British Pound Under Heavy Pressure vs. Euro & Dollar Amidst "Extremely Strong" Bear Signals

Image © Rawpixel.com, Adobe Images

- May keeps alive prospect of 'no deal' Brexit in appearance before parliament

- Bears now in control of GBP says technical specialist

- Sterling to remain erratic in current Brexit environment

We are seeing a big, independent leg lower in Sterling Thursday with one analyst telling us that traders are feeding off "extremely strong" bearish signals on the Pound.

The troubling technical setup behind Sterling coincides with UK Prime Minister Theresa May telling parliametarians she is unwilling to rule out a 'no deal' Brexit in March 2019 if her Brexit deal struck with the EU fails to pass through parliament in December.

"The timetable is such that actually some people would need to take some practical steps in relation to no deal if the parliament were to vote down the deal on the 11th of December," May told the liaison committee of select committee chairs.

Furthermore, May described calls for another referendum or delaying 29 March's departure date as attempts to "frustrate" Brexit.

The signal to markets is that the leeway available to politicians to avoid a 'no deal' Brexit is actually less than might have been previously assumed.

There was an assumption that all would be done to avoid a 'no deal' Brexit, but it is increasingly clear that perhaps the best bet is that a negotiated 'no deal' Brexit can be achieved.

Sterling is naturally factoring in this assumption.

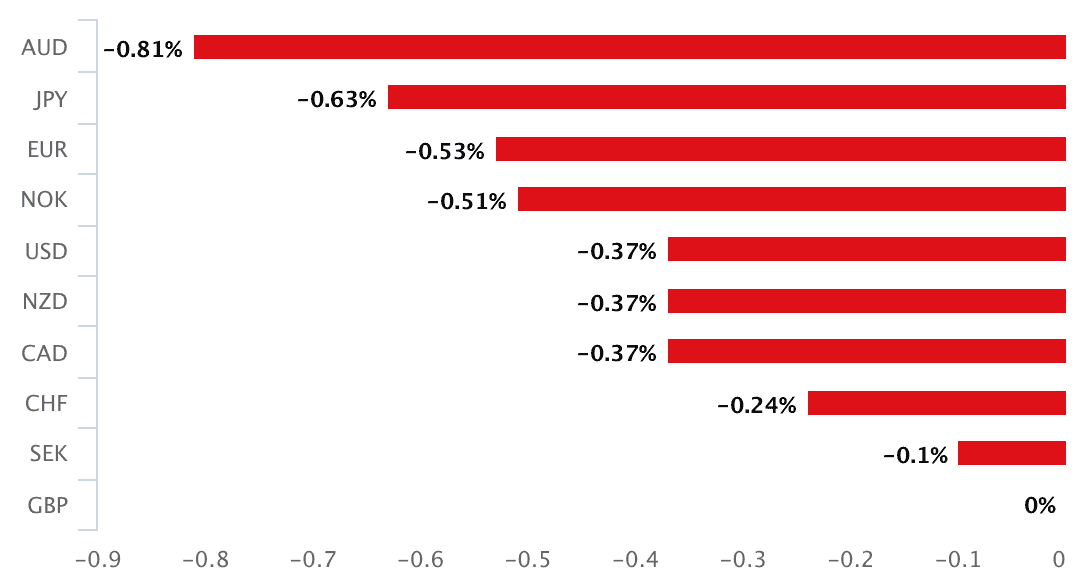

The currency is easily the worst-performing major currency with the performance board suggesting this is down to independent Sterling weakness:

The Dollar had been the laggard on the back of comments made by the Federal Reserve's Jerome Powell, but we are now seeing Sterling come under pressure and we would say this is largely linked to ongoing negativity surrounding Brexit.

Prime Minister Theresa May is widely expected to see the deal she struck with the EU voted down by parliamentarians from across the political divide and there remains little credible alternative to 1) her plan and 2) the 'no deal' Brexit if that plan fails.

"Expect much more GBP volatility ahead of the December 11th vote," says Chris Turner, a foreign exchange strategist at ING Bank N.V.

"Risks are unusually high and tilted toward more Sterling downside," says Lefteris Farmakis, a Strategist with UBS, "the outlook for Sterling for 2019 is clouded by significant uncertainty with respect to near-term Brexit developments."

One pound buys 1.1215 euros on the open markets at the time of writing with high-street banks offering in the region of between 1.0920 and 1.1020 for international transfers, independent specialists are offering in between 1.1100 and 1.1130.

One pound buys 1.2778 dollars on the open markets, high-street banks are offering between 1.2430 and 1.2530, independent providers are offering in between 1.2650 and 1.2680.

Technically, the Bears are in Charge of Sterling

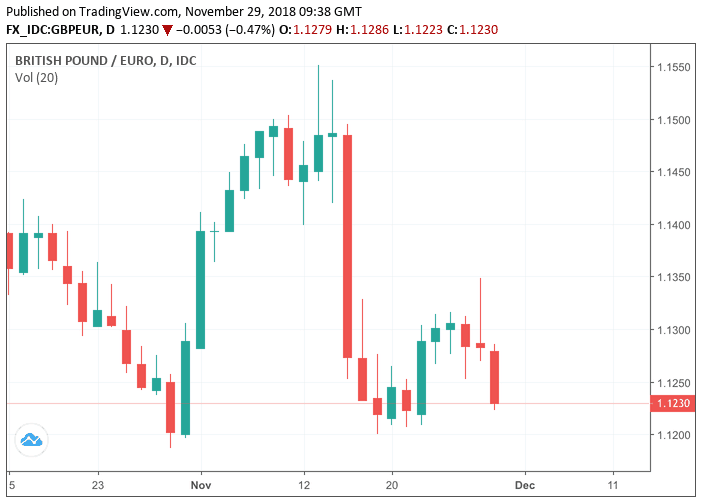

The decline in Sterling fits a pattern of ongoing erratic behaviour:

"EUR/GBP will probably remain in a some kind of erratic trading patter near current levels as long as uncertainty on the approval remains as high as it is right now," says Piet Lammens, a foreign exchange strategist with KBC Markets.

This is a technically driven market we believe.

The Pound-to-Euro exchange rate is currently quoted at 1.1230, having been as high as 1.1350 in the past 24 hours.

Peter Stoneham, an analyst on the currency desk at Thomson Reuters says "EUR/GBP bulls feeding off extremely strong bull signal," confirming technical buying and selling is causing a headache for the Pound.

Above: A view of daily EUR/GBP price action.

"Market gunning for the daily cloud top and recent highs just above 0.8900," says Stoneham, referencing the recent lows in GBP/EUR just below 1.1235.

An "extremely strong" bear signal was seen mid-week, courtesy of the GBP/EUR sell-off that followed the comments made by U.S. Federal Reserve Chair Jerome Powell which prompted a surge in Euro buying.

The selling pressure we are seeing could be the result of that strong signal that came in the form of a "long candle wick" says Stoneham.

"Strong bull confirmation so far and momentum confirms an impressive turnaround," says Stoneham referencing the Euro's shift in fortunes for the better against Sterling.

Stoneham favours selling the Pound on strength noting a weekly bear run in GBP/EUR has restated and he is targeting an eventual push towards 1.11.

Above: A view of daily GBP/EUR price action.