GBP/CAD Dollar Week Ahead Forecast: Risk of Data Curbing Rally

- GBP/CAD recovery faces potential UK headwinds

- As UK budget & wages data decides BoE outlook

- U.S. inflation also eyed amid lull in Canadian data

Image © Pound Sterling Live

The Pound to Canadian Dollar exchange rate entered the new week near the new year high but could find its multi-week rally cut short if UK economic data or the government budget lead market expectations for the Bank of England (BoE) Bank Rate to remain under pressure in the days ahead.

Sterling and the Canadian Dollar both benefited alongside others on Monday as global market concerns about the stability of the U.S. banking system were somewhat undermined by the joint actions of the U.S. Treasury, Federal Reserve (Fed) and Federal Deposit Insurance Corporation (FDIC) on Sunday.

"The biggest question plaguing markets going into the weekend was what was going to happen to the uninsured deposits not covered by the FDIC maximum and, what that would mean for potential contagion," says Ian Pollick, head of fixed income, currency and commodity strategy at CIBC Capital Markets.

"This stabilization announcement, at the margin, reduces the impact this week – but the scope beyond is likely similar. We are not worried about the CAD banks. Liquidity positions in Canada are strong," Pollick writes in Monday commentary.

Worries over the accessibility of bank deposits were the primary driver of the Silicon Valley Bank failure at the weekend but these concerns were effectively written off themselves on Sunday when federal agencies more or less pre-emptively guaranteed something close to a full bailout of all depositors.

Above: Pound to Canadian Dollar rate shown at 2-hour intervals with selected moving averages and alongside USD/CAD.

Above: Pound to Canadian Dollar rate shown at 2-hour intervals with selected moving averages and alongside USD/CAD.

GBP/CAD traded buoyantly in Europe on Monday but now has to navigate a series of risks lurking in the UK and U.S. calendars during what will be a quiet week ahead for Canadian economic figures and the Loonie.

"The rapid ring-fencing operation in the US bodes reasonably well for risk appetite levels in the FX market over the first couple of trading sessions this week. However, events outside North America need to be monitored closely," says Stephen Gallo, a global FX strategist at BMO Capital Markets.

"The rapid ring-fencing operation gives the Fed room to continue its inflation fight. The scale of stress testing done by regulators probably indicates a degree a preparedness for recent events. This should leave another Fed rate hike on the table next week," Gallo adds in Monday market commentary.

Inflation and it's impact on the U.S. Dollar could hamstring Sterling further on Tuesday if the data comes in stronger than expected but earlier UK job and wage figures are likely at least as important for GBP/CAD this week.

"More recently better than expected UK economic data may have provided some support. The market is priced for another 50 bps on BoE rates before a peak is reached," says Jane Foley, head of FX strategy at Rabobank.

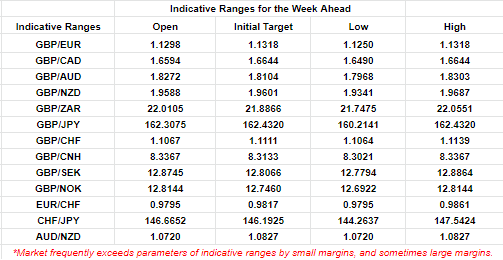

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"Speculators’ net short CAD positions increased between Feb 7 and Feb 21 as the market digested the signalled pause in policy from the BoC," Foley writes in a Monday review of Chicago Futures Trading Commission (CFTC) data covering the positions of speculative traders.

Consensus among economists suggests Tuesday's will show annualised wage and salary growth dipping further in January while the unemployment rate is also tipped to rise from 3.7% to 3.8%.

These and next week's inflation figures will be key inputs into this month's BoE decision, which is widely seen as being a toss-up between a 0.25% increase in Bank Rate to 4.25% and no change at all, although the UK's annual fiscal update also poses risk for GBP/CAD on Wednesday.

"Granted, the Chancellor likely will confirm in the Budget that households’ energy bills will not rise in Q2, as previously planned. But households still will be hit by the withdrawal of the £67-a-month discount on their energy bills in April," warns Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"In addition, any replacement of the super-deduction scheme, which ends next month, will come too late to shore up capex in Q2. Overall, then, fiscal policy still will squeeze GDP this year. Output also will be depressed in May by the extra bank holiday for the King’s coronation," he adds in a Monday research briefing.

Above: GBP/CAD at daily intervals with selected moving averages and alongside USD/CAD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: GBP/CAD at daily intervals with selected moving averages and alongside USD/CAD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.