Pound Sterling Struggles After Inflation Rises Less than Expected

Image © Adobe Images

Pound Sterling underperformed most other major currencies in early trade on Wednesday after an anticipated rebound in UK inflation underwhelmed expectations and services sector inflation fell back to a two-year low for July.

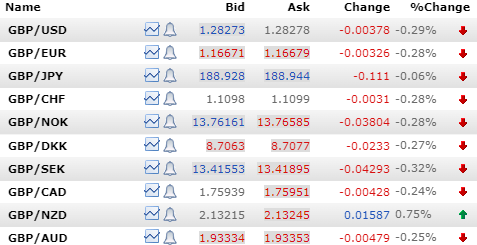

Sterling gave ground to all major currencies except the New Zealand Dollar with its largest losses seen in relation to the Swiss Franc, Canadian Dollar and Euro after Office for National Statistics figures showed inflation rising less than expected in July.

Profit-taking in GBP/EUR and GBP/CHF appeared to drive Sterling's losses after inflation rose to 2.2% last month, up from 2% but below the expected 2.3%. Core inflation, meanwhile, fell back to 3.3%, from 3.5%, when it was expected at 3.4%.

"This may not alleviate the Bank’s concerns about persistent price pressures entirely. And it probably isn’t enough to prompt a back-to-back interest rate cut in September,” Capital Economics economists said.

"But it does lend some support to our view that CPI inflation will be back below the 2% target next year and that interest rates will fall further and faster than markets expect," they added in a note to clients following the report.

Above: Interbank reference rates for Sterling relative to G10 currencies on Tuesday. Source: Netdania.

Most notably, the closely watched measure of services sector inflation fell back to 5.2% in July, from 5.7%, marking a two-year low that will likely be welcomed by the Bank of England.

This opens the door for further interest rate cuts later in the year, according to Capital Economics, and likely explains why the Pound weakened almost across the board following the report.

Services inflation is closely monitored by the Bank of England because it has been flagged as a leading indicator for overall inflation and the risk of it persisting at an above-target level in the coming years.

The other indicator watched most closely by policymakers is average earnings growth, the elevated level of which was part of what discouraged the BoE from cutting interest rates until August.

However, data out on Tuesday showed earnings growth moderating to its slowest pace January 2021 in June, after it declined to an annual 4.5% when bonuses are included, and to 5.4% when bonuses are excluded.

Above: Pound to Dollar rate shown at daily intervals alongside Pound to Euro rate.