Bank of England's Pill Hints Interest Rate Cuts in 2023 an Unlikely Prospect, Hints at Another Hike in May

Above: File image of Huw Pill. Image © Global Utmaning, Lasse Skog. Modified from original, reproduced under CC licensing, non-commercial.

The Bank of England's Chief Economist warned it could still be too soon for the Bank of England to pause its interest rate hiking cycle.

In a speech to the Graduate Institute in Geneva, Pill also hinted that the market's expectations for rate cuts by year-end were also premature as there remained a risk of inflationary pressures in the UK proving persistent.

Pill maintained a view that UK inflation was to fall sharply over the coming months but it might not fall back to the 2.0% target given the strong jobs market.

"Although headline inflation is set to fall significantly in the course of this year owing to a combination of base effects and falls in energy prices, caution is still needed in assessing inflation prospects on account of the potential persistence of domestically generated inflation," he said.

The Bank of England confirmed at its March policy update it would base upcoming decisions purely on incoming data, ensuring the mid-month release of labour market and inflation data would determine whether rates would rise again in May.

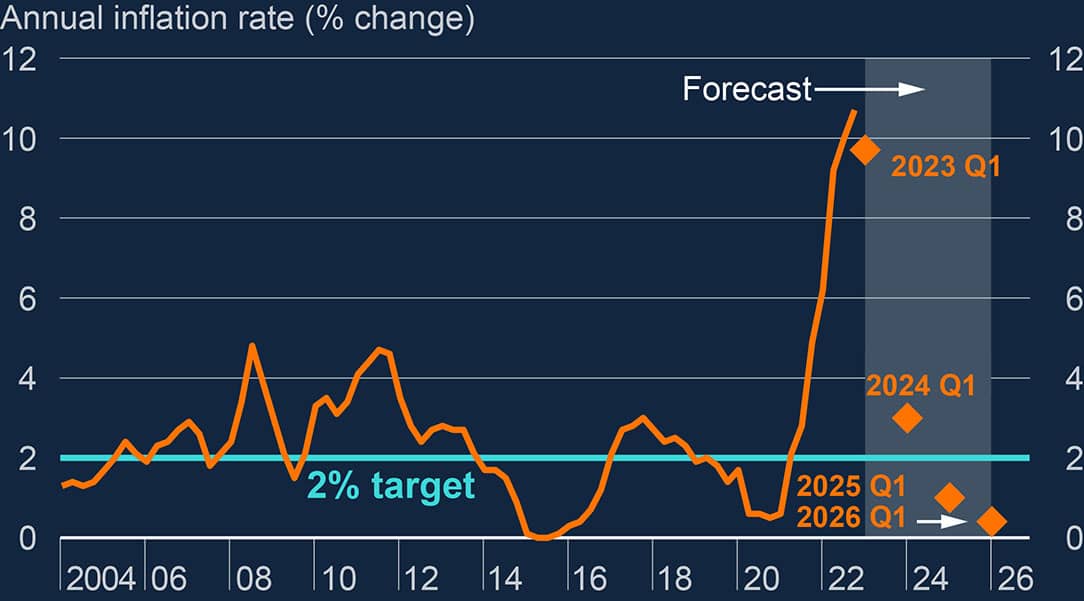

Above: The Bank of England's most recent inflation projections might be too optimistic.

But Pill's speech suggests a greater than 50-50 chance he would favour interest rates going up another 25 basis points.

"In February, the MPC signalled that it had adopted a more ‘data-dependent’ stance. This was consistent with establishing a clear inflexion point in the upward path of Bank Rate – but not necessarily a pause, still less a turning point," said Pill.

Ahead of Pill's speech market pricing showed investors were seeing a 50-50 chance Bank Rate rises by 25 basis points in May, with an interest rate cut fully priced by the first quarter of 2024.

But Pill's comments that a "turning point" is certainly not being considered explicitly pushes back against any expectations for a cut.

Pill's speech came on the same day his colleague on the Monetary Policy Committee, Silvana Tenreyro, said in a speech delivered in Glasgow that inflation will "fall well below target".

She condoned the market's expectations for cuts, saying "I expect that the high current level of Bank Rate will require an earlier and faster reversal, to avoid a significant inflation undershoot."

"Huw Pill pouring a fair amount of cold water on this view today. His speech leaves open the chance of another hike in May should the data show evidence of persistent domestic price growth," says Simon French, Chief Economist and Head of Research at Panmure Gordon.

Currency markets have moved from focusing purely on the quantum of rate hikes coming from central banks to focusing on the potential for rate cuts.

Money markets reveal investors see the Federal Reserve cutting by about 50bp by year-end, the Canadian Dollar by 42 and the Reserve Bank of Australia by 14.

These expectations can be reflected in the underperformance of the U.S. Dollar, Canadian Dollar and Australian Dollar over recent weeks.

The British Pound has meanwhile found itself supported since the Bank's March decision to hike interest rates again and relatively steady guidance from the Bank regarding the outlook.

Should the Bank keep interest rate cut expectations at bay, the Pound could remain an outperformer.