GBP exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here