Australian Dollar Bruised as Softer Wages Query RBA Cash Rate Outlook

- Written by: James Skinner

"A break of the 200dma around 0.6804 would be important technically and confirm the USD correction higher thesis we have been working with the past few weeks" - Jefferies.

Image © Newtown Grafitti, Reproduced under CC Licensing.

The Australian Dollar slipped to the bottom of the major currency bucket in the midweek session as softer-than-expected wage growth appeared to weigh on market expectations for the Reserve Bank of Australia (RBA) cash rate while adding to losses inspired by elevated bond yields elsewhere.

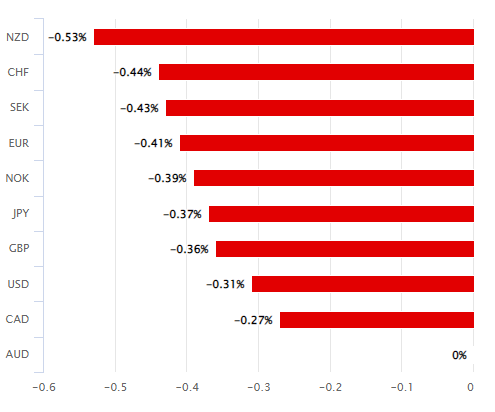

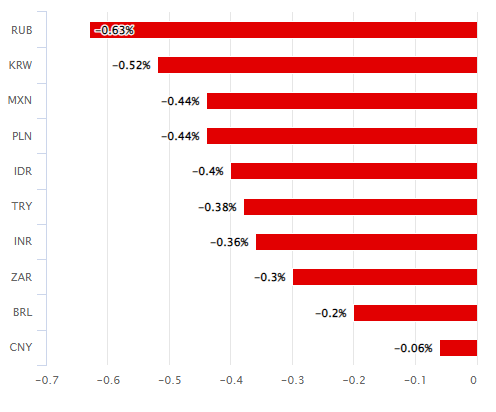

Australian Dollars were sold across the G10 and G20 boards on Wednesday, leaving the antipodean currency lagging behind only three others in the G20 basket for the week overall after the Australian Bureau of Statistics Wage Price Index suggested the final quarter saw a softening of wage pressures.

"The Wage Price Index rose 0.8% q/q in Q4, weaker than the consensus expectation of 1.0% q/q. Annual growth edged up to 3.3% y/y, the highest in a decade, but below the RBA’s forecast of 3.5% y/y," says Catherine Birch, a senior economist at ANZ.

"While today’s print will give the RBA comfort that a price-wage spiral does not appear to be emerging, we don’t think it alone will prevent further rate rises," Birch and colleagues write in a review of the data.

The wage index had risen by 1% in the third quarter and economists had looked on average to see it increase by 1.1% for the final quarter.

Above: Australian Dollar performance relative to G10 and G20 currencies on Wednesday. Source: Pound Sterling Live. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Wednesday's losses meant the Korean Won, South African Rand and Canadian Dollar were the only other G20 currencies to fall further for the week after the Australian Dollar sank in sympathy with local bond yields.

"We note Australia's Wage Price Index excludes changes in aggregate labour costs associated with 'job switching' and promotions, as well as super payments and other non-wage payments," says Andrew Boak, CFA and chief economist for Australia & New Zealand at Goldman Sachs.

"Given these factors tend to add to growth during tight labour markets, WPI growth is likely understating growth in aggregate labour costs at the moment. Broader measures of labour costs will be released in next week's 4Q2022 National Accounts," Boak and colleagues said in a review of the data.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Softer wage growth is a curveball for a market that had recently lifted forecasts and expectations to imply a likely peak somewhere above the 4% for the Australian cash rate later this year in a repricing that followed February's policy statement from the RBA.

Governor Philip Lowe said in early February's statement that further increases are likely to be necessary while warning of only a narrow path ahead to a 'soft landing' of the economy, which would be less likely in any scenario where high levels of wage growth lead to a self-sustaining inflation cycle.

"It's still possible for us here in Australia to navigate this narrow path, especially if inflation and wage expectations remain contained and the issues on the supply side continue to be resolved. But it's also possible that we get knocked off this narrow path," he told the House of Representatives just last week.

Above: AUD/USD shown at hourly intervals alongside AUD/GBP. Click image for closer inspection.

"If people expect high inflation to continue, then it's likely to continue, with the higher inflation expectations reflecting wage settlements and firms' pricing decisions. So it's important that people expect and believe that high inflation is only temporary," he told the Standing Committee on Economics.

Wednesday's wage price index was followed by losses for Australian Dollar exchange rates but wasn't the only headwind weighing like an anchor around the ankles of the currency because rising global bond yields and risk aversion in international asset markets were also in the mix previously on Tuesday.

Stock indices had fallen almost across the board on Tuesday as U.S. and European bond yields rose in the wake of S&P Global surveys suggesting a January rebound in activity for manufacturing and services sectors in most parts, with the UK surveys seeing the largest bounce.

"Terminal is now pricing around 4.25% in Australia relative to 3.75% not too long ago. AUD/USD continues to hover around 0.6875 in between the 200dma and 50dma," says Brad Bechtel, global head of FX at Jefferies.

"A break of the 200dma around 0.6804 would be important technically and confirm the USD correction higher thesis we have been working with the past few weeks," Bechtel writes in a Tuesday market commentary.

Above: AUD/USD shown at daily intervals with selected moving averages and featured alongside AUD/GBP. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes