New Zealand Dollar Could Curb GBP/NZD Rally if RBNZ Forges Further Ahead

"The pound has outperformed in recent weeks. A break of the 0.51 “pivot zone” [GBP/NZD: 1.9607] now sets up a move to 0.4950 [GBP/NZD: 2.020]" - Kiwibank.

Image © Adobe Images

The New Zealand Dollar climbed broadly ahead of the weekend in a corrective rebound that further crimp an earlier rally in GBP/NZD if the Reserve Bank of New Zealand (RBNZ) keeps its eye on the prize that is the Kiwi inflation target by reiterating its February outlook for the cash rate next week.

New Zealand's Dollar gave ground to the Swiss Franc and Swedish Krona on Friday but otherwise continued to recoup prior losses from other major currencies and especially recent outperformers like the Pound, Canadian Dollar and European single currency.

Sterling, the Euro and Swiss Franc have outperformed throughout March to lay claim to the top three spots in the major currency league table for the year so far in exactly that order, although rallies by all three currencies will run the risk of a partial reversal next Wednesday.

"We may see a bounce in the NZD next week if the RBNZ is hawkish, as we expect. We expect both the RBNZ and RBA to hike next week, but how their tones contrastwillbe key for NZD/AUD direction over April," says David Croy, a senior strategist at ANZ.

"GBP is still in an uptrend, and NZD’s loss overnight weighed on this cross too. Little contrasting news of note; will depend a bit on RBNZ," he adds.

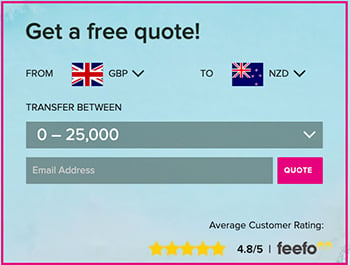

Above: GBP/NZD shown at 4-hour intervals alongside NZD/USD, EUR/NZD and AUD/NZD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: GBP/NZD shown at 4-hour intervals alongside NZD/USD, EUR/NZD and AUD/NZD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

The RBNZ is widely expected to lift its cash rate from 4.75% to 5% next week but financial markets will listen most closely to any remarks on the outlook for borrowing costs after the bank projected in February that its cash rate will likely have to rise to 5.5% later this year.

"The RBNZ is hell-bent on breaking the back of the inflation beast, with their thoughts centred around a 5.5% terminal rate. Although, as we have noted on many occasions, the RBNZ’s pre-set path to 5.5% is likely to be a step too far," says Jarrod Kerr, chief economist at Kiwibank.

"We believe the OCR should peak at either 4.75% or 5%, and pause for six months. Enough is enough, and the RBNZ has done more than enough," Kerr and colleagues write in a Monday research briefing.

Pricing in interest rate derivative markets suggests investors no longer expect Kiwi borrowing costs to rise that far after the March failure of Silicon Valley Bank and others in the U.S. prompted downward revisions to forecasts and expectations for interest rates in many parts of the world.

But New Zealand's Dollar has still risen against some currencies this month including the U.S. Dollar after expectations for Federal Reserve interest rates were scaled back even more significantly, although much now depends on next week's RBNZ decision.

"Our colleagues at ASB anticipate a 25bp hike, which would represent a slowing in the pace of hiking," says Harry Ottley, an associate economist at Commonwealth Bank of Australia.

Above: Pound to New Zealand Dollar rate shown at daily intervals alongside NZD/USD. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: Pound to New Zealand Dollar rate shown at daily intervals alongside NZD/USD. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"This will take the OCR to 5.0%, its highest level since 2008 and the spread between the Australian and NZ key policy rate will push out further," Ottley and colleagues write in a Friday research briefing.

There are reasons for why the RBNZ might view the outlook for inflation and interest rates in New Zealand as being little changed from February, however, and with potentially positive implications for the Kiwi Dollar next week.

These include the potentially inflationary implications of the repair and rebuilding work set to take place following the natural disasters of February.

But it remains to be seen if sticking with the February outlook would be enough for the RBNZ to reverse the 2023 uptrend in GBP/NZD.

"The pound has outperformed in recent weeks. A break of the 0.51 “pivot zone” [GBP/NZD: 1.9607] now sets up a move to 0.4950 [GBP/NZD: 2.020]. Will this be the move that breaks the multi-year narrowing triangle? If so, then lows in 2022 become the next downside targets," Kiwibank's Kerr said earlier this week.

Above: GBP/NZD shown at weekly intervals with selected moving averages. Click image for closer inspection.

Above: GBP/NZD shown at weekly intervals with selected moving averages. Click image for closer inspection.