One Reason for Britons and the UK to Consider Being 'Poorer'

Image © Adobe Images

Bank of England (BoE) Chief Economist Huw Pill caused controversy this week when saying everybody must accept being poorer due to inflation but this wouldn't have been so if he also explained how inflation risks taking food directly from the plates of people in some of the world's very poorest countries.

While participating in a Columbia University podcast the BoE's chief economist spoke of a pass-the-parcel game in which companies and individuals raise prices for products, services and salaries in attempts to preserve 'real' incomes due to the high levels of inflation seen over recent years.

The remarks came with a suggestion that people accept being worse off rather than seeking to close the gap between annual pay growth that is reported to have been in the region of 5% or 6% over recent months, and an annual inflation rate that has remained in the double-digits over the same time.

Consumer price inflation of 10.1% in March was more than five times the BoE's two percent target, hence how and why the Bank's chief economist was quick to be rebuked and criticised by market commentators and media pundits alike.

However, it's possible many would respond differently had they known at the same time exactly how inflation and wage pressures in the UK can impact others elsewhere, particularly those in some of the world's very poorest countries.

The impact is not obvious even to those who might have some grasp of economics, and so most members of the public would have little opportunity to consider how they might impact others without the benefit of the below.

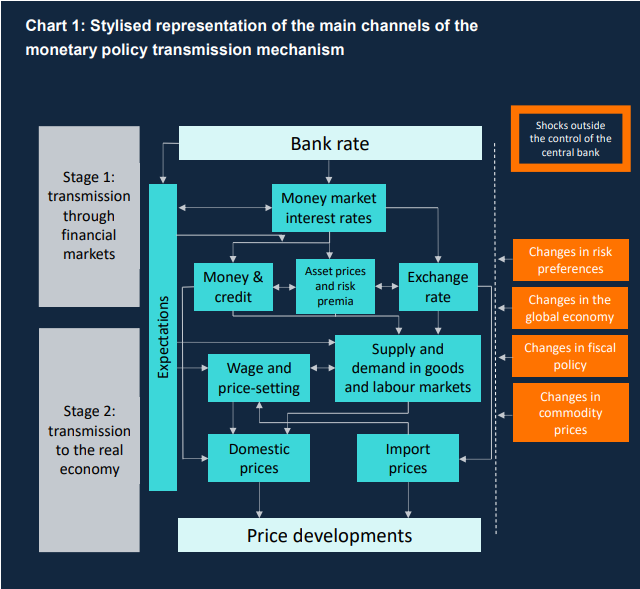

Source: Expectations, Lags and the Transmission of Monetary Policy, Bank of England.

Above, the arrows connecting blue boxes with the words "wage and price-setting," and "import prices," and "price developments" highlight how rising wage growth in the UK and other advanced economies can and does lead producers of imported goods - particularly food and energy - to raise their own prices.

These sorts of price rises produce the most destructive kind of inflation because, quite apart from leading the Bank of England (BoE) to raise Bank Rate, they also raise the cost of essential goods in countries where there are neither the means to pay higher prices, nor the means to produce those goods internally.

Such inflation almost always manifests in crises of the kind like the war now playing out in the African country of Sudan and the import crisis experienced in Sri Lanka during the opening half of last year.