Dollar to Rise in 2018: ANZ's Latest Exchange Rate Forecast Tables

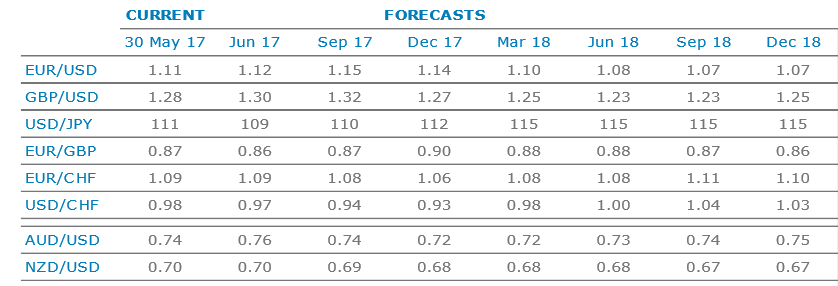

The US Dollar is forecast to weaken during 2017 but then to make a broad-based recovery in 2018, according to the latest forecasts from ANZ bank.

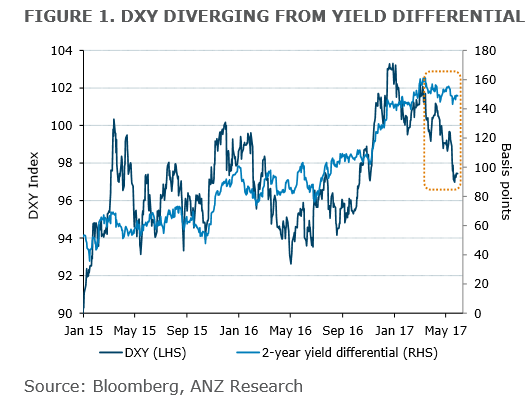

“The DXY (Dollar Index) looks to have based at the levels seen prior to the November 2016 US elections. But technically, the downtrend remains in place and it is too soon to call the bottom for the dollar,” said ANZ’s Koon Goh.

Heightened expectations of increased spending on infrastructure and from tax cuts which drove the Trump-rally phase for the Dollar have been priced out during the recent decline, whilst the risk of the President being impeached or some other scandal hitting the government now weighs.

“Political risk premium has shifted away from the EUR towards the USD,” said Goh.

Still, the political risk premium being baked into the Dollar is only expected to be temporary and should unravel in 2018.

The added risk premium also neatly explains the widening disparity between the DXY and interest rate differentials, which are the primary drivers of currency value, but again the wide disparity is only likely to be temporary.

ANZ are more bullish GBP and EUR – partly due to a lower USD – but also in the case of EUR because of a relaxation of political risk since Macron’s victory.

They are cautiously bullish for Asian currencies (excluding RMB and INR) as they see the Asian growth cycle peaking.

ANZ are bearish for AUD.

Forecasts in More Detail

EUR/USD is forecast to rise to a peak of 1.15 at the top of its 3-year range in September ’17 before falling back down to a trough of 1.07 in December ’18.

GBP/USD follows a similar trajectory, rising to a peak of 1.32 in Q3 2017 before falling to a low of 1.23 in June 2018.

USD/JPY is expected to remain buoyant, slipping to 109 next month but then rising up to stay at 115 throughout 2018.

EUR/GBP is forecast to rise to 0.90 in December ‘17 before falling back down to 0.86 at the end of ’18.

EUR/CHF is forecast to fall to 1.06 in Dec ’17 and then rise to a peak at 1.11 in Q3 ’18.

USD/CHF will fall to 0.93 in Dec ’17 and then reverse and rise to a peak of 1.04 in Q3 ’18.

AUD/USD will rise to 0.76 next month before declining to a low of 0.72 in December and then recovering once again to a hit 0.75 in Q4 ’18.

NZD/USD is set to gently decline throughout the next 18 months to a low of 0.67 in Sep and Dec of 2018.