Outlook for USD Still Positive BUT Beware: EUR/USD Could Hit 1.20 Once More

- Written by: Gary Howes

Image (C) Pound Sterling Live 2015.

The euro is forecast to rise further against the US dollar whose current bout of weakness has further to run.

This is the view of a number of leading currency analysts who have been spending time considering where the Greenback is headed.

Any further decline in USD strength will certainly aid the pound sterling - the GBP/USD exchange rate continues to enjoy a strong run with solid employment data further aiding a recovery from the lows of the 1.50 area.

At the time of writing the euro to dollar exchange rate (EUR/USD) is trading at 1.1333 on the spot wholesale market. We are seeing a number of UK banks quoting transfer rates in the region of 1.0890 while the best independent broker rate is seen at 1.1255.

Forecasting Near-Term Weakness in the USD

The dollar ran into a brick wall in late January - the failure to advance further against a basket of currencies has ensured relief for those looking to buy the USD.

“We remain bullish on the outlook for the USD overall but our valuation estimate suggests that a lot of good news is priced in to the USD broadly at current levels and more supportive news or developments may be needed for the USD to strengthen further at this stage,” notes Shaun Osborne, the leading currency analyst at Canada’s TD Securities.

Osborne thinks trends support his view that the USD is poised to consolidate in the near-term (next few weeks) before strengthening again.

Below is a graphical representation of the USD’s consolidation displayed in the dollar index (DXY) - this is a composite index that represents the dollar against a basket of currencies.

Note the RSI is now below oversold levels at 70 suggesting the required fire-power for another leg higher could well be building. The only question being the timing of the next move.

According to Sean Callow at Westpac in Australia the reason for the pause in USD strength can be explained by the current technical resistance seen in the above dollar index representation:

“The DXY remains below a significant long term resistance level at 95.86 (long term cloud / Fibonacci retracement).

“The price has not committed to breaking or rejecting this level, hence the state of consolidation we see across USD pairs.”

Also convinced that the United States dollar is due a soft patch is Karen Jones at Commerzbank who tells us which is the key level that must be broken before we can feel confident of further gains:

“Above 95.86 will introduce scope to 99.49 October 2003 high and the 101.50/61.8% retracement of the same move down from the 2001 peak.

Be Patient Before Selling the Euro to Dollar Rate Once More

As Osborne alludes to, the longer-term picture favours the Greenback. Agreeing that we are in for a momentary period of USD weakness is MacNeil Curry at Bank of America Merrill Lynch.

He sees the headline euro to dollar exchange rate giving us further strength in coming days. Commenting on the EURUSD outlook Curry says:

“Correcting higher. Since the Jan-29 low at 1.1098, €/$ has been stuck in a choppy correction.

“Within this correction, we look for one last push higher toward 1.1730, before renewed topping and a resumption of the larger bear trend for 1.1098, ahead of 1.0765 and eventually below. A break of 1.1270says the downtrend is resuming.”

But, beware, the euro could advance event higher against the USD according to Jones:

“The Elliott wave count on the daily chart is pointing to a potential 1.1703/86 correction (double Fibonacci retracement) and even potentially 1.2085.”

What About the Long-Term?

So with a bunch of analysts telling us to expect dollar weakness in the near-term but strength in the long-term, just how far can the USD travel?

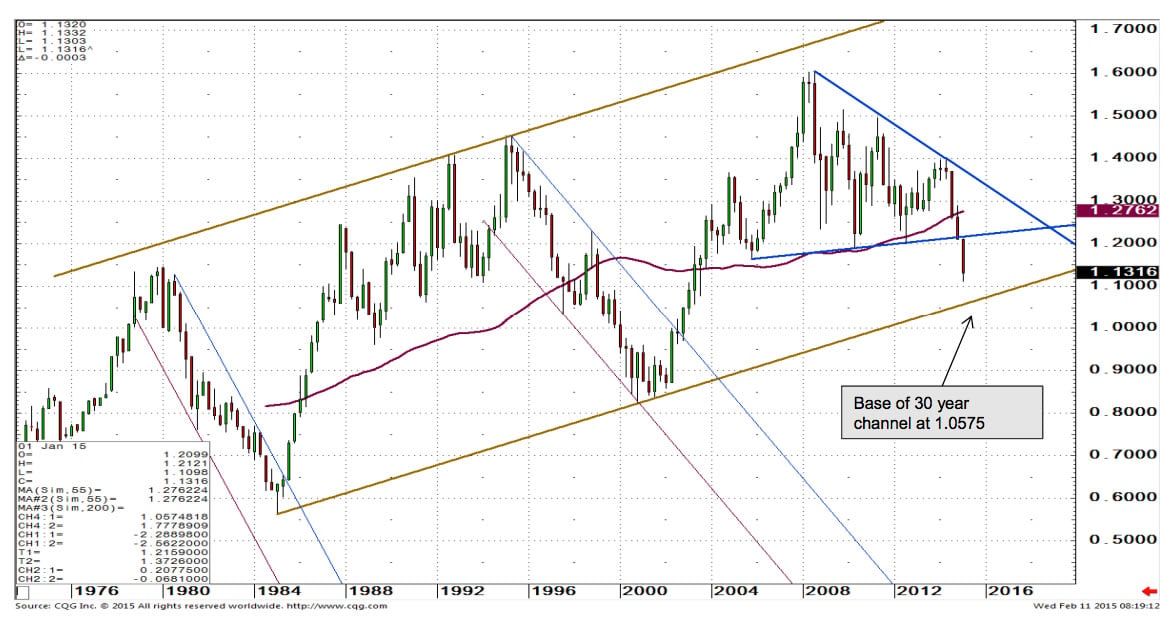

Historically we note that the EUR/USD could be heading towards the base of a 30 year channel at 1.0575.

So while parity in the exchange rate pair could be possible, we would be more confident in calling an end to the downside at this point.

When the EUR/USD stops declining we could well see a cessation of USD strength elsewhere.