Peak in Australian Wages Could Mean a Peak in RBA Interest Rates

Image © Adobe Images

Australian wages appear to be peaking, which could in turn mean the Reserve Bank of Australia (RBA) has potentially reached its peak interest rate for the current cycle.

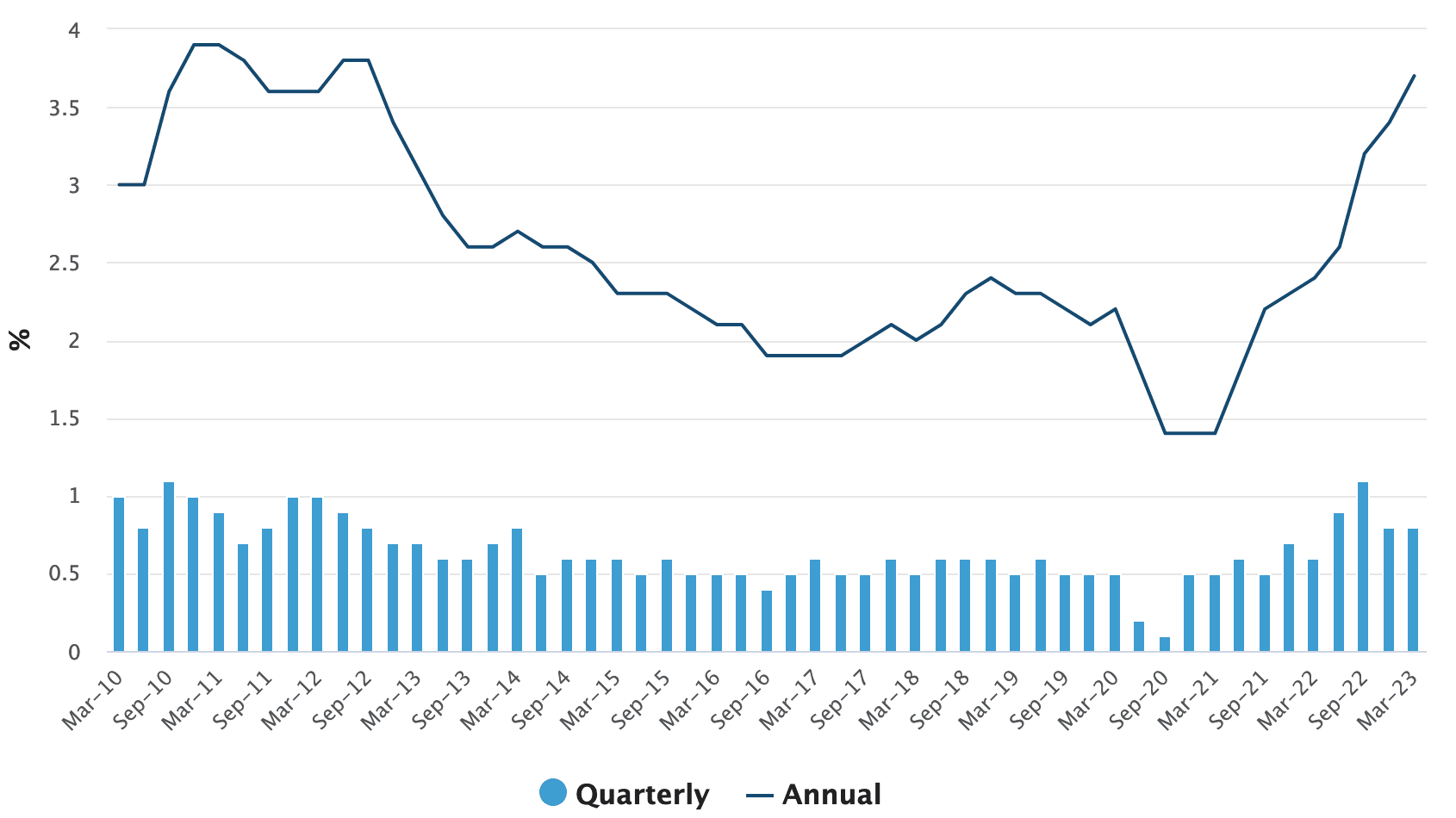

Australia's wage index lifted 0.8% quarter-on-quarter in the first quarter, which was a touch softer than the market's expectation for 0.9% growth.

"Wages continue to disappoint broader expectations and while private sector wage gains are moderating faster than we had anticipated," says Justin Smirk, an economist at Westpac.

The Q1 figure suggests the September quarter's 1.1% was the peak for wage growth.

The wage index meanwhile grew 3.7% year-on-year in the first quarter, ahead of expectations for 3.6%, thanks to revisions to previous releases.

Kristina Clifton, a currency strategist at Commonwealth Bank of Australia (CBA) says the Australian Dollar "was volatile around the release of the Q1 wage price index."

The volatility in the currency reflects the importance of wages to RBA policy as they contribute to the inflation pipeline.

Markets are currently grappling with whether or not the RBA has finalised its hiking cycle: if the answer is 'yes' then the Australian Dollar will find it has little support from the interest rate channel.

CBA's Australian economics team note that there are signs that private sector wages growth is plateauing, "supporting the view that the RBA cash rate has peaked at 3.85%".

But analysts at Westpac see further wage pressures in the pipeline and that the peak is yet to come, a view, if correct, could offer support to a view the RBA has further work to do.

"We are seeing wage inflationary pressures shift away from the private sector and towards the public sector," says Westpac's Smirk.

Private sector wages rose 0.8% in Q1, down from 0.9% in Q4 2022 and 1.2% in Q3. Public sector wages rose 0.9% in Q1, up from 0.8% in Q4 and 0.6% in Q3.

Westpac sees further gains in public sector wages (if a peak of 4.8% y/y is achieved) which could mean a peak in the wage index reaches 4.1% y/y (provided private sector wages hold their current pace of inflation).

The next major release for Australia comes on Thursday when monthly employment figures are released.

"Australian employment is due a weak result following two very strong months of expansion. A weaker than expected result this month can see AUD/USD head towards downside support at 0.6595," says Clifton.

The market is expecting a reading of 25K for April.

The data comes after the RBA raised interest rates again in May, but the minutes for the May 02 meeting show the decision was finely balanced.

Indeed, economists say the minutes likely indicate the RBA is now ready to pause its hiking cycle.