GBP/AUD Week Ahead Forecast: Rally Vulnerable to GDP and Inflation Data

- GBP/AUD could have scope to test above 1.79 short-term

- But GBP/AUD vulnerable & volatile on any data surprises

- AU retail sales, January inflation & Q4 GDP data in focus

Image © Adobe Images

The Pound to Australian Dollar exchange rate has climbed sharply in recent trade but would find itself vulnerable in likely volatile price action this week if the rally is stalled by Australia's January retail sales and inflation figures.

Australia's Dollar underperformed other major currencies last week following the final quarter Wage Price Index reading that came in softer than the consensus had expected and was followed by the potentially troublesome listing of a singular vacancy for the Reserve Bank of Australia (RBA) board.

Official reports of softer wage growth followed two successive employment reports that were also weaker than many anticipated and came ahead of this week's data deluge, which begins with a January retail sales report on Tuesday and gives way to inflation and GDP figures on Wednesday.

January retail sales came in stronger than expected with a reading of 1.9% month-on-month in January said the ABS, beating expectations for 1.5% and representing a strong comeback from the previous month's -3.9%.

The data has however been unable to snap an ongoing correction lower in the Aussie Dollar.

"AUD/USD will likely weaken further in the early part of the week. AUD/USD may carve out a bottom later this week," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"However, the major driver of AUD/USD this week will remain offshore influences such as the trend in the USD against the major currencies," Capurso and colleagues write in a Monday research briefing.

Above: Pound to Australian Dollar rate shown at hourly intervals alongside AUD/USD. Click image for closer inspection.

"The A$ remains in corrective mode with stronger US data/hawkish Fed resolve and waning crude/ energy prices and slumping metals weighing on sentiment," says Sean Callow, a senior FX strategist at Westpac in Sydney.

"The break below key support in the 0.6780/0.68 region adds to downside risks pointing to the next obvious target at 0.6660 which is the 50% retracement of October to February rally," Callow writes in Monday market commentary.

Upcoming domestic highlights include the GDP release for the fourth quarter of 2022 and the CPI indicator for January (Wednesday).

"We expect both to show some impact from sharply higher interest rates," Capurso and colleagues say. "Signs the Chinese government will significantly step up its infrastructure spending will likely help AUD/CAD unwind some of its recent losses."

Softer final quarter consumption risks weakness in GDP for the period but markets will likely be much more focused on the inflation figures emerging from Australia at the same time as the economic output number.

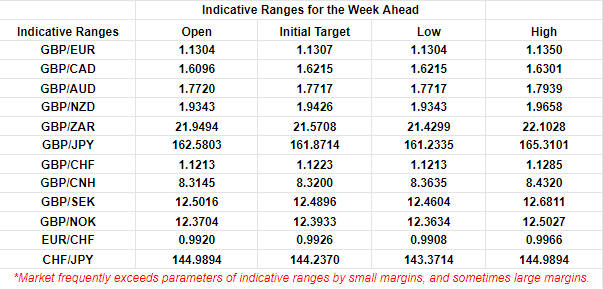

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The risks around Wednesday's inflation numbers are potentially on the upside given earlier in February the RBA warned that it could take several years for inflation to return to within the 2% to 3% target band even if the bank lifts its cash rate to the 3.75% in that time.

Interest rate derivative markets, however, have since leapfrogged the RBA's new forecasts to price-in a peak of 4.27% for this year and it may be relevant that Australian inflation did not fall in December whereas in most other developed market economies it did.

That could mean ongoing upside risks for the RBA cash rate also potentially the Australian Dollar this week, implying scope for GBP/AUD to be toppled near nascent highs from the mid-week session onward.

"Q4 retail sales were weaker than expected in New Zealand while corporate profits were much stronger than expected in Australia. This is in line with our view that the medium-term policy outlook still leans in AUD’s favor," says Isabella Rosenberg, a strategist at Goldman Sachs, in reference to AUD/NZD.

Above: Pound to Australian Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.